- Taiwan

- /

- Semiconductors

- /

- TWSE:3189

3 Global Stocks Estimated To Be Trading At Up To 47.5% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of renewed U.S.-China trade tensions and concerns over a prolonged government shutdown, global markets have experienced increased volatility, with major indices like the S&P 500 and Nasdaq Composite showing mixed performance. In such uncertain times, identifying undervalued stocks can be an effective strategy for investors seeking opportunities; these stocks are often trading below their intrinsic value, presenting potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.18 | CN¥38.19 | 49.8% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.91 | CN¥88.95 | 49.5% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.75 | 49.5% |

| Japan Eyewear Holdings (TSE:5889) | ¥2031.00 | ¥4061.83 | 50% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥956.00 | ¥1906.07 | 49.8% |

| Essex Bio-Technology (SEHK:1061) | HK$4.77 | HK$9.46 | 49.6% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.35 | €6.64 | 49.5% |

| Bilendi (ENXTPA:ALBLD) | €21.80 | €43.21 | 49.5% |

| Aquafil (BIT:ECNL) | €1.94 | €3.85 | 49.5% |

Underneath we present a selection of stocks filtered out by our screen.

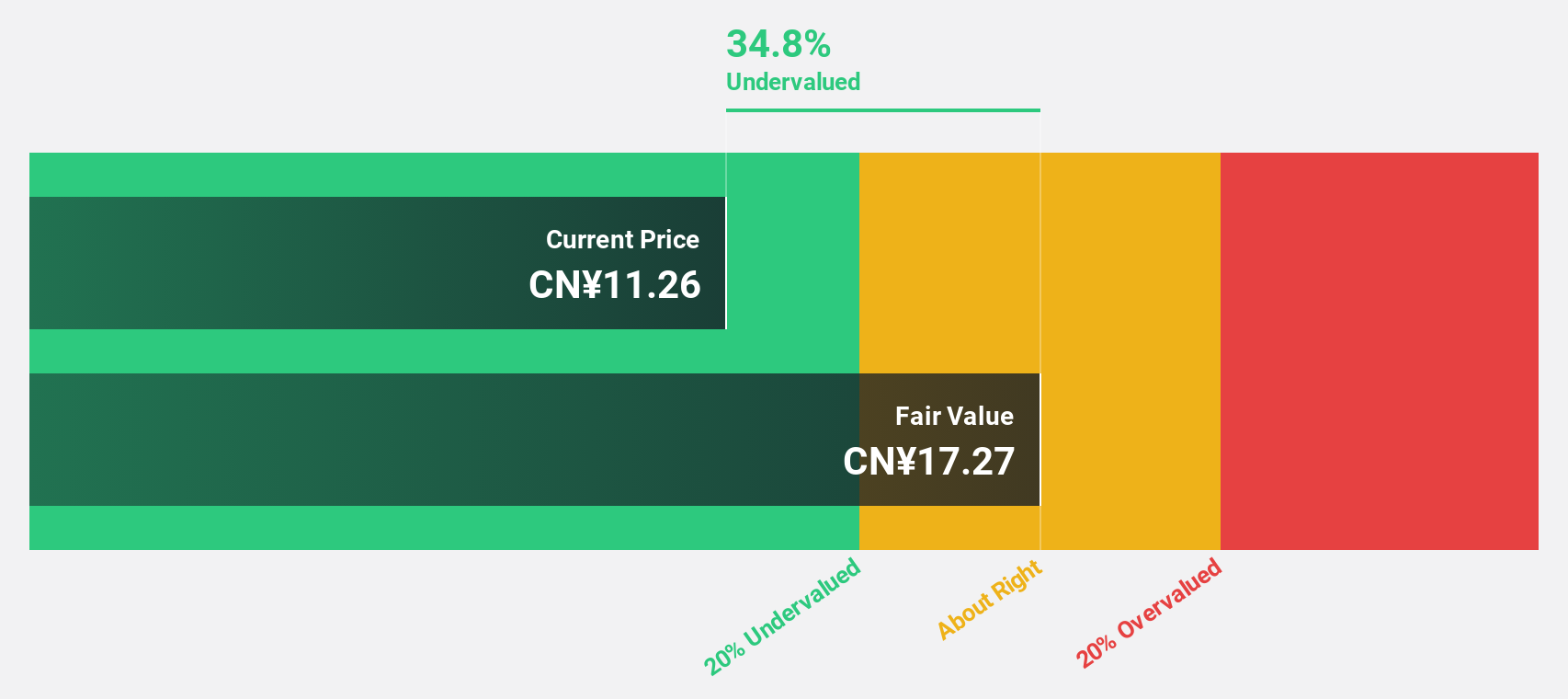

Zanyu Technology Group (SZSE:002637)

Overview: Zanyu Technology Group Co., Ltd. operates in the research, development, manufacture, and sale of surfactants and oleo chemicals both within China and internationally, with a market cap of CN¥4.85 billion.

Operations: The company's revenue is primarily derived from Oil & Fat Chemical at CN¥6.92 billion and Daily Chemical Factory at CN¥5.57 billion, with additional income from Processing services amounting to CN¥64.79 million.

Estimated Discount To Fair Value: 31.7%

Zanyu Technology Group is trading at CN¥11.58, significantly below its estimated fair value of CN¥16.97, indicating potential undervaluation based on cash flows. Despite a high debt level and unstable dividend history, earnings are projected to grow significantly at 40.45% annually over the next three years, outpacing market expectations. Recent earnings showed increased revenue and net income compared to last year, while upcoming changes in company bylaws may influence future operations and governance structure.

- Our growth report here indicates Zanyu Technology Group may be poised for an improving outlook.

- Dive into the specifics of Zanyu Technology Group here with our thorough financial health report.

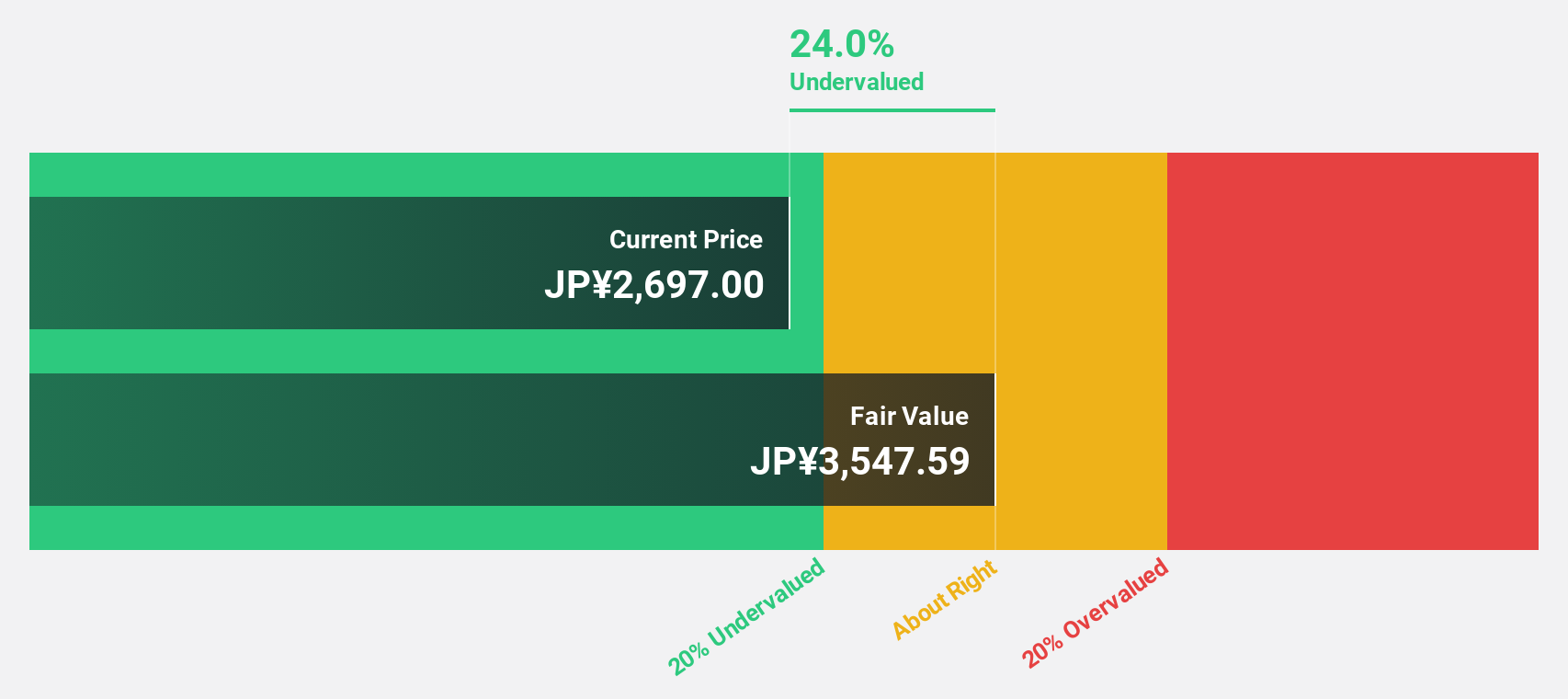

Globe-ing (TSE:277A)

Overview: Globe-ing Inc. offers digital transformation and strategic consulting, along with digital analytics and data services in Japan, with a market cap of ¥67.23 billion.

Operations: The company's revenue is derived from ¥0.12 billion in AI services and ¥9.11 billion in consulting services.

Estimated Discount To Fair Value: 19.2%

Globe-ing is trading at ¥2,860, below its estimated fair value of ¥3,539.71. The company forecasts strong revenue growth of 21% annually and earnings growth of 20.3%, both surpassing market averages. Recent guidance revisions highlight improved profitability due to expanding AI services and operational efficiencies. Despite recent share price volatility, strategic moves such as acquiring X-AI.Labo enhance its AI capabilities, potentially bolstering long-term cash flow generation and supporting undervaluation claims based on cash flows.

- Our expertly prepared growth report on Globe-ing implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Globe-ing.

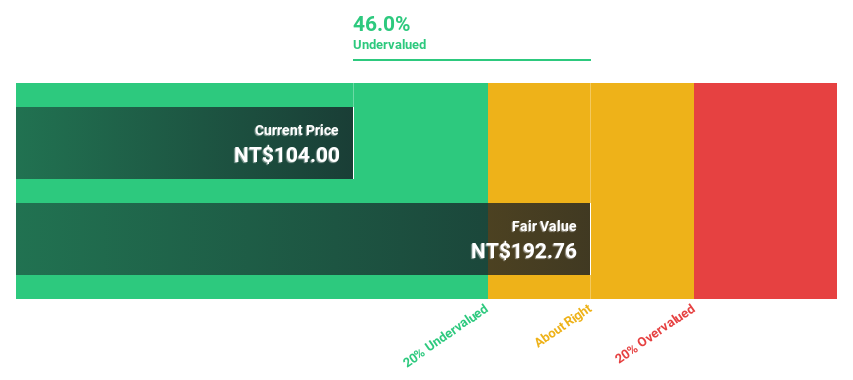

Kinsus Interconnect Technology (TWSE:3189)

Overview: Kinsus Interconnect Technology Corp., along with its subsidiaries, manufactures and sells electronic products both in Taiwan and internationally, with a market cap of NT$61.41 billion.

Operations: The company's revenue primarily comes from its IC Substrate segment, generating NT$27.75 billion, and its Optical Department, contributing NT$6.67 billion.

Estimated Discount To Fair Value: 47.5%

Kinsus Interconnect Technology is trading at NT$147.5, significantly below its estimated fair value of NT$280.93, suggesting undervaluation based on cash flows. The company reported substantial earnings growth with net income for the second quarter rising to NT$338.19 million from NT$88.56 million year-on-year and a six-month net income increase to NT$614.26 million from NT$113.06 million previously, despite recent share price volatility and slower revenue growth projections compared to earnings forecasts.

- Our earnings growth report unveils the potential for significant increases in Kinsus Interconnect Technology's future results.

- Delve into the full analysis health report here for a deeper understanding of Kinsus Interconnect Technology.

Key Takeaways

- Dive into all 513 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsus Interconnect Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3189

Kinsus Interconnect Technology

Engages in the manufacture and sale of electronic products in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives