- Poland

- /

- Real Estate

- /

- WSE:ECH

Three Stocks That May Be Undervalued In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by political shifts and economic data releases, major U.S. stock indexes have shown mixed results, with growth stocks significantly outperforming their value counterparts. This divergence presents a unique opportunity for investors to explore potentially undervalued stocks that may offer resilience or growth potential amidst these fluctuating conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩19960.00 | ₩39689.35 | 49.7% |

| Komax Holding (SWX:KOMN) | CHF120.20 | CHF240.31 | 50% |

| GREE (TSE:3632) | ¥458.00 | ¥912.32 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1445.00 | ¥2885.33 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.88 | 49.9% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.62 | US$43.17 | 49.9% |

| Pluxee (ENXTPA:PLX) | €20.555 | €40.82 | 49.6% |

| Visional (TSE:4194) | ¥8501.00 | ¥16991.03 | 50% |

| Cicor Technologies (SWX:CICN) | CHF58.40 | CHF116.64 | 49.9% |

Let's uncover some gems from our specialized screener.

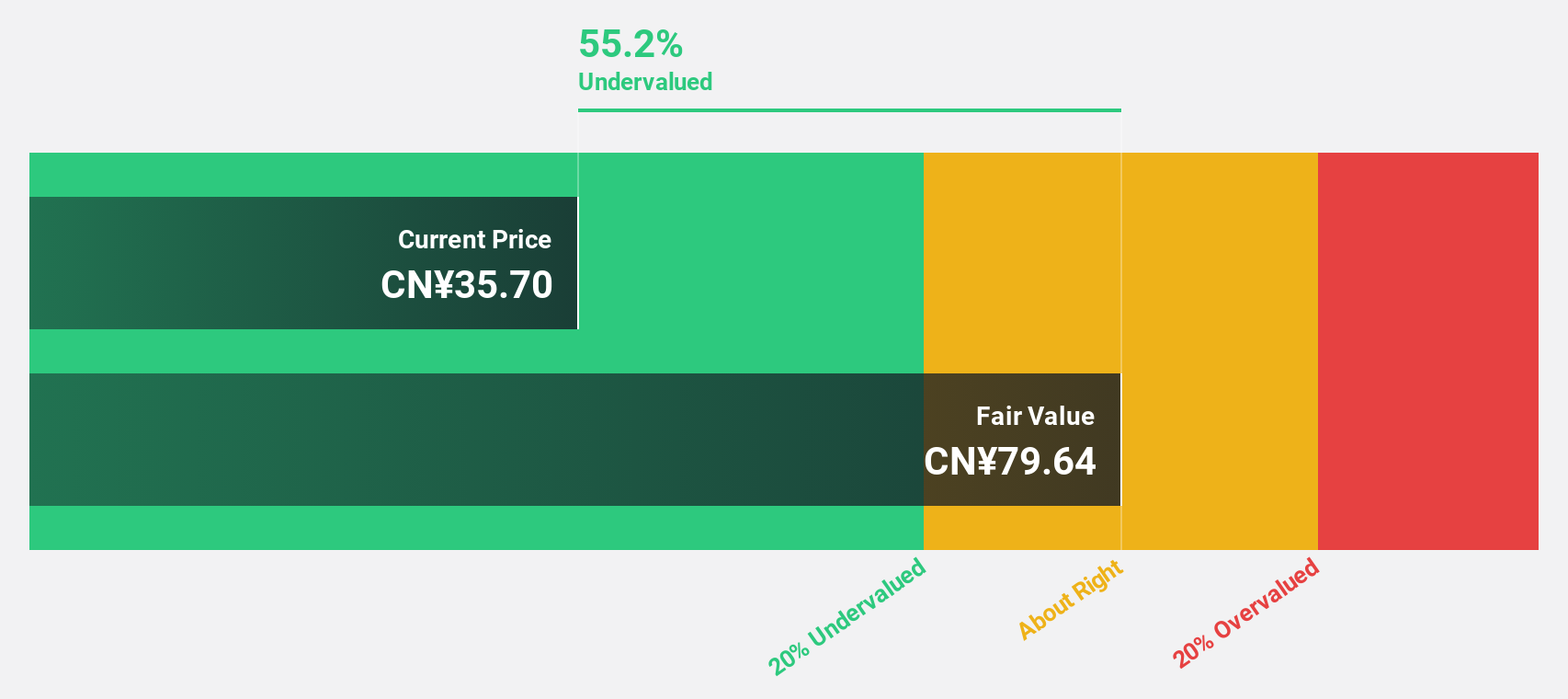

Suzhou Shihua New Material Technology (SHSE:688093)

Overview: Suzhou Shihua New Material Technology Co., Ltd. operates in the new materials industry and has a market cap of CN¥5.27 billion.

Operations: I can't provide a summary of the company's revenue segments as the specific information appears to be missing from the provided text.

Estimated Discount To Fair Value: 33.3%

Suzhou Shihua New Material Technology is trading at CN¥20.21, significantly below its estimated fair value of CN¥30.31, indicating potential undervaluation. Despite high non-cash earnings and a dividend not well covered by free cash flows, the company shows promise with an 18.4% earnings growth over the past year and projected revenue growth of 35% annually—outpacing market expectations. Recent financials reveal increased sales to CN¥566.38 million and net income of CN¥195.55 million for nine months ending September 2024.

- Our comprehensive growth report raises the possibility that Suzhou Shihua New Material Technology is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Suzhou Shihua New Material Technology.

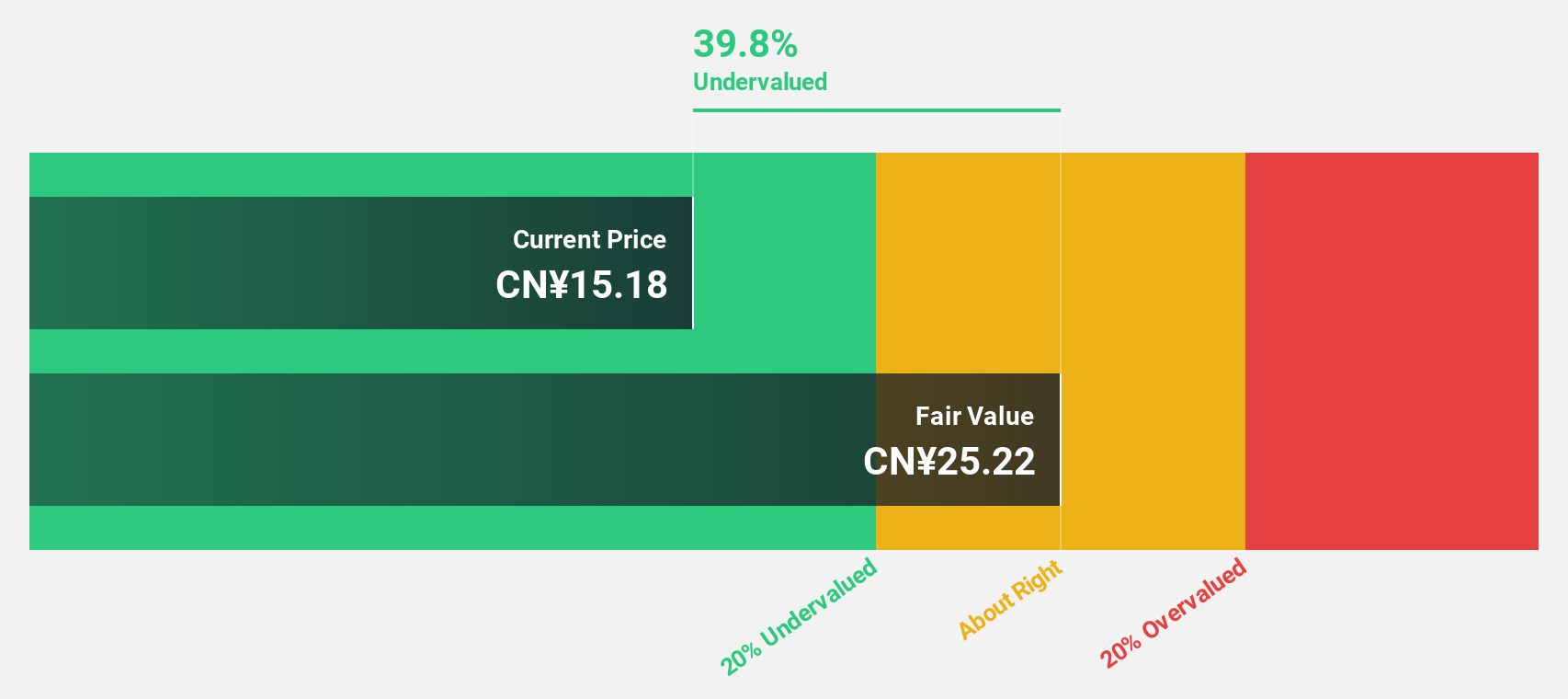

Sichuan Guoguang Agrochemical (SZSE:002749)

Overview: Sichuan Guoguang Agrochemical Co., Ltd. focuses on the R&D, manufacturing, marketing, and distribution of agrochemical products both in China and internationally, with a market cap of approximately CN¥6.64 billion.

Operations: The company's revenue is derived from its involvement in the research, development, production, and distribution of agrochemical products and materials across both domestic and international markets.

Estimated Discount To Fair Value: 14.4%

Sichuan Guoguang Agrochemical is trading at CN¥14.19, below its estimated fair value of CN¥16.58, suggesting potential undervaluation based on cash flows. The company reported sales of CNY 1.44 billion and net income of CNY 270 million for the nine months ending September 2024, with earnings per share rising to CNY 0.61 from CNY 0.51 last year. Despite past shareholder dilution and an unstable dividend track record, earnings are forecast to grow significantly at over 20% annually.

- According our earnings growth report, there's an indication that Sichuan Guoguang Agrochemical might be ready to expand.

- Get an in-depth perspective on Sichuan Guoguang Agrochemical's balance sheet by reading our health report here.

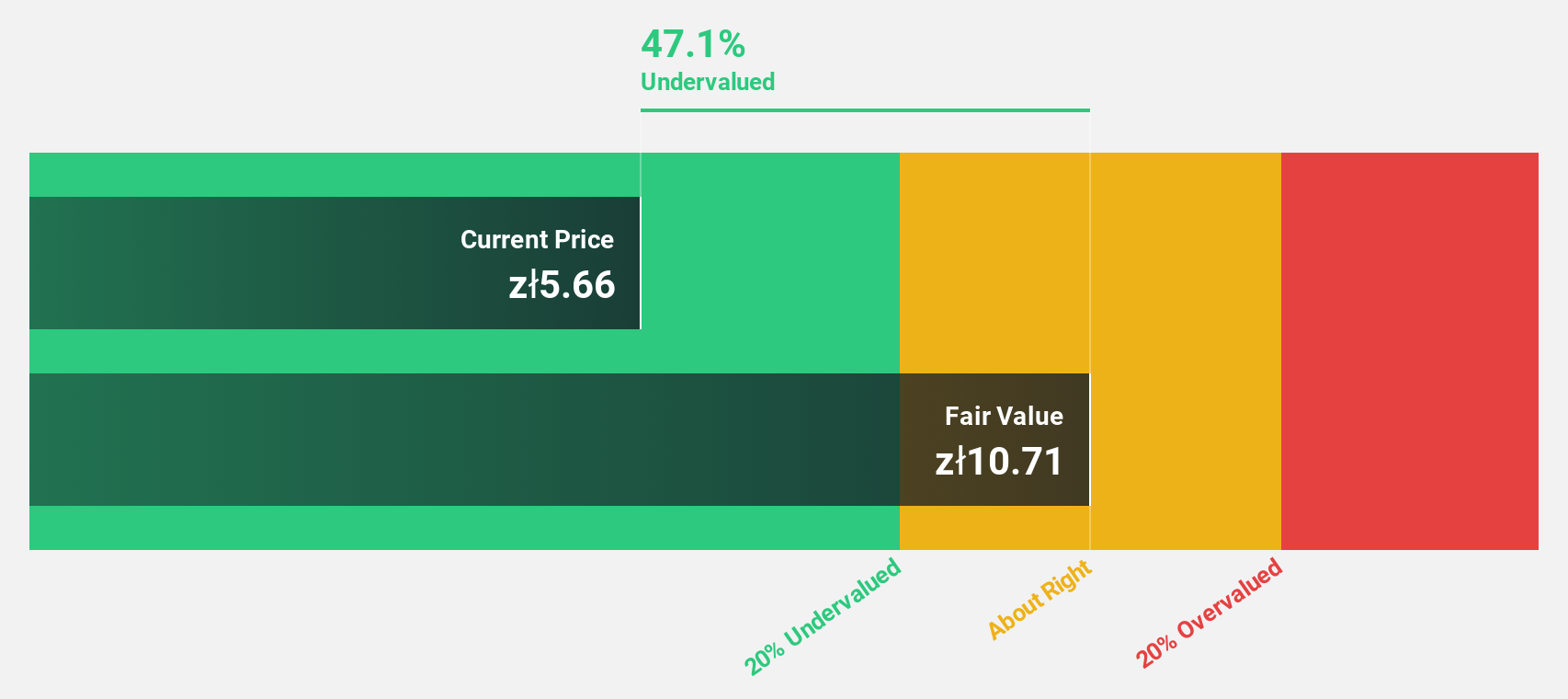

Echo Investment (WSE:ECH)

Overview: Echo Investment S.A. operates in Poland, focusing on the construction, lease, and sale of office, retail, and residential buildings with a market cap of PLN1.93 billion.

Operations: The company's revenue segments include the construction, lease, and sale of office, retail, and residential buildings in Poland.

Estimated Discount To Fair Value: 37.3%

Echo Investment is trading at PLN 4.67, significantly below its estimated fair value of PLN 7.45, highlighting potential undervaluation based on cash flows. Despite a challenging recent performance with a Q3 net loss of PLN 13.19 million and declining profit margins, revenue and earnings are forecast to grow faster than the Polish market at 14% and over 30% annually, respectively. However, dividend sustainability and interest coverage remain concerns for investors.

- In light of our recent growth report, it seems possible that Echo Investment's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Echo Investment stock in this financial health report.

Seize The Opportunity

- Explore the 901 names from our Undervalued Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Echo Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ECH

Echo Investment

Engages in the construction, lease, and sale of office, retail, and residential buildings in Poland.

Slight and slightly overvalued.