In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on stocks and affected investor sentiment across major indices. Despite these challenges, growth stocks have shown resilience, with the tech-heavy Nasdaq Composite Index managing slight gains amid broader market fluctuations. In such an environment, companies with high insider ownership often signal confidence from those who know the business best. This article explores three growth stocks where insiders are demonstrating their belief in the company’s potential by maintaining significant ownership stakes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Zangge Mining (SZSE:000408)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zangge Mining Company Limited produces and sells potassium chloride under the Blue Sky brand in China, with a market cap of CN¥44.48 billion.

Operations: The company's revenue is primarily derived from the production and sale of potassium chloride in China.

Insider Ownership: 13.2%

Zangge Mining demonstrates potential as a growth company with high insider ownership, despite reporting a decline in sales and net income for the first nine months of 2024. The firm is trading at a favorable price-to-earnings ratio compared to the Chinese market and has initiated a share buyback program worth up to CNY 300 million. While earnings are expected to grow significantly, revenue growth lags behind market averages, and its dividend history remains unstable.

- Take a closer look at Zangge Mining's potential here in our earnings growth report.

- Our expertly prepared valuation report Zangge Mining implies its share price may be lower than expected.

Satellite ChemicalLtd (SZSE:002648)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Satellite Chemical Co., Ltd. is a low-carbon chemical company that produces and markets functional chemicals, new polymer materials, and new energy materials both in China and globally, with a market cap of CN¥64.21 billion.

Operations: The company generates revenue from functional chemicals, new polymer materials, and new energy materials in both domestic and international markets.

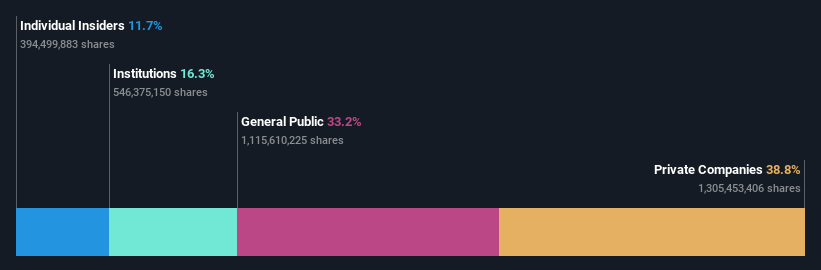

Insider Ownership: 11.7%

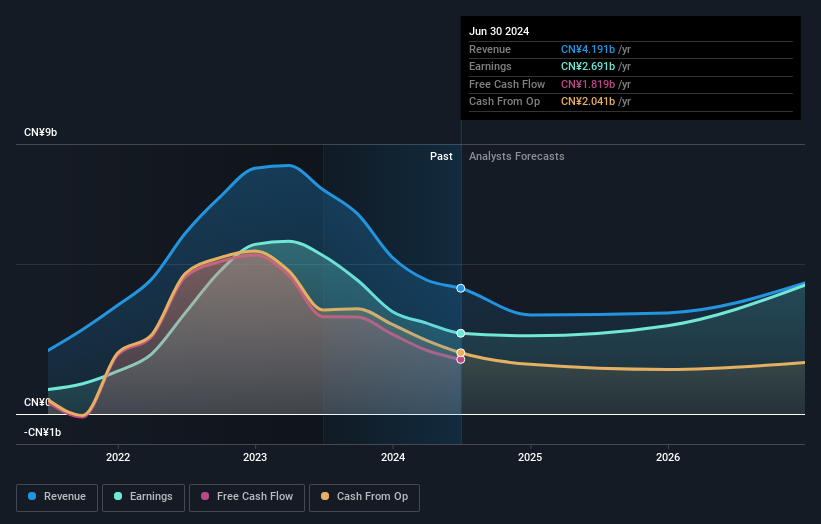

Satellite Chemical shows promise with strong revenue growth, reporting CNY 32.28 billion in sales for the first nine months of 2024, a slight increase from the previous year. Earnings are projected to grow significantly at 23.93% annually, though slightly below market expectations. The stock trades well below its estimated fair value and offers good relative value compared to peers. However, its dividend history is unstable and lacks recent insider trading activity insights.

- Get an in-depth perspective on Satellite ChemicalLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Satellite ChemicalLtd shares in the market.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials in China with a market cap of CN¥31.47 billion.

Operations: Shenzhen Capchem Technology Co., Ltd. generates revenue through its activities in electronic chemicals and functional materials within China.

Insider Ownership: 39.4%

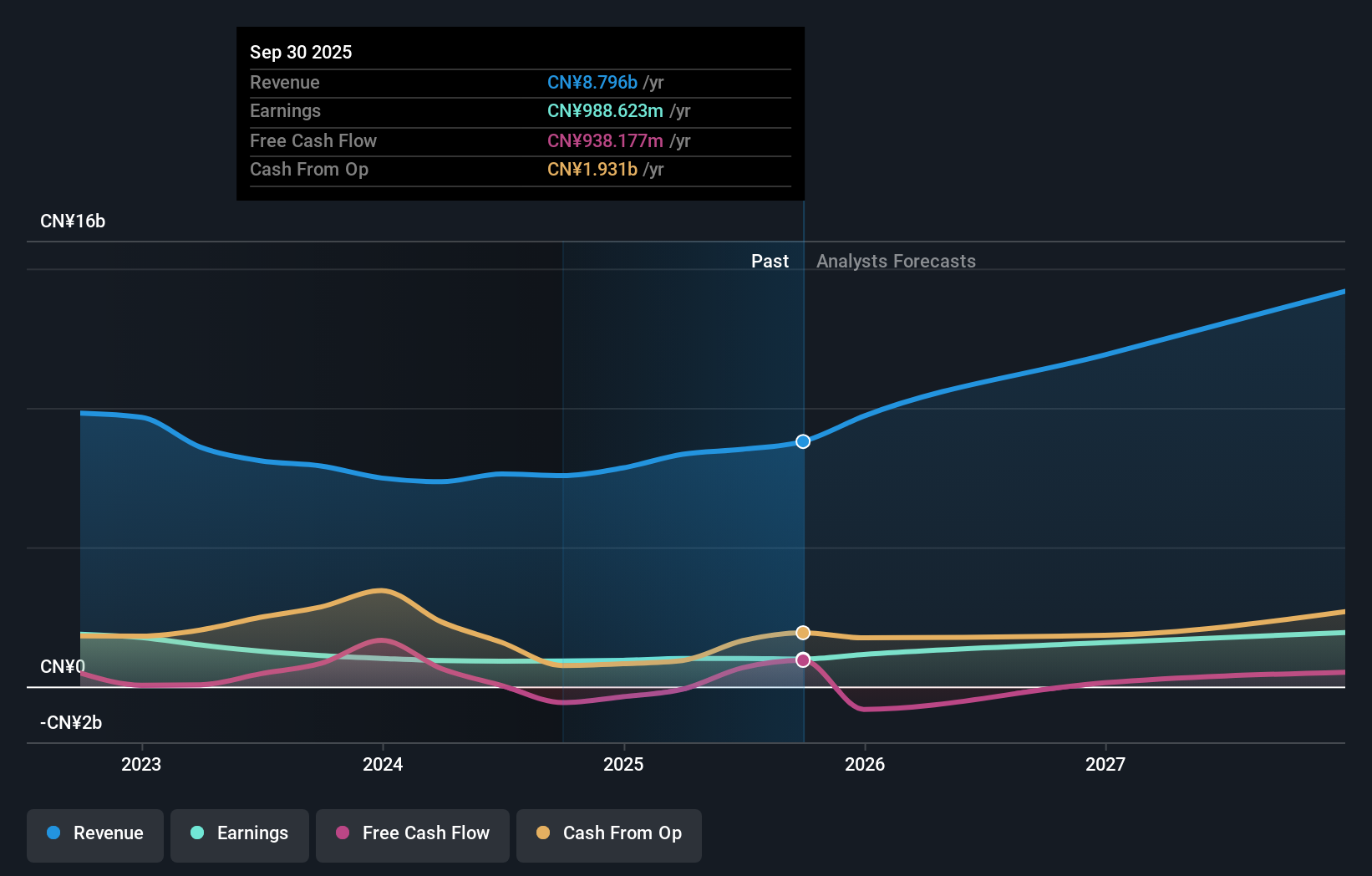

Shenzhen Capchem Technology demonstrates potential with projected annual earnings growth of 27.6%, outpacing the Chinese market's expected 24%. Despite a recent dip in net income to CNY 415.8 million for H1 2024, revenue grew to CNY 3.58 billion. The company completed a share buyback worth CNY 60.42 million, indicating confidence in its valuation. However, its dividend yield of 1.44% is not well covered by free cash flows and lacks substantial recent insider trading activity insights.

- Unlock comprehensive insights into our analysis of Shenzhen Capchem Technology stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Capchem Technology shares in the market.

Make It Happen

- Reveal the 1517 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002648

Satellite ChemicalLtd

A low-carbon chemical company, manufactures and sells functional chemicals, new polymer materials, and new energy materials in China and internationally.

Very undervalued with solid track record and pays a dividend.