High Insider Ownership Growth Stocks To Consider December 2024

Reviewed by Simply Wall St

As global markets experience mixed results, with major U.S. indices reaching record highs and growth stocks outperforming value shares, investors are closely watching the Federal Reserve's upcoming decisions on interest rate cuts. Amid this backdrop of economic uncertainty and sector variance, identifying growth companies with high insider ownership can offer insights into potential investment opportunities, as these firms often demonstrate strong alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts in China and has a market cap of CN¥15.54 billion.

Operations: The company's revenue segments include the production of automotive interior components in China.

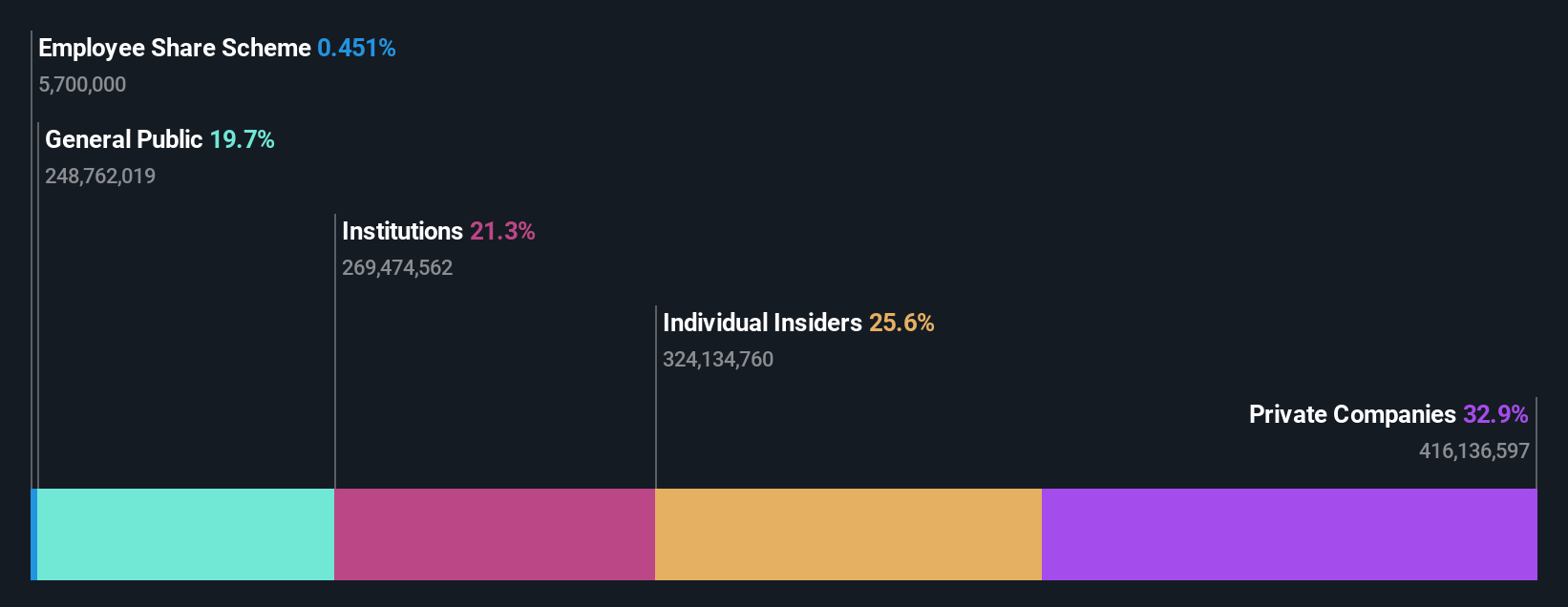

Insider Ownership: 25.7%

Ningbo Jifeng Auto Parts is trading at a significant discount to its estimated fair value and analysts expect the stock price to rise by 25.1%. Despite a recent net loss of CNY 531.94 million, earnings are forecasted to grow over 114% annually, with profitability anticipated within three years. Revenue growth is projected at 17% per year, surpassing the Chinese market average of 13.7%, although past shareholder dilution remains a concern.

- Take a closer look at Ningbo Jifeng Auto Parts' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Ningbo Jifeng Auto Parts' current price could be quite moderate.

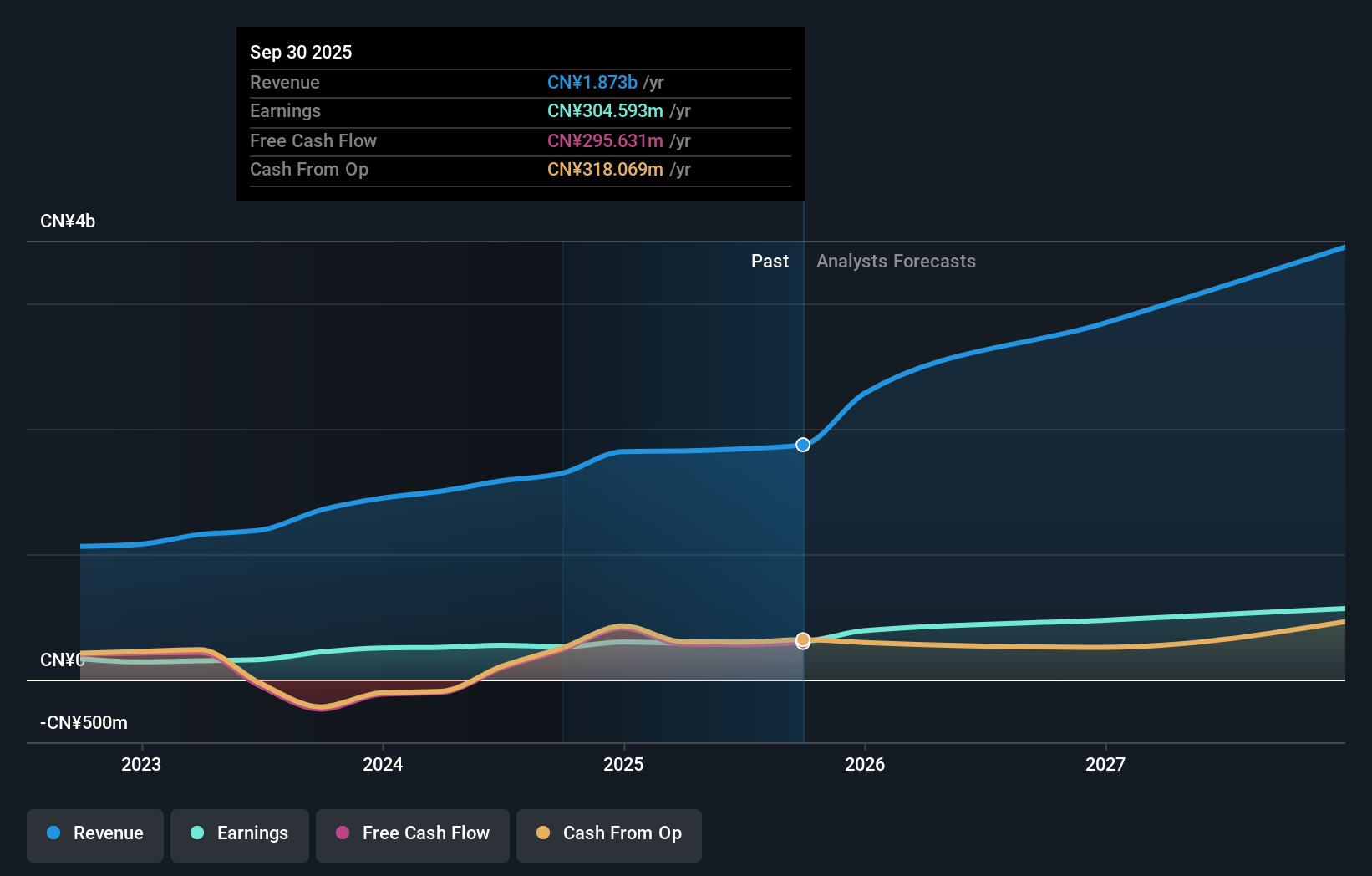

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. focuses on the research and development, design, and sale of wireless audio SOC chips, with a market cap of CN¥13.64 billion.

Operations: The company generates revenue from its activities in the research, development, design, and sale of wireless audio SOC chips.

Insider Ownership: 26.3%

Shenzhen Bluetrum Technology shows promising growth potential with expected revenue growth of 24.2% annually, outpacing the Chinese market average. Earnings are projected to grow at 25.76% per year, although slightly below the market's pace. The company's recent financials reveal a rise in sales to CNY 1.25 billion and net income of CNY 206.71 million for the nine months ending September 2024, indicating solid performance despite a volatile share price and an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Shenzhen Bluetrum Technology stock in this growth report.

- Our valuation report here indicates Shenzhen Bluetrum Technology may be overvalued.

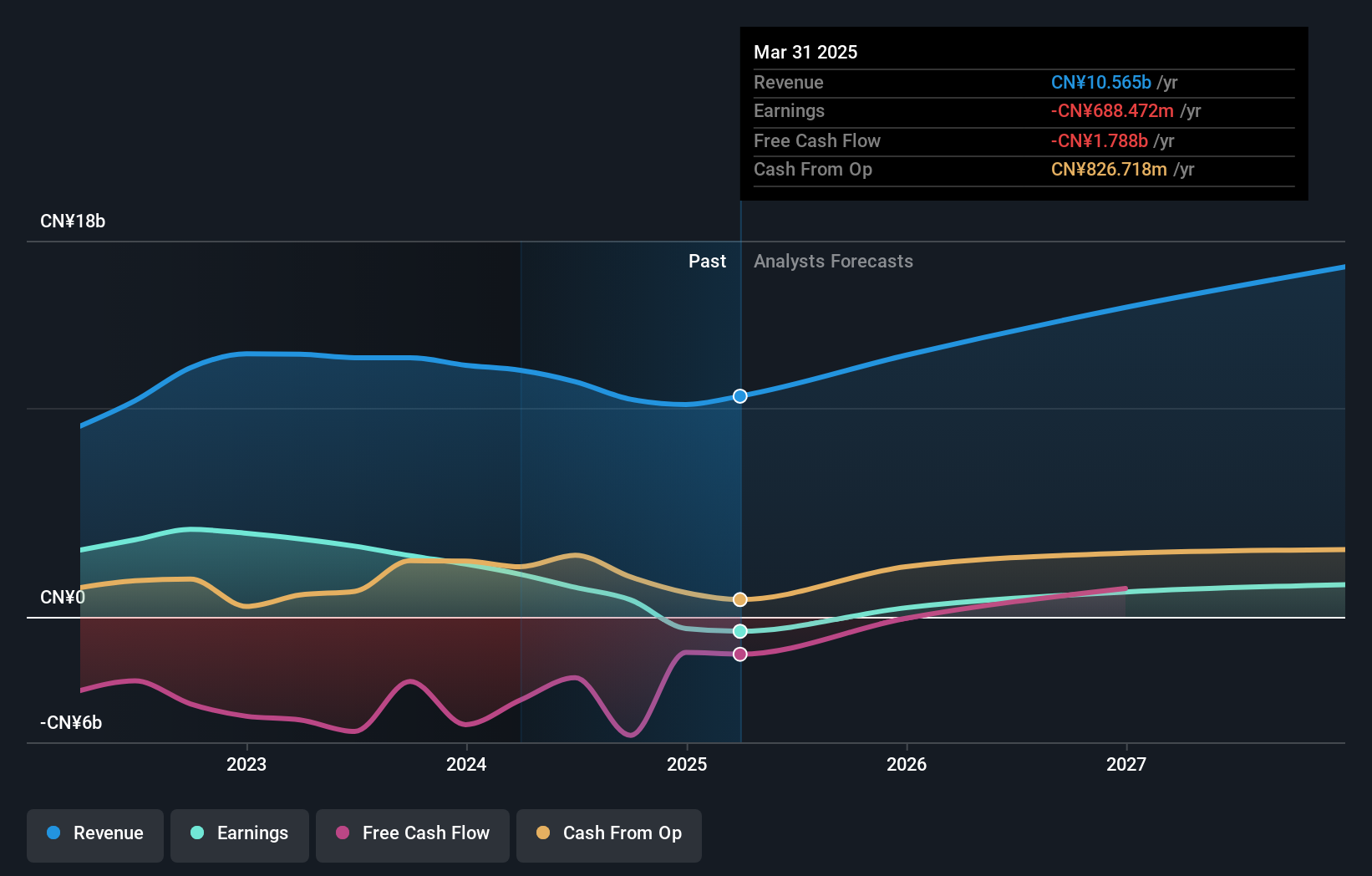

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd. and its subsidiaries provide film products both in China and internationally, with a market cap of CN¥35.66 billion.

Operations: Yunnan Energy New Material Co., Ltd. generates its revenue primarily through the production and sale of film products both domestically and internationally.

Insider Ownership: 30.5%

Yunnan Energy New Material's earnings are forecast to grow significantly at 38.4% annually, surpassing the Chinese market average. Despite trading at 22.9% below estimated fair value, recent financials show a decline in sales and net income for the first nine months of 2024, with revenue dropping to CNY 7.46 billion and net income falling to CNY 443.5 million from last year. The company's debt coverage by operating cash flow remains a concern amidst no substantial insider trading activity recently noted.

- Delve into the full analysis future growth report here for a deeper understanding of Yunnan Energy New Material.

- According our valuation report, there's an indication that Yunnan Energy New Material's share price might be on the expensive side.

Taking Advantage

- Gain an insight into the universe of 1511 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002812

Yunnan Energy New Material

Offers film products in China and internationally.

Reasonable growth potential with adequate balance sheet.