As global markets grapple with heightened trade tensions and economic uncertainty, small-cap stocks in Asia present a unique opportunity for investors seeking to navigate the current volatility. In this environment, identifying companies with robust fundamentals and resilience to external shocks becomes essential, making them potential hidden gems in the Asian market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Interactive Digital Technologies | 1.23% | 7.48% | 5.93% | ★★★★★★ |

| Donpon Precision | 38.56% | 0.47% | 48.37% | ★★★★★★ |

| ITE Tech | NA | 7.53% | 13.84% | ★★★★★★ |

| CTCI Advanced Systems | 28.82% | 23.23% | 27.69% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Aeolus Tyre | 35.14% | 0.01% | 17.84% | ★★★★★☆ |

| Lungteh Shipbuilding | 55.17% | 28.09% | 42.33% | ★★★★★☆ |

| Wuhan Guide Technology | 10.56% | 10.03% | 19.12% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd (SHSE:603227)

Simply Wall St Value Rating: ★★★★★★

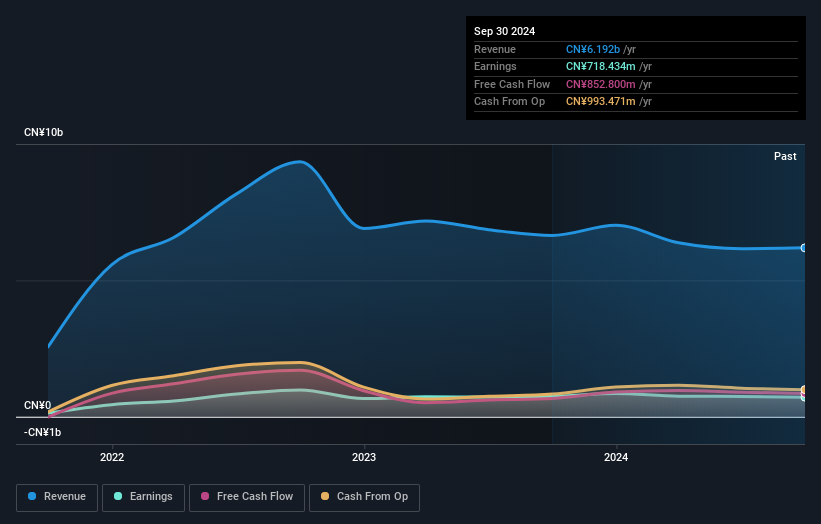

Overview: Xinjiang Xuefeng Sci-Tech(Group)Co.,Ltd, along with its subsidiaries, is engaged in the production and sale of civil explosives, with a market capitalization of CN¥9.76 billion.

Operations: The company's primary revenue is derived from the production and sale of civil explosives. It operates with a market capitalization of CN¥9.76 billion, reflecting its significant presence in the industry.

Xinjiang Xuefeng Sci-Tech, a dynamic player in the chemical industry, has seen its debt to equity ratio improve significantly from 36.6% to 14.4% over five years, indicating prudent financial management. The company's interest payments are comfortably covered by EBIT at a robust 456 times coverage, showcasing strong operational earnings quality. Despite recent negative earnings growth of 4%, its price-to-earnings ratio of 13.6x remains attractive compared to the broader CN market's average of 32.6x. Recently, Guangdong Hongda Holdings acquired a substantial stake for CNY2.2 billion (US$), reflecting strategic interest and potential future synergies in this evolving sector.

Shandong Wit Dyne HealthLtd (SZSE:000915)

Simply Wall St Value Rating: ★★★★★★

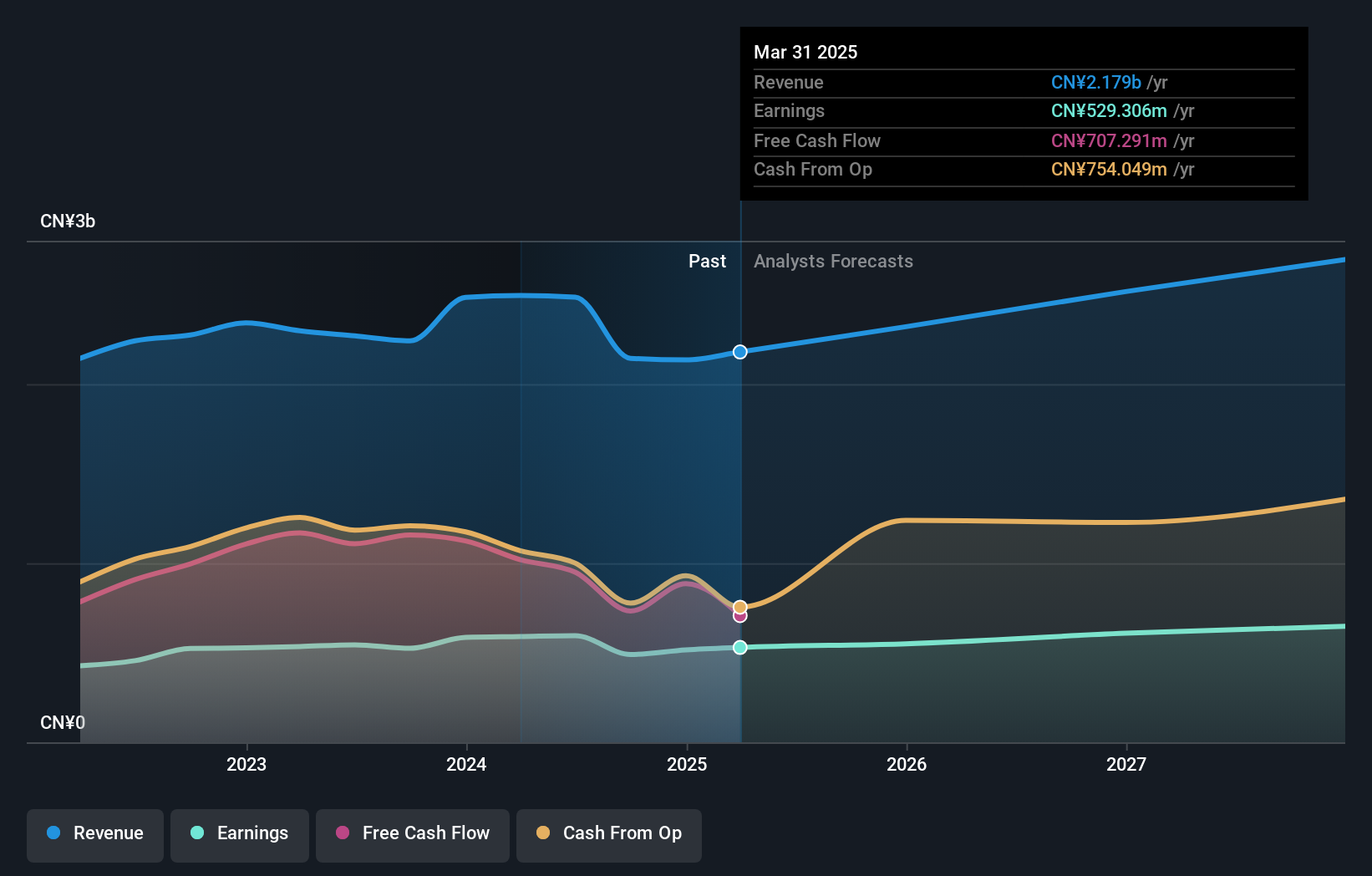

Overview: Shandong Wit Dyne Health Co., Ltd. operates in the pharmaceutical industry within China and has a market capitalization of CN¥6.99 billion.

Operations: Wit Dyne Health generates revenue primarily from its pharmaceutical operations in China. The company's net profit margin has been observed at 12% over recent periods.

Shandong Wit Dyne Health, a nimble player in the pharmaceutical sector, offers an intriguing opportunity. The company is trading at 40% below its estimated fair value and boasts high-quality earnings despite recent negative earnings growth of 6.7%. With no debt on its books now compared to a debt-to-equity ratio of 0.8% five years ago, financial stability seems assured. Its free cash flow remains positive, supporting profitability and future growth prospects. In March 2025, they affirmed a cash dividend proposal of CNY20 per share for the year 2024, highlighting their commitment to shareholder returns amidst challenging industry conditions.

- Click here and access our complete health analysis report to understand the dynamics of Shandong Wit Dyne HealthLtd.

Learn about Shandong Wit Dyne HealthLtd's historical performance.

Stanley Agriculture GroupLtd (SZSE:002588)

Simply Wall St Value Rating: ★★★★★☆

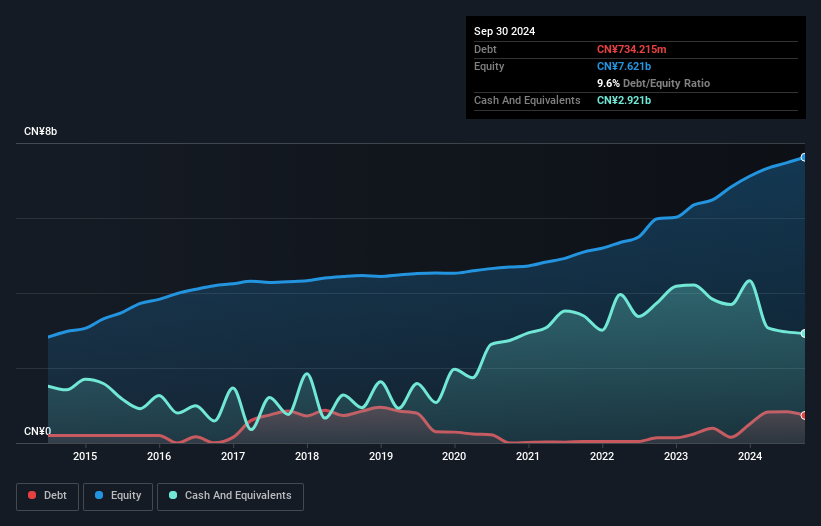

Overview: Stanley Agriculture Group Co., Ltd. focuses on the research, development, production, and sale of compound fertilizers in China with a market cap of CN¥8.79 billion.

Operations: Stanley Agriculture Group Co., Ltd. generates revenue primarily from the sale of compound fertilizers. The company's financial performance is influenced by its ability to manage production costs and optimize its profit margins.

Stanley Agriculture Group Ltd. showcases a compelling profile with a Price-To-Earnings ratio of 11.2x, notably lower than the broader CN market at 32.6x, suggesting potential value for investors. The company has demonstrated robust earnings growth of 32% over the past year, outpacing the Chemicals industry that saw a -4% change, indicating strong operational performance. Despite an increase in its debt to equity ratio from 6.6 to 9.6 over five years, Stanley maintains more cash than its total debt, alleviating immediate financial concerns and positioning it well for continued profitability and growth prospects within its sector.

Where To Now?

- Access the full spectrum of 2592 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603227

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd

Produces and sells civil explosives.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives