BSM Chemical Co.,Ltd.'s (SZSE:300796) 27% Cheaper Price Remains In Tune With Earnings

Unfortunately for some shareholders, the BSM Chemical Co.,Ltd. (SZSE:300796) share price has dived 27% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 5.2% in the last year.

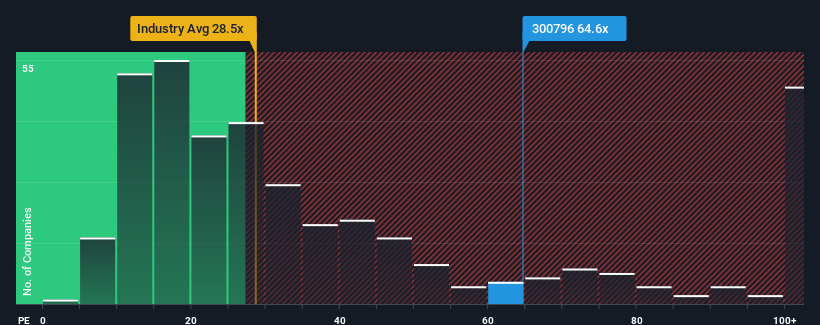

Even after such a large drop in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 28x, you may still consider BSM ChemicalLtd as a stock to avoid entirely with its 64.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

BSM ChemicalLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for BSM ChemicalLtd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like BSM ChemicalLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 94% each year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 24% per year, which is noticeably less attractive.

In light of this, it's understandable that BSM ChemicalLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On BSM ChemicalLtd's P/E

BSM ChemicalLtd's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of BSM ChemicalLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for BSM ChemicalLtd (1 is a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than BSM ChemicalLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BSM ChemicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300796

BSM ChemicalLtd

Engages in the research and development, and production, and sale of chemical intermediates of pendimethalin in the Mainland of China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives