The Market Lifts Fujian Green Pine Co., Ltd. (SZSE:300132) Shares 27% But It Can Do More

The Fujian Green Pine Co., Ltd. (SZSE:300132) share price has done very well over the last month, posting an excellent gain of 27%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

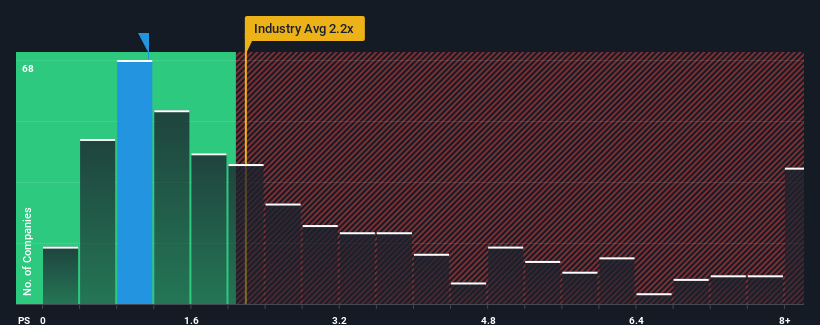

Even after such a large jump in price, Fujian Green Pine may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2.2x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Fujian Green Pine

How Has Fujian Green Pine Performed Recently?

With revenue that's retreating more than the industry's average of late, Fujian Green Pine has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Fujian Green Pine will help you uncover what's on the horizon.How Is Fujian Green Pine's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fujian Green Pine's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. As a result, revenue from three years ago have also fallen 51% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the dual analysts following the company. That's shaping up to be similar to the 23% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Fujian Green Pine's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Fujian Green Pine's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Fujian Green Pine's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Fujian Green Pine you should know about.

If you're unsure about the strength of Fujian Green Pine's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Fujian Green Pine, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300132

Fujian Green Pine

Engages in the research and development, production, and sale of turpentine derivatives.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives