- Japan

- /

- Commercial Services

- /

- TSE:7868

Undiscovered Gems And 2 Other Promising Small Caps With Potential

Reviewed by Simply Wall St

As global markets react to the uncertainty surrounding the incoming Trump administration and fluctuating economic indicators, small-cap stocks have experienced mixed performance, with indices like the S&P 600 reflecting these broader market sentiments. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and potential for growth despite external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tianjin Yiyi Hygiene ProductsLtd (SZSE:001206)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Yiyi Hygiene Products Co., Ltd focuses on the research, design, production, and sale of disposable pet and personal hygiene care products both in China and internationally, with a market capitalization of CN¥2.99 billion.

Operations: Yiyi Hygiene Products generates revenue primarily from the sale of disposable pet and personal hygiene care products. The company's cost structure includes expenses related to research, design, production, and international sales operations. Notably, Yiyi Hygiene Products has experienced fluctuations in its gross profit margin over recent reporting periods.

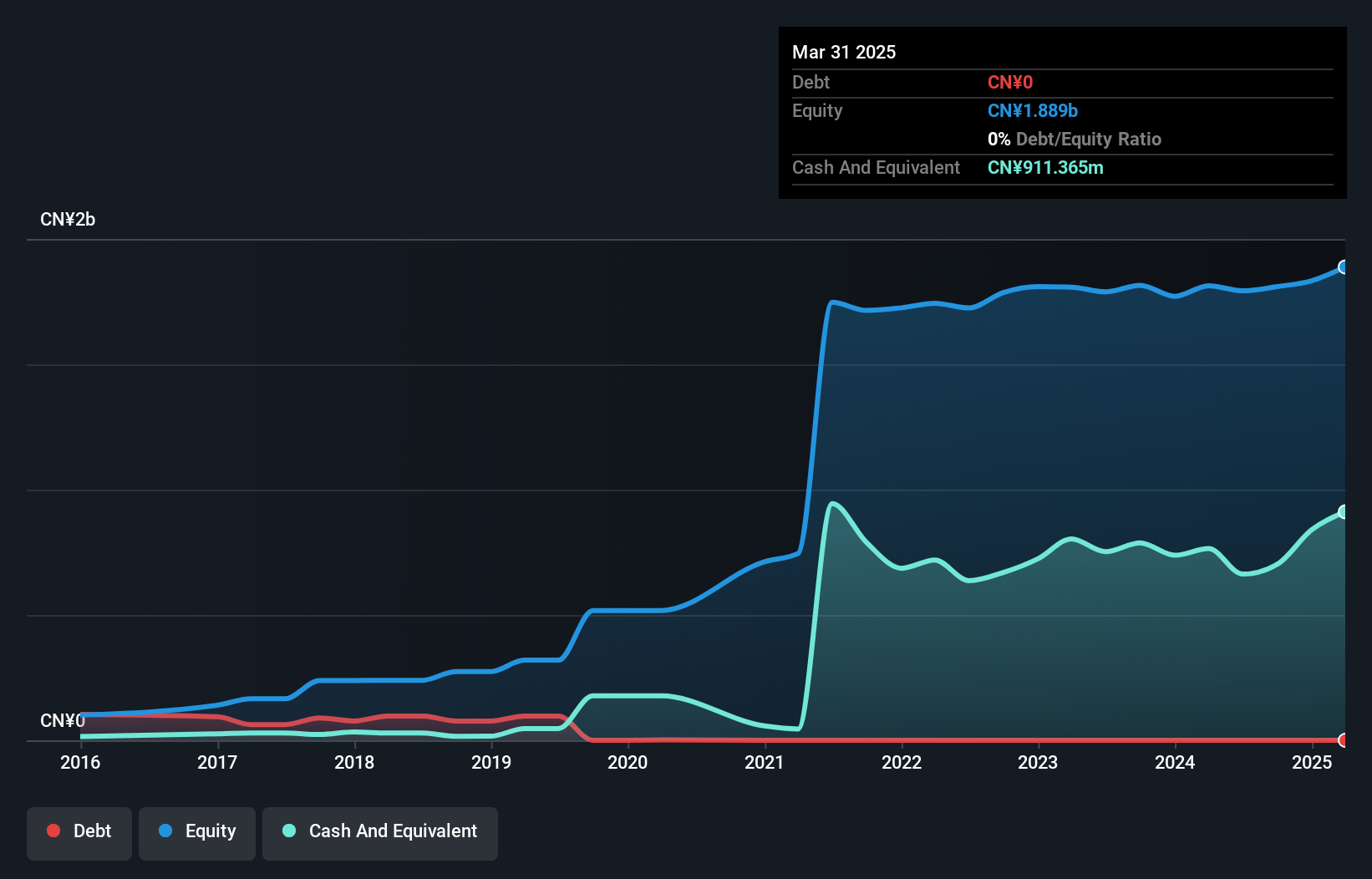

Tianjin Yiyi Hygiene Products, a nimble player in its industry, has shown impressive earnings growth of 50.1% over the past year, outpacing the broader Household Products sector's -6.7%. With no debt on its books for five years and a favorable price-to-earnings ratio of 18x compared to China's market average of 35.9x, it presents an attractive valuation proposition. The company's net income surged to CNY 150.93 million for the nine months ending September 2024 from CNY 87.38 million the previous year, reflecting high-quality earnings and free cash flow positivity that bolster investor confidence in its future prospects.

Hubei Forbon TechnologyLtd (SZSE:300387)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei Forbon Technology Co., Ltd. researches, develops, produces, and sells fertilizer additives worldwide, with a market cap of CN¥2.48 billion.

Operations: Forbon Technology generates revenue primarily from the sale of fertilizer additives. The company's cost structure includes expenses related to research, development, production, and sales.

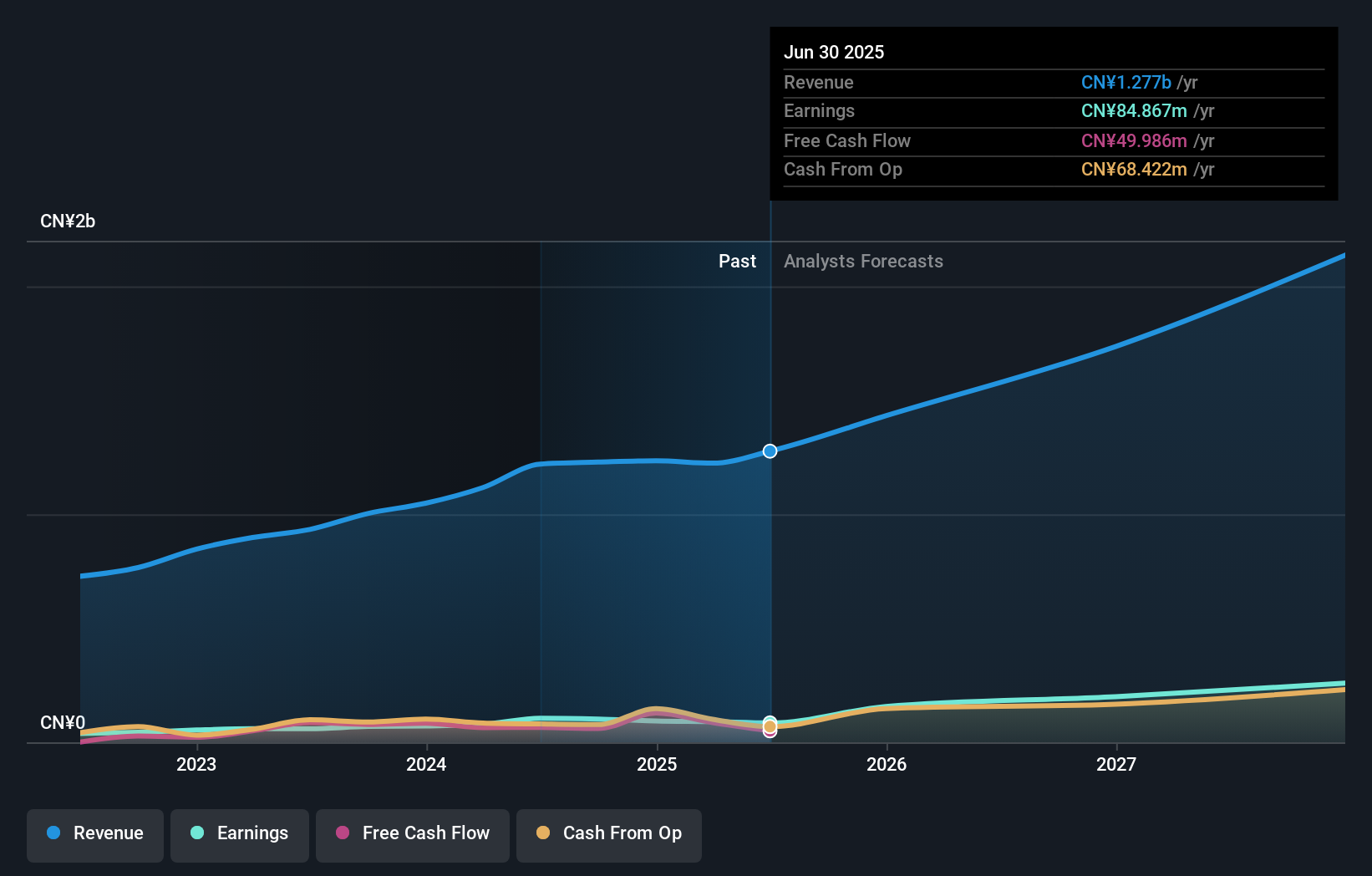

Forbon Technology, a nimble player in the chemical sector, has demonstrated impressive growth. Earnings surged by 46.9% over the past year, outpacing the industry's -5.3%. The company's net debt to equity ratio stands at a satisfactory 3%, reflecting prudent financial management. Its price-to-earnings ratio of 24.3x is attractively below the broader Chinese market average of 35.9x, suggesting potential value for investors. Recent earnings show robust performance with sales reaching CNY 930 million and net income climbing to CNY 91 million for nine months ending September 2024, underscoring its strong operational momentum and promising future outlooks in profitability growth at an expected annual rate of nearly 20%.

- Navigate through the intricacies of Hubei Forbon TechnologyLtd with our comprehensive health report here.

Learn about Hubei Forbon TechnologyLtd's historical performance.

KOSAIDO Holdings (TSE:7868)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KOSAIDO Holdings Co., Ltd. operates as a printing company in Japan with a market cap of ¥73.06 billion.

Operations: KOSAIDO Holdings generates revenue primarily through its printing operations. The company's cost structure includes expenses related to production and distribution, impacting its profitability. Gross profit margin trends can be analyzed for insights into operational efficiency over time.

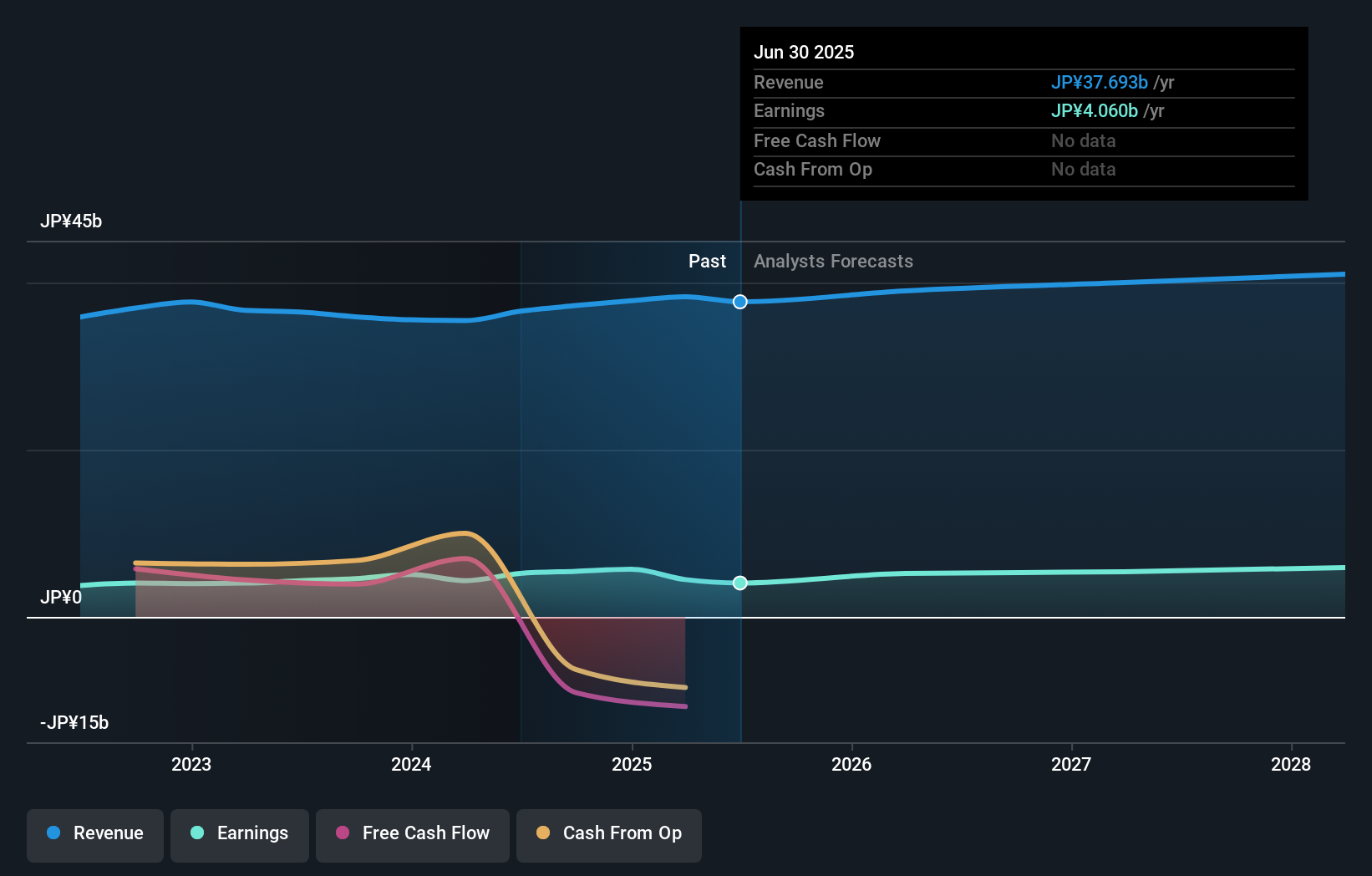

KOSAIDO Holdings, a company with a satisfactory net debt to equity ratio of 15.2%, has demonstrated strong earnings growth of 19.3% over the past year, outpacing the Commercial Services industry average of 8.8%. Despite this growth, shareholders experienced dilution in the last year, which is something to watch. The company's price-to-earnings ratio stands at 13.4x, slightly below the JP market average of 13.5x, suggesting potential value for investors. However, its share price has been highly volatile recently and it doesn't generate free cash flow currently. KOSAIDO forecasts net sales of ¥39.7 billion and an operating profit of ¥8 billion for fiscal year ending March 2025.

- Click here to discover the nuances of KOSAIDO Holdings with our detailed analytical health report.

Evaluate KOSAIDO Holdings' historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 4629 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOSAIDO Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7868

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026