As global markets navigate a choppy start to the year, driven by inflation concerns and political uncertainties, investors are keeping a close eye on economic data and central bank policies. Amidst this backdrop, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★☆ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

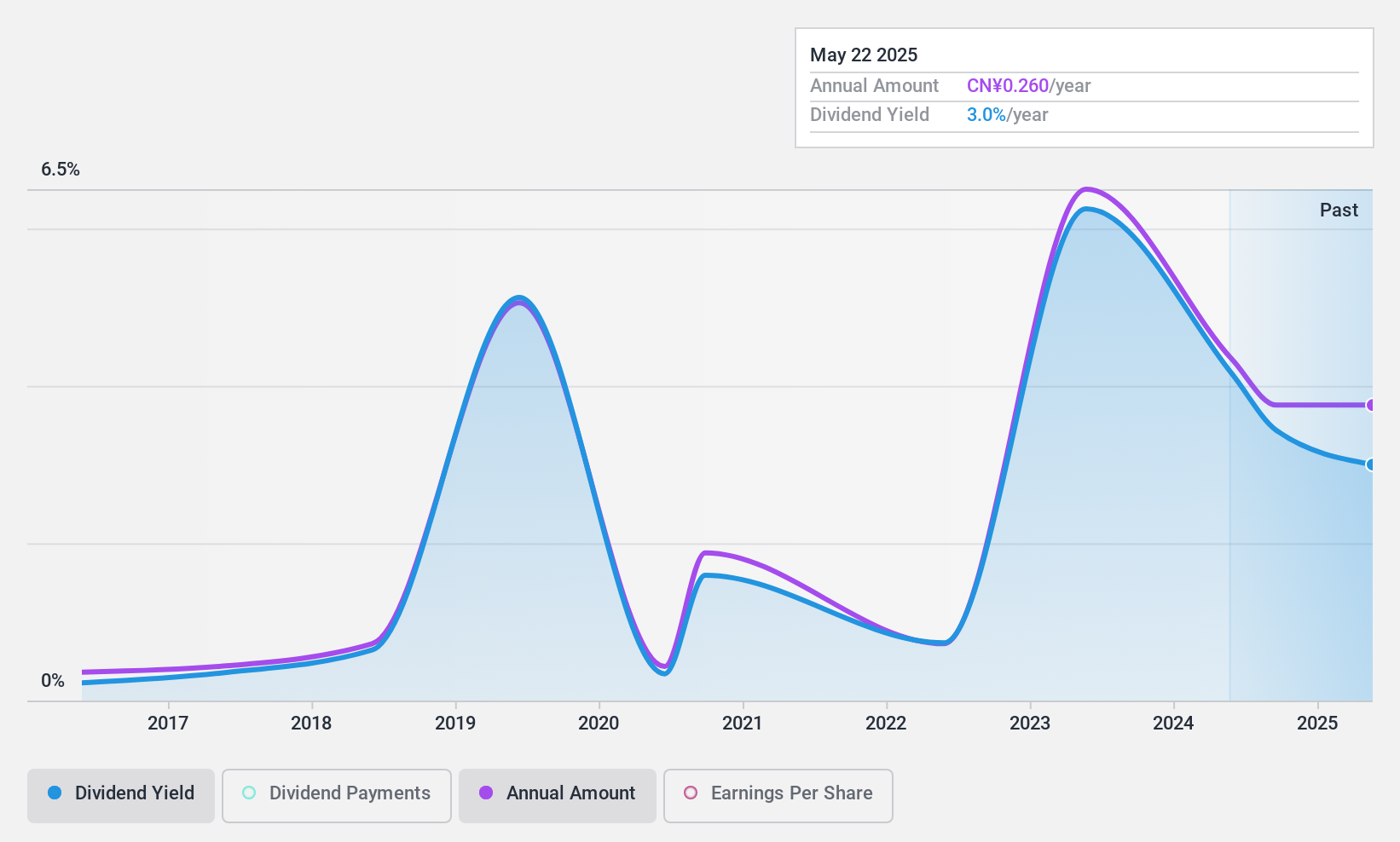

Baoxiniao Holding (SZSE:002154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. is involved in the research, development, production, and sale of branded clothing products in China with a market cap of CN¥61 billion.

Operations: Baoxiniao Holding Co., Ltd.'s revenue is primarily derived from its Textile and Apparel segment, which generated CN¥4.98 billion.

Dividend Yield: 3.3%

Baoxiniao Holding's dividend yield of 3.35% places it among the top 25% of dividend payers in China. Despite a high payout ratio of 84.3%, dividends are well-covered by cash flows, with a cash payout ratio at 35.8%. However, its dividend history is marked by volatility and unreliability, with past drops over 20%. The stock trades at a good value relative to peers, despite recent declines in revenue and net income.

- Click to explore a detailed breakdown of our findings in Baoxiniao Holding's dividend report.

- Upon reviewing our latest valuation report, Baoxiniao Holding's share price might be too pessimistic.

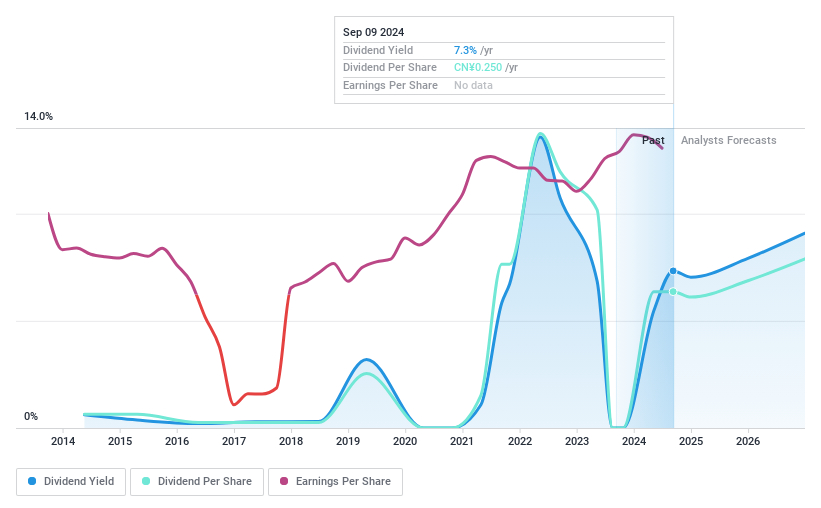

Daoming Optics&ChemicalLtd (SZSE:002632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daoming Optics&Chemical Co., Ltd specializes in the research, development, production, and sale of reflective materials and products globally, with a market cap of CN¥5.05 billion.

Operations: Daoming Optics&Chemical Co., Ltd generates its revenue primarily from the production and sale of reflective materials and products on a global scale.

Dividend Yield: 3.2%

Daoming Optics & Chemical Ltd's dividend yield of 3.22% ranks in the top 25% of the CN market, yet its high payout ratio of 161.6% indicates dividends are not well covered by earnings. Despite a decade-long increase, dividend payments have been volatile and unreliable, with significant annual drops. Recent earnings show improved revenue (CNY 1.03 billion) and net income (CNY 143.99 million), but profit margins have decreased from last year’s figures, raising sustainability concerns.

- Get an in-depth perspective on Daoming Optics&ChemicalLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Daoming Optics&ChemicalLtd's shares may be trading at a discount.

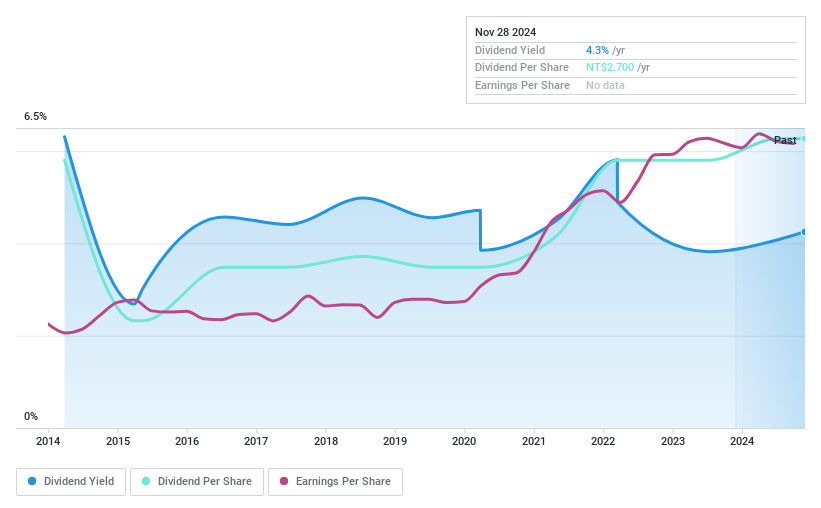

Standard Chemical & Pharmaceutical (TWSE:1720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Standard Chemical & Pharmaceutical Co. Ltd., with a market cap of NT$10.99 billion, is engaged in the production and distribution of pharmaceutical products.

Operations: Standard Chemical & Pharmaceutical Co. Ltd.'s revenue primarily comes from human medicine (NT$3.17 billion), food products (NT$2.16 billion), and active pharmaceutical ingredients (NT$1.34 billion).

Dividend Yield: 4.4%

Standard Chemical & Pharmaceutical's dividend yield of 4.39% is below the TW market's top tier, and its dividends have been volatile and unreliable over the past decade. However, payments are covered by earnings with a payout ratio of 56.9% and cash flows at 44.8%. Recent financials show an increase in sales to TWD 1.74 billion for Q3, though net income slightly decreased to TWD 217.39 million compared to last year, indicating stable yet cautious performance for dividend sustainability.

- Unlock comprehensive insights into our analysis of Standard Chemical & Pharmaceutical stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Standard Chemical & Pharmaceutical is priced lower than what may be justified by its financials.

Seize The Opportunity

- Explore the 1996 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1720

Standard Chemical & Pharmaceutical

Standard Chemical & Pharmaceutical Co. Ltd.

Flawless balance sheet, good value and pays a dividend.