- China

- /

- Metals and Mining

- /

- SZSE:002721

Undiscovered Gems With Potential To Shine In January 2025

Reviewed by Simply Wall St

As global markets grapple with inflation fears and political uncertainties, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index slipping into correction territory. Despite this challenging backdrop, opportunities remain for discerning investors who can identify stocks with strong fundamentals and growth potential that may be overlooked in a volatile market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) is involved in component manufacturing and industrial trading across Sweden, the Nordic region, Europe, North America, Asia, and internationally with a market cap of approximately SEK9.97 billion.

Operations: Beijer Alma generates revenue primarily through its Lesjöfors segment, contributing SEK4.82 billion, and Beijer Tech segment, adding SEK2.25 billion.

Beijer Alma, a player in the machinery sector, has shown impressive performance with earnings growth of 44.5% over the past year, outpacing its industry peers. This Swedish company is trading at 7.3% below its estimated fair value, suggesting potential undervaluation. However, it carries a high net debt to equity ratio of 51.5%, which might be concerning for some investors despite interest payments being well-covered by EBIT at 4.3x coverage. Recent financials reveal significant improvements; net income surged to SEK 303 million from SEK 134 million year-on-year for Q3 2024 and basic EPS climbed to SEK 5.02 from SEK 2.22.

- Delve into the full analysis health report here for a deeper understanding of Beijer Alma.

Review our historical performance report to gain insights into Beijer Alma's's past performance.

Jiangsu Zijin Rural Commercial BankLtd (SHSE:601860)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zijin Rural Commercial Bank Co., Ltd offers a range of banking products and services to both personal and business customers, with a market cap of CN¥10.14 billion.

Operations: The bank generates revenue primarily through interest income from loans and advances, as well as fees from various banking services. Its net profit margin has shown variability across periods.

Jiangsu Zijin Rural Commercial Bank stands out with total assets of CN¥271 billion and equity of CN¥19.6 billion, highlighting its robust position. The bank's allowance for bad loans is notably sufficient at 217%, ensuring strong risk management. With liabilities primarily funded through low-risk customer deposits, making up 87% of its funding sources, it reflects a stable financial structure. Despite negative earnings growth of -3.2% last year against the industry average growth rate of 3.6%, the bank trades at a significant discount to estimated fair value by 50%. Net income remained steady over recent periods, reinforcing its consistent performance amidst challenges.

- Unlock comprehensive insights into our analysis of Jiangsu Zijin Rural Commercial BankLtd stock in this health report.

Understand Jiangsu Zijin Rural Commercial BankLtd's track record by examining our Past report.

Beijing Kingee Culture Development (SZSE:002721)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Kingee Culture Development Co., Ltd. operates in the cultural industry with a market cap of CN¥6.65 billion.

Operations: Kingee Culture Development generates revenue primarily through its cultural industry operations. The company's market capitalization is approximately CN¥6.65 billion, indicating its scale within the sector.

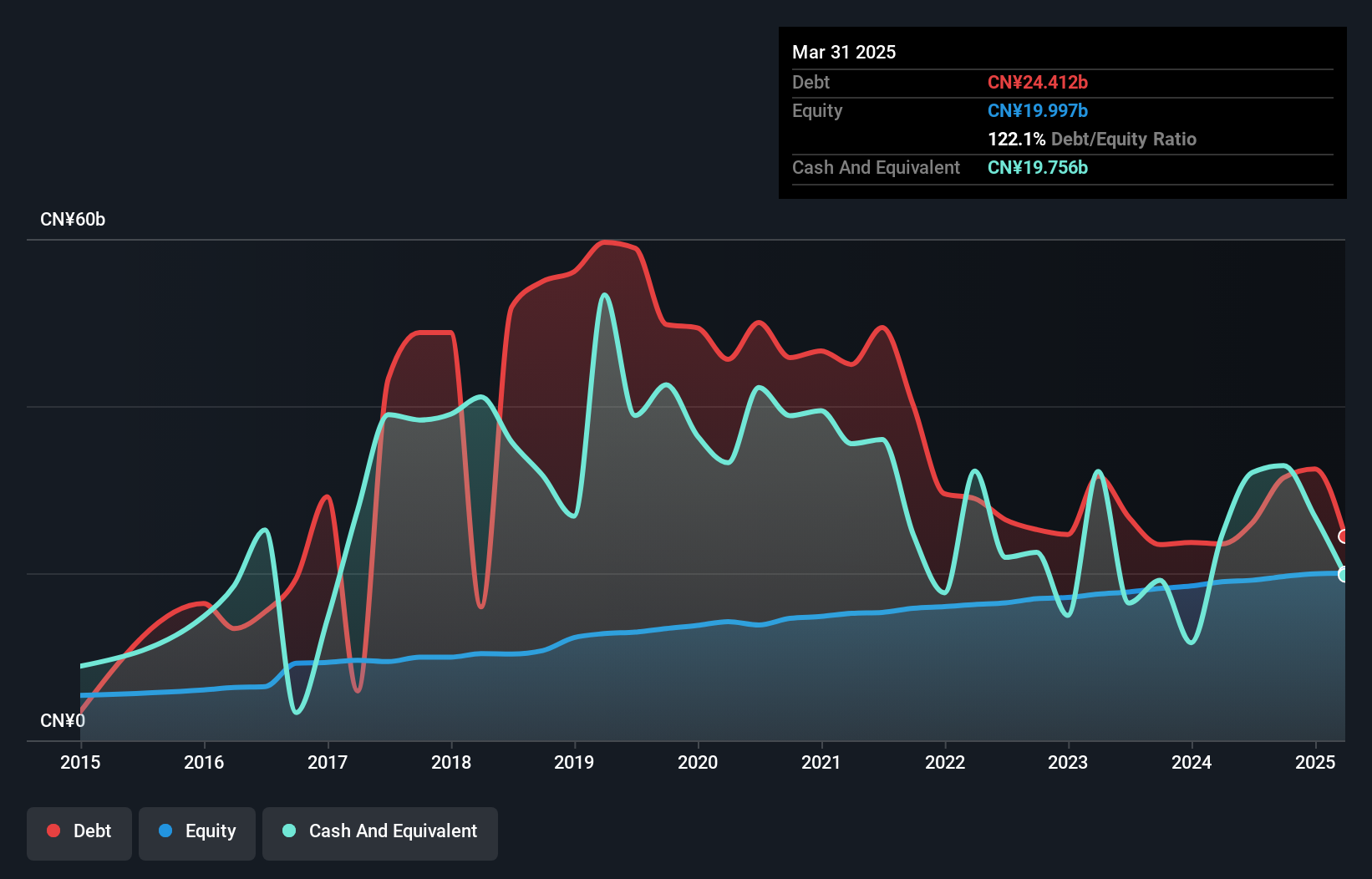

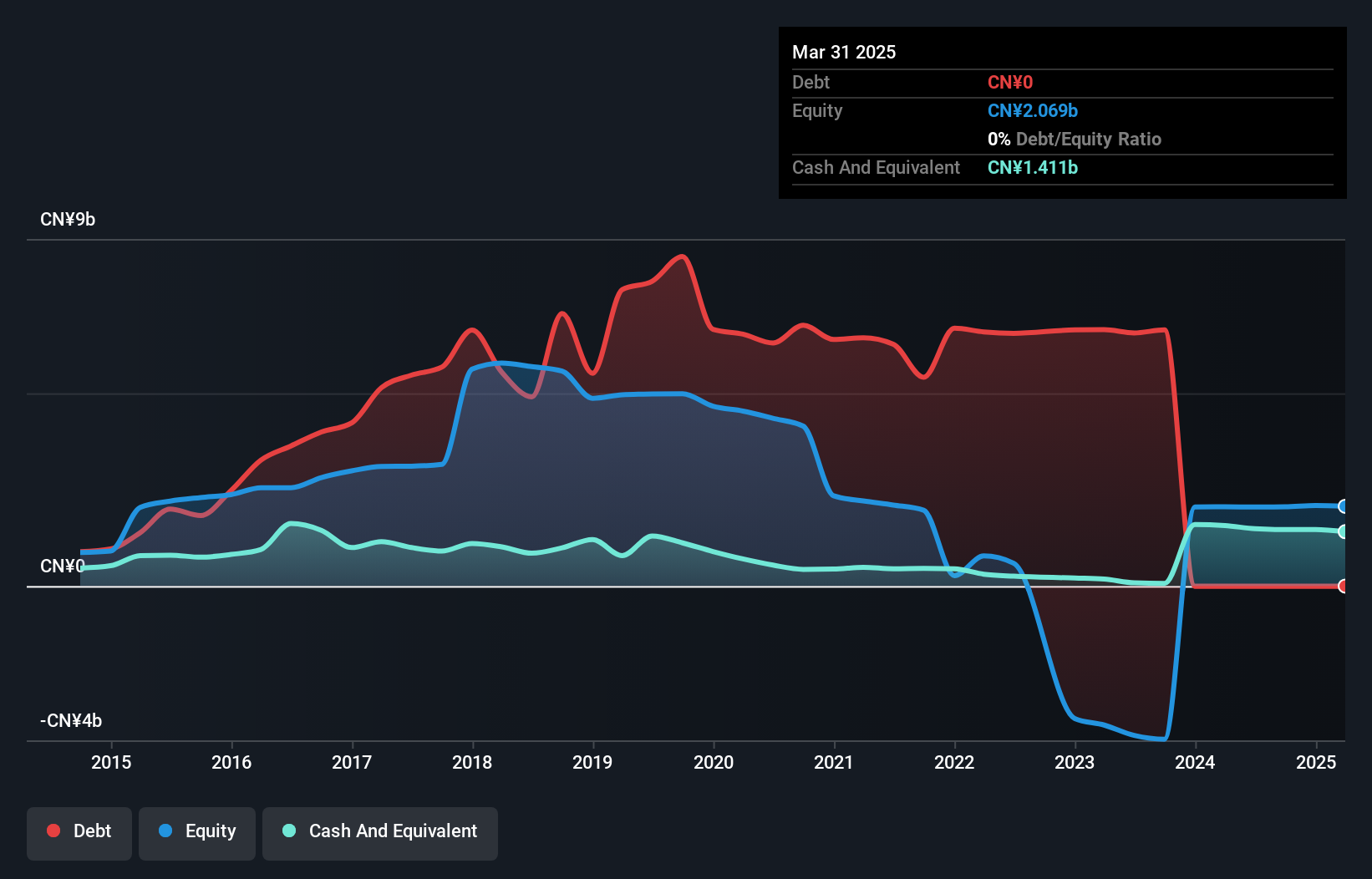

Beijing Kingee Culture Development, a smaller player in the market, recently turned profitable with net income reaching CNY 0.61 million for the first nine months of 2024, contrasting a net loss of CNY 521.4 million last year. Despite sales dropping to CNY 276.78 million from CNY 1.31 billion, its price-to-earnings ratio stands attractively low at 5.6x against the broader CN market's average of 34.1x. The company has eliminated debt over five years from a high debt-to-equity ratio of 171%, which likely enhances financial stability and positions it well for future opportunities despite not yet generating positive free cash flow.

Seize The Opportunity

- Delve into our full catalog of 4628 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Kingee Culture Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002721

Beijing Kingee Culture Development

Engages in the research, design, development, and sale of gold jewelry under the Jinyi, Yuewang Jewelry, and Yue Wang Ancient Gold brands in China.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026