Three Stocks Estimated To Be Trading Below Fair Value In December 2024

Reviewed by Simply Wall St

As global markets continue to experience mixed performances, with major U.S. indexes hitting record highs while others like the Russell 2000 see declines, investors are keenly observing the divergence between growth and value stocks. Amidst this landscape of fluctuating economic indicators and geopolitical developments, identifying stocks trading below their fair value becomes particularly appealing for those seeking potential opportunities in undervalued assets. In such a market environment, a good stock is often characterized by strong fundamentals that may not yet be fully recognized or appreciated by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥17.20 | CN¥33.16 | 48.1% |

| Komax Holding (SWX:KOMN) | CHF120.20 | CHF240.31 | 50% |

| Hanwha Systems (KOSE:A272210) | ₩20700.00 | ₩39719.81 | 47.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.88 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1449.00 | ¥2890.08 | 49.9% |

| GREE (TSE:3632) | ¥451.00 | ¥862.54 | 47.7% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.62 | US$43.17 | 49.9% |

| Pluxee (ENXTPA:PLX) | €20.555 | €40.82 | 49.6% |

| Visional (TSE:4194) | ¥8567.00 | ¥17012.91 | 49.6% |

| Cicor Technologies (SWX:CICN) | CHF58.40 | CHF116.64 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

HANMI Semiconductor (KOSE:A042700)

Overview: HANMI Semiconductor Co., Ltd. manufactures and sells semiconductor equipment both in South Korea and internationally, with a market cap of ₩6.79 trillion.

Operations: The company generates revenue from the sale of semiconductor equipment amounting to ₩461.54 billion.

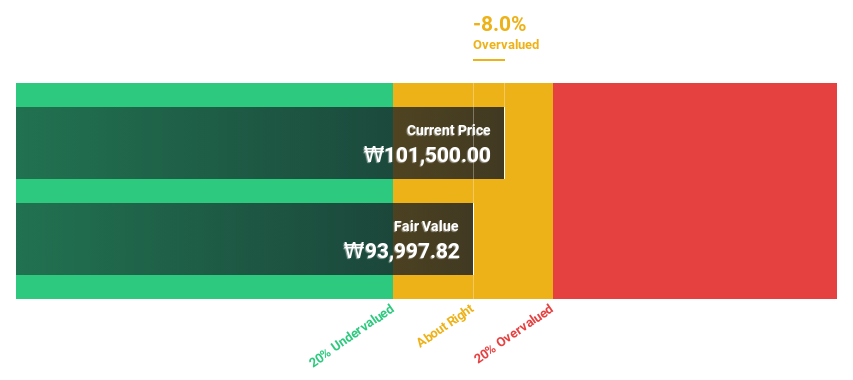

Estimated Discount To Fair Value: 2%

HANMI Semiconductor is trading slightly below its estimated fair value of ₩82,796.06, indicating potential undervaluation. Despite a decline in profit margins compared to last year, the company has shown strong earnings growth with net income rising significantly in recent quarters. Revenue and earnings are forecasted to grow substantially faster than the Korean market average. Additionally, a share repurchase program aims to enhance shareholder value by stabilizing stock prices through May 2025.

- Our earnings growth report unveils the potential for significant increases in HANMI Semiconductor's future results.

- Get an in-depth perspective on HANMI Semiconductor's balance sheet by reading our health report here.

Yunnan Energy New Material (SZSE:002812)

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both in China and internationally, with a market cap of CN¥35.66 billion.

Operations: The company's revenue primarily comes from its film product offerings, which are distributed both domestically in China and internationally.

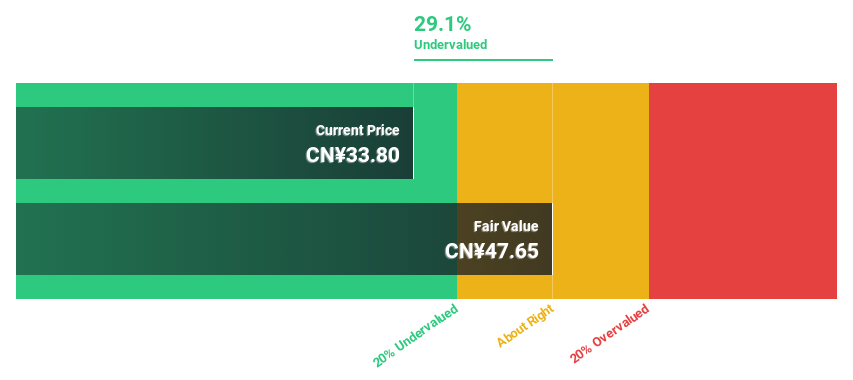

Estimated Discount To Fair Value: 22.9%

Yunnan Energy New Material is trading at CN¥36.77, below its estimated fair value of CN¥47.66, highlighting potential undervaluation based on cash flows. Despite a significant drop in profit margins and net income over the past year, earnings are expected to grow substantially faster than the Chinese market average. However, debt coverage by operating cash flow remains weak. Recent earnings reports show decreased sales and net income compared to the previous year.

- Our growth report here indicates Yunnan Energy New Material may be poised for an improving outlook.

- Click here to discover the nuances of Yunnan Energy New Material with our detailed financial health report.

YanKer shop FoodLtd (SZSE:002847)

Overview: YanKer shop Food Co., Ltd researches, develops, produces, and sells leisure food products in China and internationally with a market cap of CN¥14.45 billion.

Operations: The company generates revenue primarily from the production and sale of snack food, totaling CN¥4.97 billion.

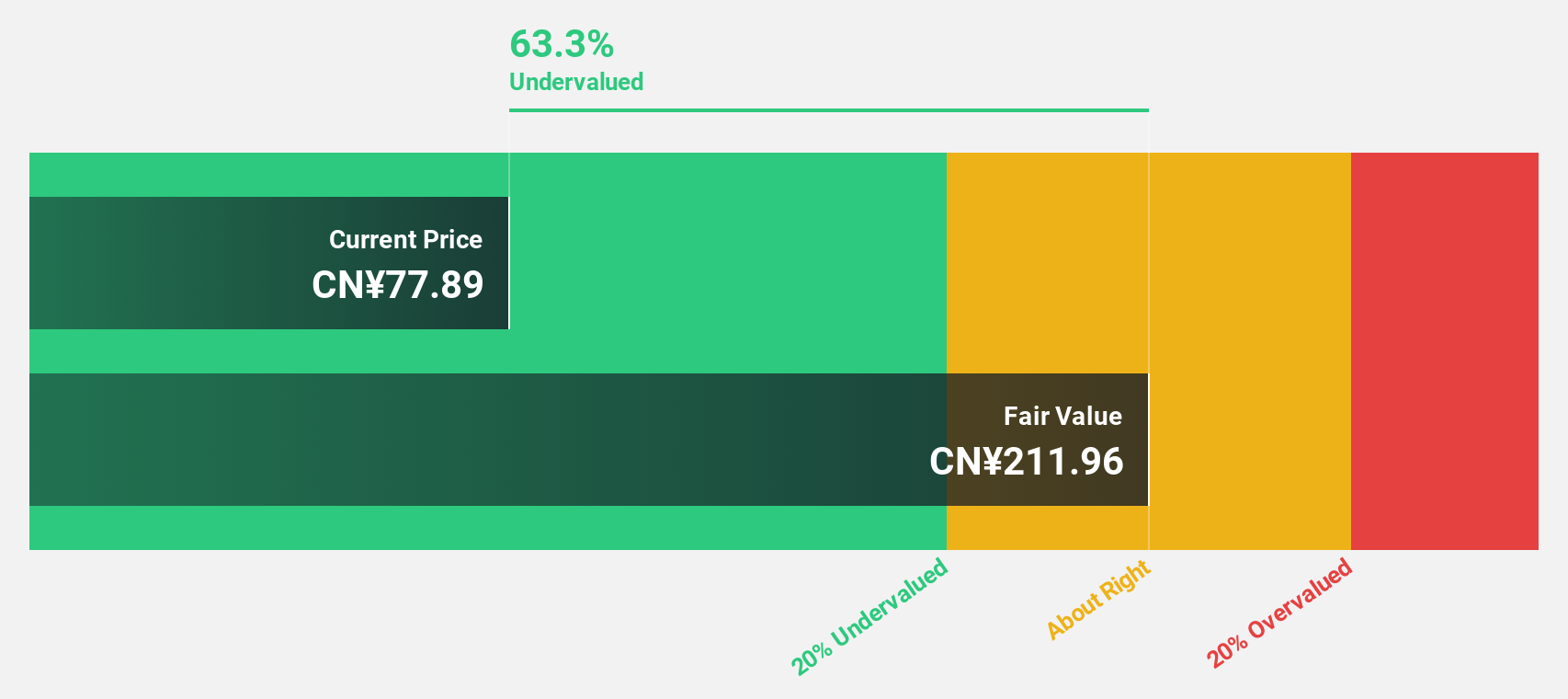

Estimated Discount To Fair Value: 37.4%

YanKer shop Food Ltd. is trading at CN¥54.89, significantly below its estimated fair value of CN¥87.66, indicating potential undervaluation based on cash flows. Despite earnings growing slower than the Chinese market average, revenue growth outpaces it and is expected to continue at over 20% annually. Recent nine-month results show increased sales of CN¥3.86 billion and net income of CN¥493.03 million compared to last year, reinforcing strong financial performance amid ongoing share buybacks.

- Our comprehensive growth report raises the possibility that YanKer shop FoodLtd is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of YanKer shop FoodLtd.

Key Takeaways

- Unlock our comprehensive list of 901 Undervalued Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002812

Yunnan Energy New Material

Offers film products in China and internationally.

Reasonable growth potential with adequate balance sheet.