Fujian Acetron New Materials Co., Ltd. (SZSE:300706) Looks Just Right With A 42% Price Jump

Fujian Acetron New Materials Co., Ltd. (SZSE:300706) shares have had a really impressive month, gaining 42% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.9% in the last twelve months.

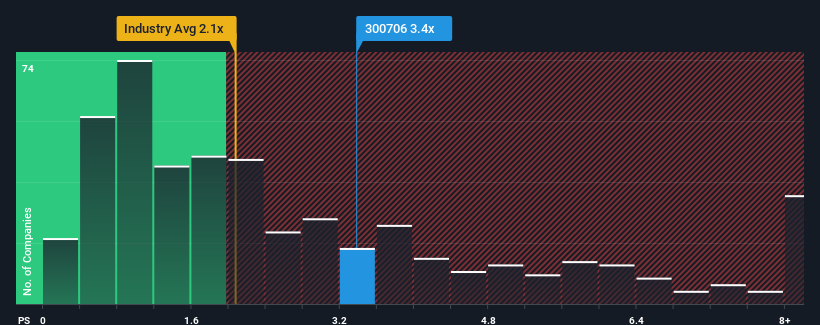

Following the firm bounce in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Fujian Acetron New Materials as a stock to potentially avoid with its 3.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Fujian Acetron New Materials

How Has Fujian Acetron New Materials Performed Recently?

With revenue growth that's exceedingly strong of late, Fujian Acetron New Materials has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fujian Acetron New Materials will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Fujian Acetron New Materials would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. Pleasingly, revenue has also lifted 132% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Fujian Acetron New Materials' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Fujian Acetron New Materials' P/S

Fujian Acetron New Materials shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Fujian Acetron New Materials maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Fujian Acetron New Materials (including 1 which makes us a bit uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300706

Fujian Acetron New Materials

Engages in the research, development, production, and sale of vacuum evaporation and sputter coating materials in China.

Low with imperfect balance sheet.

Market Insights

Community Narratives