Discovering December 2024's Undiscovered Gems on the None Exchange

Reviewed by Simply Wall St

As global markets continue to climb, with small-cap indices like the Russell 2000 reaching new heights, investors are keeping a close eye on economic indicators that might impact these smaller companies. Amidst geopolitical tensions and shifting domestic policies, the resilience of consumer spending and recent record highs in key indices suggest potential opportunities for discerning investors. In this dynamic environment, identifying stocks that exhibit strong fundamentals, adaptability to market changes, and growth potential can be crucial for uncovering undiscovered gems on the None Exchange.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen King Explorer Science and Technology (SZSE:002917)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen King Explorer Science and Technology Corporation engages in the research, design, development, manufacturing, and sale of intelligent equipment systems for civil explosive production and blasting service companies both in China and internationally, with a market cap of CN¥3.52 billion.

Operations: King Explorer generates revenue primarily from the sale of intelligent equipment systems to civil explosive and blasting service companies. The company's net profit margin has shown fluctuations, indicating variability in its cost structure and profitability over different periods.

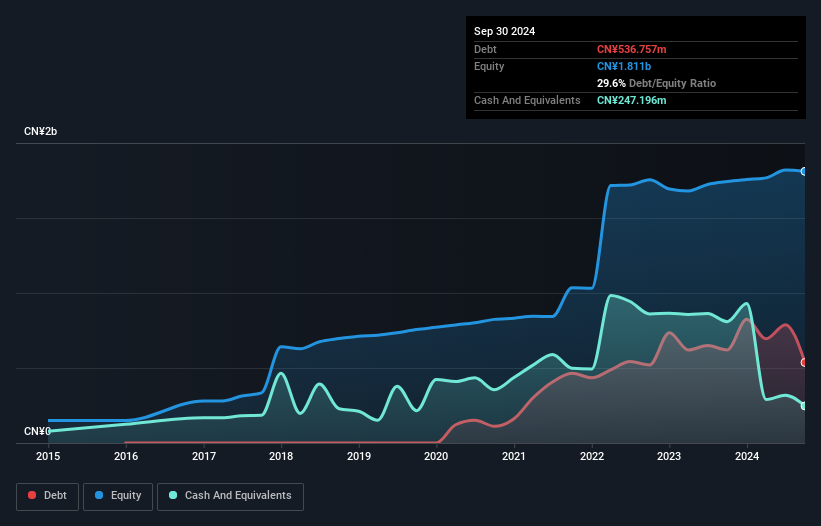

Shenzhen King Explorer Science and Technology, a promising small cap, reported impressive earnings growth of 117% over the past year, outpacing the -5% decline in the Chemicals industry. The company's net income for the nine months ending September 2024 rose to CNY 107.67 million from CNY 80.81 million previously, reflecting its high-quality earnings profile. With a debt to equity ratio climbing to 29.6% over five years yet maintaining a satisfactory net debt to equity ratio of 16%, it seems well-positioned financially. Trading at about 46% below estimated fair value suggests potential upside if growth projections hold true.

Delta Galil Industries (TASE:DELG)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Galil Industries Ltd. specializes in the design, development, production, marketing, and sale of intimate and activewear products with a market capitalization of ₪5.18 billion.

Operations: Delta Galil Industries generates revenue primarily from its Private Brands and Delta Israel segments, contributing $766 million and $302.86 million respectively. The company also benefits significantly from its Brands segment, which adds $637.48 million to the total revenue stream.

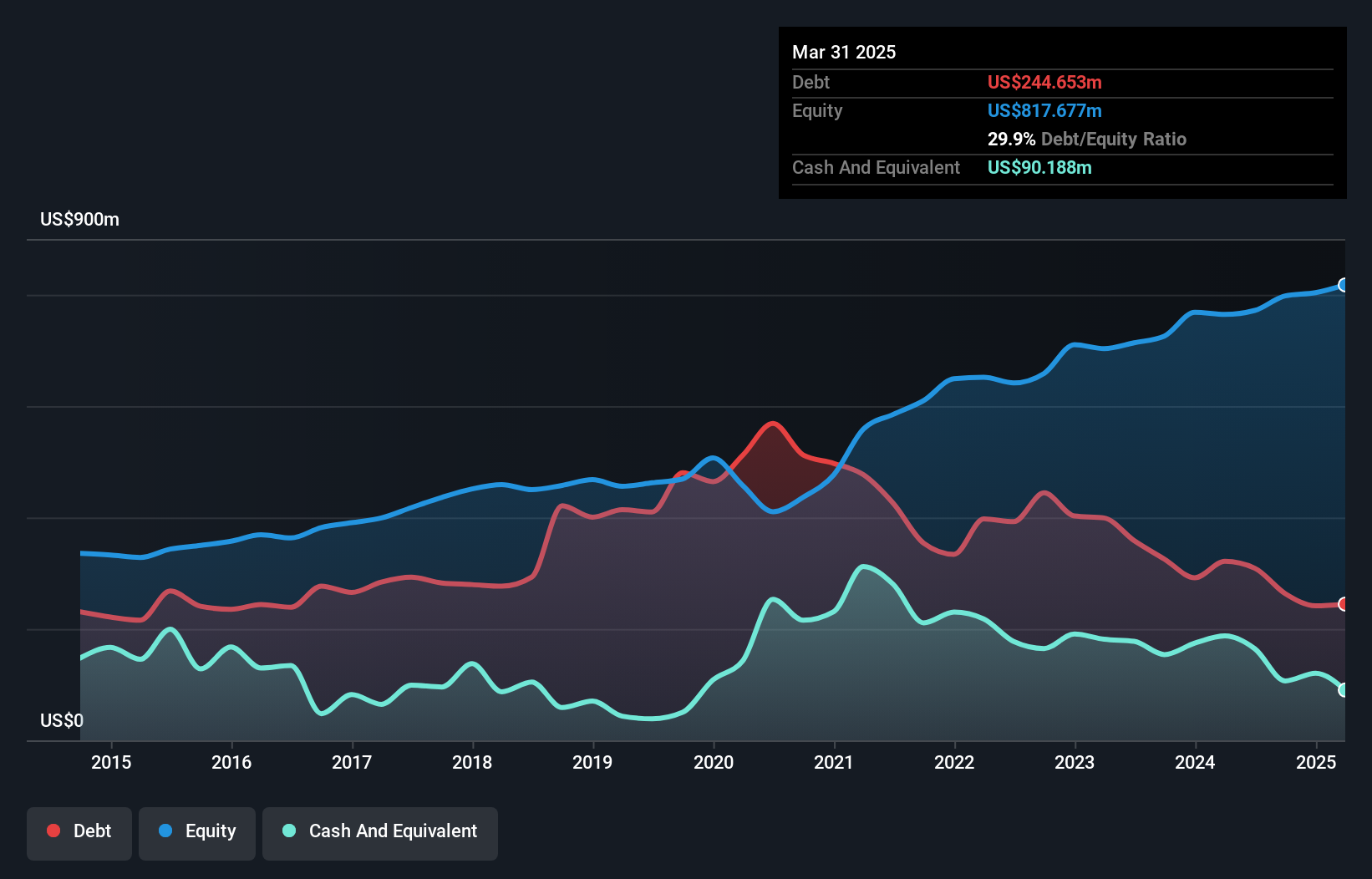

Delta Galil Industries, a dynamic player in the apparel sector, has shown robust financial health with its debt to equity ratio dropping from 102.4% to 33% over five years and a net debt to equity ratio at a satisfactory 19.6%. The company's earnings have outpaced the luxury industry with a growth of 17.6% last year, reflecting high-quality earnings and solid interest coverage of 5.4 times EBIT. Recent strategic moves include a joint venture with Reliance Retail Ventures in India to innovate apparel offerings and expand market presence, alongside reaffirmed strong financial guidance for the year ahead with expected sales between $1.99 billion and $2.03 billion US$.

Musashino Bank (TSE:8336)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers a range of banking products and financial services in Japan and has a market cap of ¥101.56 billion.

Operations: Musashino Bank generates revenue primarily through interest income from loans and securities, alongside fees from various financial services. The bank's cost structure includes interest expenses on deposits and borrowings, as well as operational costs related to its service offerings.

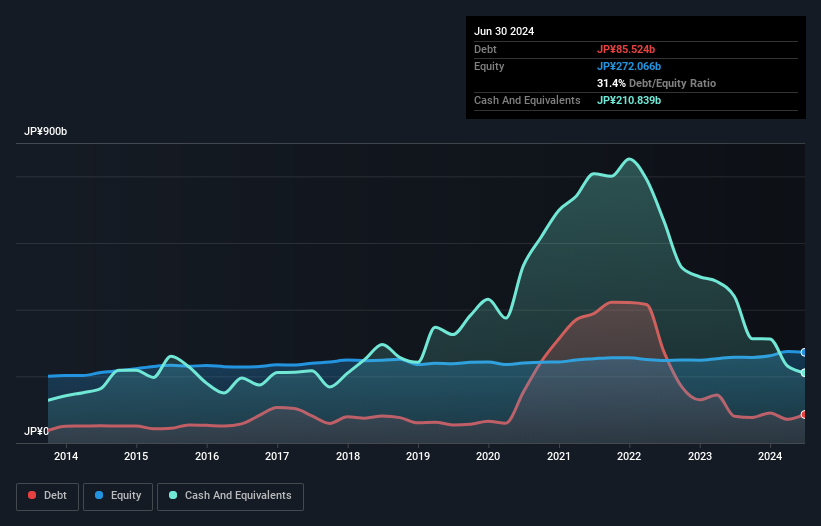

Musashino Bank, with assets totaling ¥5,416.7 billion and equity at ¥274.6 billion, showcases a robust financial foundation despite some challenges. The bank's deposits stand at ¥5,027.6 billion against loans of ¥4,023.2 billion; however, its net interest margin is only 0.9%. While it trades 44% below estimated fair value and earnings have grown by 9% annually over five years, the allowance for bad loans is insufficient at 1.7%, indicating potential risk management issues. Primarily funded through low-risk customer deposits (98%), Musashino Bank remains a notable player in its segment with high-quality past earnings.

- Take a closer look at Musashino Bank's potential here in our health report.

Review our historical performance report to gain insights into Musashino Bank's's past performance.

Taking Advantage

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8336

Musashino Bank

Provides banking products and financial services in Japan.

Excellent balance sheet established dividend payer.