- China

- /

- Basic Materials

- /

- SZSE:002785

Revenues Tell The Story For Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) As Its Stock Soars 29%

Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

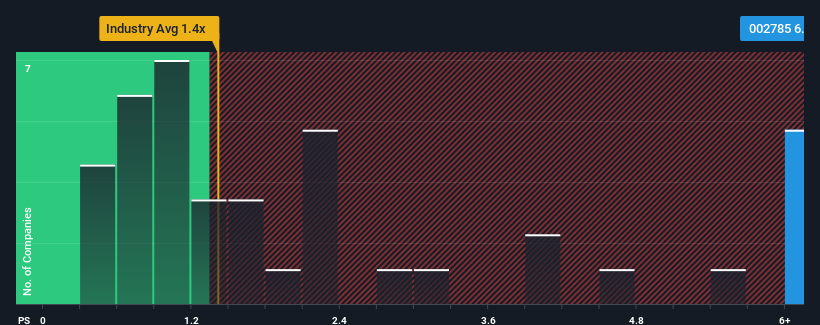

Since its price has surged higher, given around half the companies in China's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Xiamen Wanli Stone StockLtd as a stock to avoid entirely with its 6.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Xiamen Wanli Stone StockLtd

What Does Xiamen Wanli Stone StockLtd's Recent Performance Look Like?

Xiamen Wanli Stone StockLtd certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Xiamen Wanli Stone StockLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xiamen Wanli Stone StockLtd's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 9.5% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 33% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this information, we can see why Xiamen Wanli Stone StockLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Xiamen Wanli Stone StockLtd's P/S?

Xiamen Wanli Stone StockLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Xiamen Wanli Stone StockLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Xiamen Wanli Stone StockLtd with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002785

Xiamen Wanli Stone StockLtd

Develops, processes, and installs stone products, construction stones, stone carving handicrafts, and mineral products in China, Japan, South Korea, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives