Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. (SZSE:002585) Looks Just Right With A 27% Price Jump

Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. (SZSE:002585) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 52% share price drop in the last twelve months.

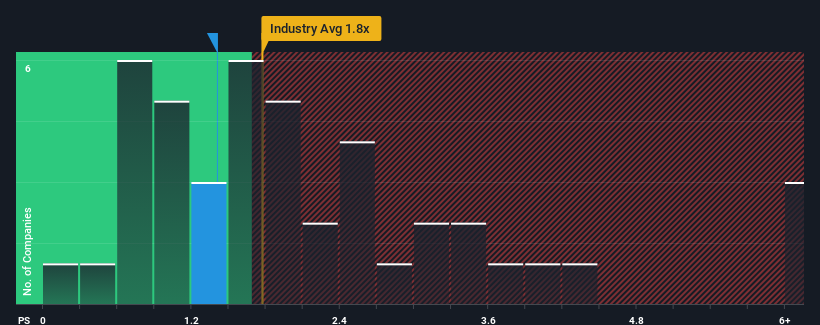

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Jiangsu Shuangxing Color Plastic New Materials' P/S ratio of 1.4x, since the median price-to-sales (or "P/S") ratio for the Packaging industry in China is also close to 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Jiangsu Shuangxing Color Plastic New Materials

What Does Jiangsu Shuangxing Color Plastic New Materials' Recent Performance Look Like?

Jiangsu Shuangxing Color Plastic New Materials has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu Shuangxing Color Plastic New Materials.How Is Jiangsu Shuangxing Color Plastic New Materials' Revenue Growth Trending?

Jiangsu Shuangxing Color Plastic New Materials' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. Regardless, revenue has managed to lift by a handy 9.8% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 21%, which is not materially different.

In light of this, it's understandable that Jiangsu Shuangxing Color Plastic New Materials' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Jiangsu Shuangxing Color Plastic New Materials' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Jiangsu Shuangxing Color Plastic New Materials' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Packaging industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware Jiangsu Shuangxing Color Plastic New Materials is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002585

Jiangsu Shuangxing Color Plastic New Materials

Jiangsu Shuangxing Color Plastic New Materials Co., Ltd.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives