As global markets navigate the implications of recent policy changes and economic indicators, U.S. stocks have been buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence infrastructure. While large-cap stocks have generally outperformed their smaller-cap counterparts, the current environment presents opportunities for discerning investors to explore under-the-radar small-cap companies that may benefit from these broader market trends. Identifying a good stock often involves looking for those with strong fundamentals, innovative growth strategies, or unique positions within emerging sectors—all of which can offer potential resilience amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| TCM Biotech International | 10.23% | 9.33% | -1.73% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Standard Foods | 7.90% | -3.40% | -24.36% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Zhejiang Shaoxing RuiFeng Rural Commercial BankLtd (SHSE:601528)

Simply Wall St Value Rating: ★★★★★★

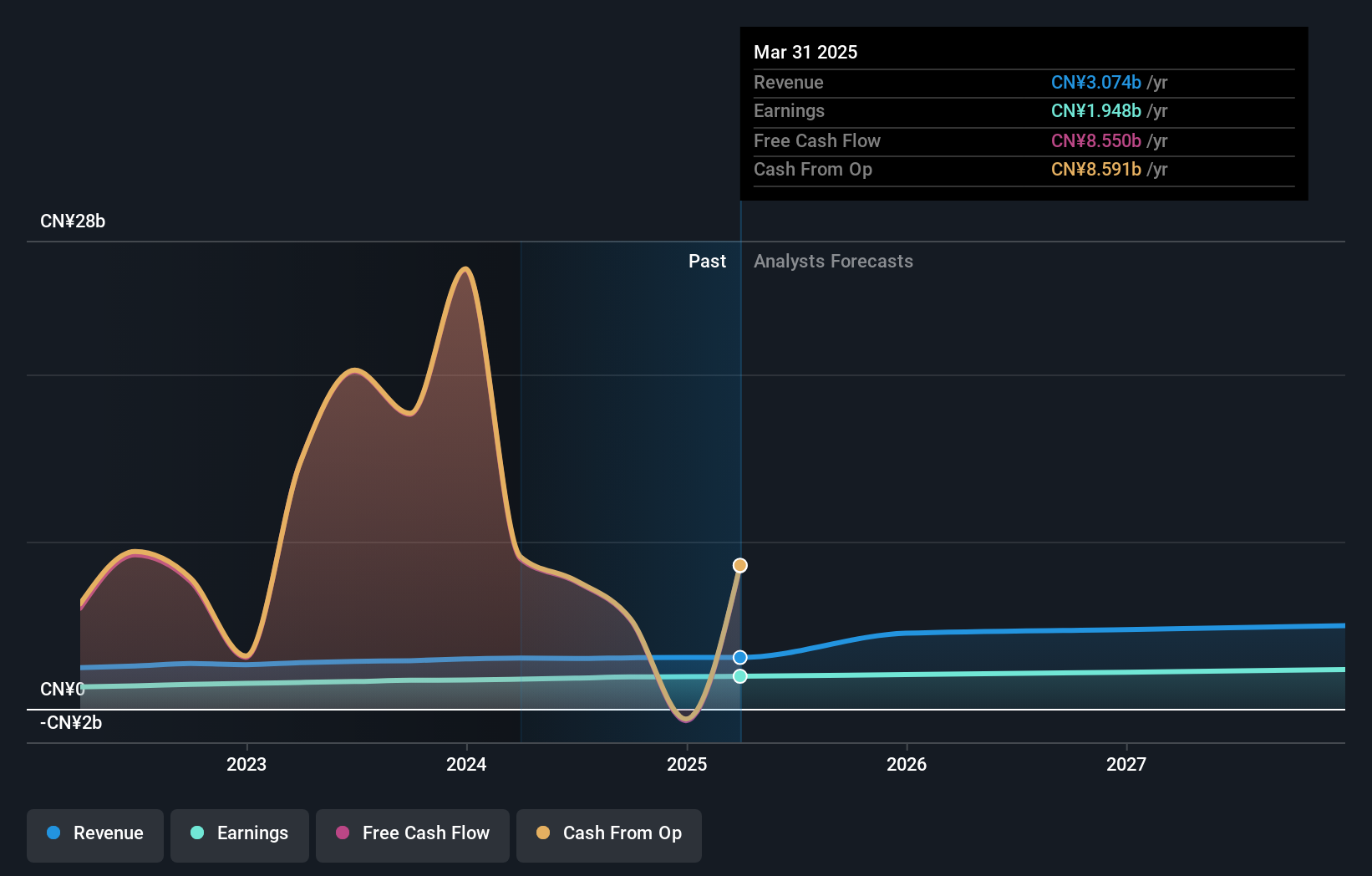

Overview: Zhejiang Shaoxing RuiFeng Rural Commercial Bank Co., Ltd offers commercial banking products and services in China, with a market cap of CN¥10.75 billion.

Operations: Zhejiang Shaoxing RuiFeng Rural Commercial Bank Co., Ltd generates revenue primarily through interest income from its lending activities and fees from financial services. The bank's net profit margin is a key performance indicator, reflecting its ability to manage costs relative to its income.

RuiFeng Bank, with total assets of CN¥211.3 billion and equity of CN¥18.1 billion, showcases a robust financial profile. It reported earnings growth of 11.7% last year, notably outpacing the industry average of 3.6%. The bank's funding is largely low-risk, with customer deposits making up 82% of liabilities. Its non-performing loans are at an appropriate level of 1%, supported by a substantial allowance for bad loans at 322%. Despite a one-off gain impacting recent results, RuiFeng remains attractive due to its strong asset base and prudent risk management strategies in place.

Shandong Dawn PolymerLtd (SZSE:002838)

Simply Wall St Value Rating: ★★★★☆☆

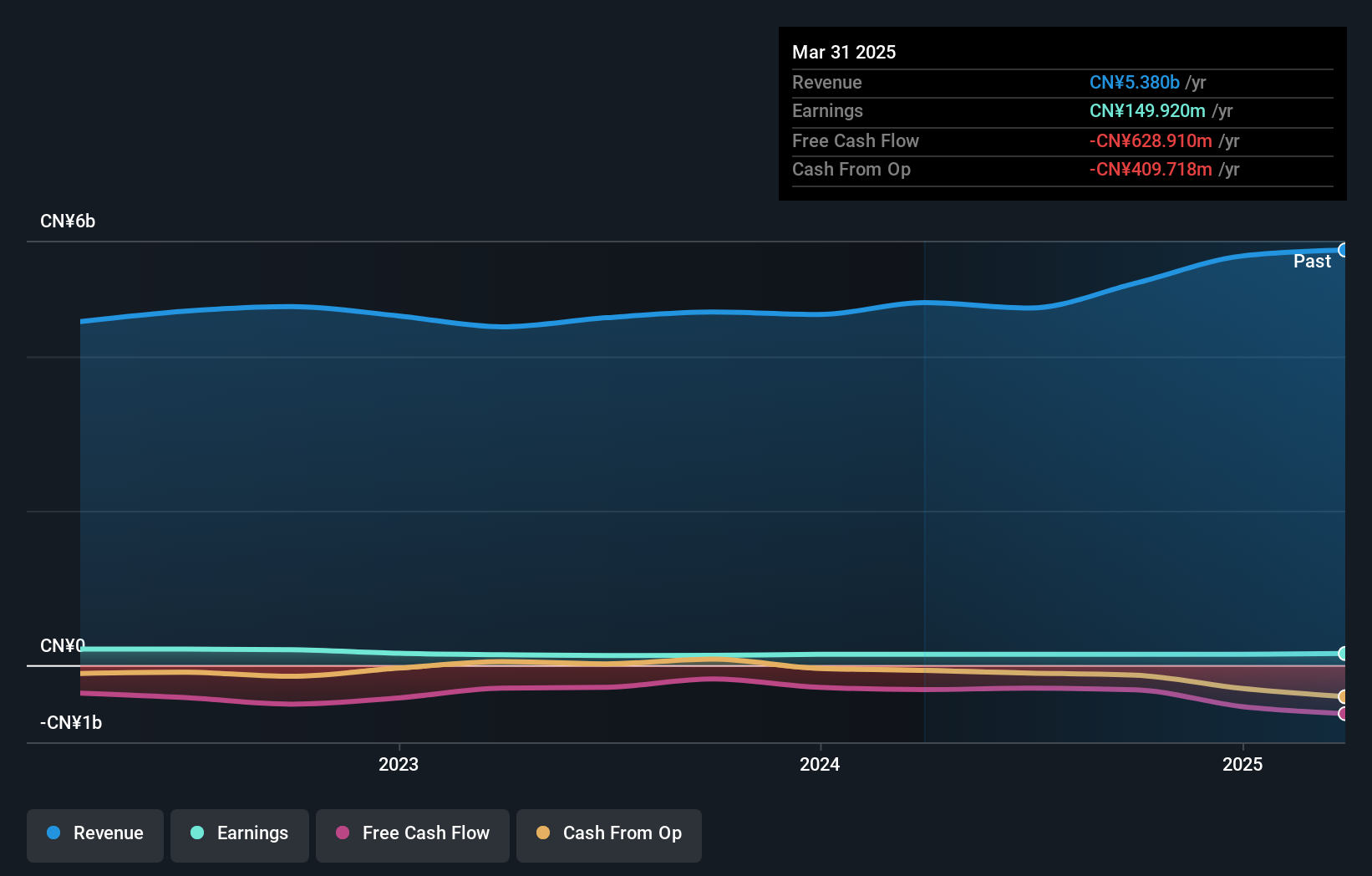

Overview: Shandong Dawn Polymer Co., Ltd. is engaged in the development, production, sale, and servicing of thermoplastic elastomers, modified plastics, master batches, and other products both in China and internationally with a market capitalization of CN¥5.13 billion.

Operations: Dawn Polymer generates revenue primarily from the sale of thermoplastic elastomers, modified plastics, and master batches. The company's financial performance is influenced by its cost structure, which includes raw material expenses and production costs. Notably, it has experienced fluctuations in its gross profit margin over recent periods.

Dawn Polymer, a nimble player in the chemicals sector, has shown resilience with an 11% earnings growth over the past year, outpacing the industry's -5.3%. Despite a satisfactory net debt to equity ratio of 24.6%, its debt to equity has risen from 32.1% to 38.8% in five years, which may warrant attention. The company's interest payments are well covered by EBIT at a multiple of 5.6x, reflecting sound financial management amidst challenges like declining earnings at an annual rate of 27.9%. Recent shareholder-approved dividends and private placements suggest proactive capital strategies for future initiatives.

- Get an in-depth perspective on Shandong Dawn PolymerLtd's performance by reading our health report here.

Understand Shandong Dawn PolymerLtd's track record by examining our Past report.

Toagosei (TSE:4045)

Simply Wall St Value Rating: ★★★★★★

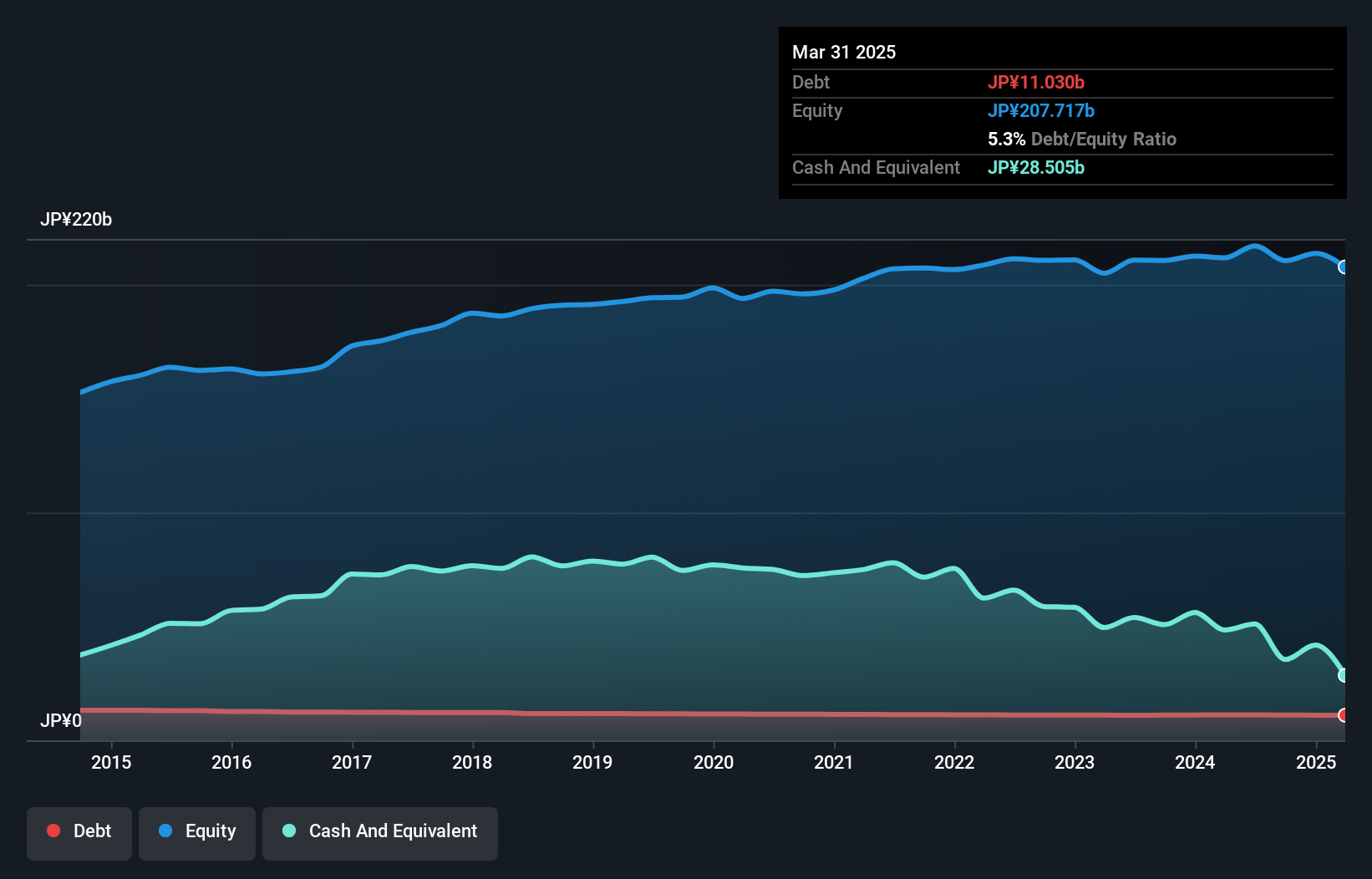

Overview: Toagosei Co., Ltd. is a company involved in the manufacturing, distribution, and sale of chemical products with a market capitalization of ¥162.48 billion.

Operations: Toagosei generates revenue primarily from its Fundamental Chemistry Product Business, which accounts for ¥81.68 billion, followed by the Polymers and Oligomer Business at ¥36.44 billion. The Resin Processing Product Business contributes ¥28.69 billion to the revenue stream.

Toagosei is making waves with its strategic moves and solid financial footing. The company recently decided to establish a subsidiary in India, aiming to tap into the growing IT and automotive sectors there. This expansion aligns with its robust earnings growth of 39.9% over the past year, outpacing the broader chemicals industry growth of 13.7%. With a debt-to-equity ratio trimmed from 6% to 5.3% over five years, Toagosei's balance sheet appears strong. Additionally, it completed a share buyback program, repurchasing nearly 4.51 million shares for ¥7 billion (US$), enhancing shareholder value further.

- Click here and access our complete health analysis report to understand the dynamics of Toagosei.

Assess Toagosei's past performance with our detailed historical performance reports.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4659 more companies for you to explore.Click here to unveil our expertly curated list of 4662 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toagosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4045

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives