After Leaping 26% Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. (SZSE:002585) Shares Are Not Flying Under The Radar

Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. (SZSE:002585) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

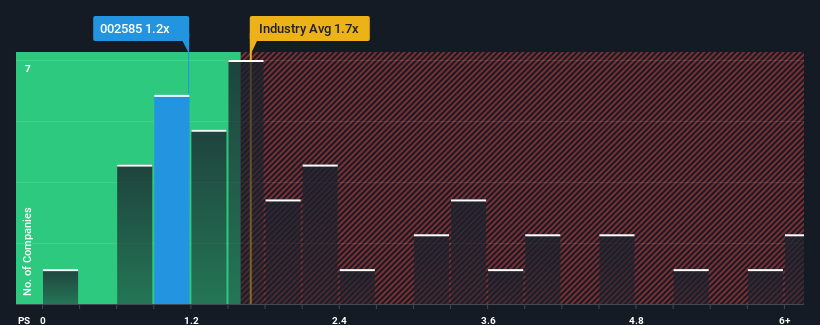

Even after such a large jump in price, it's still not a stretch to say that Jiangsu Shuangxing Color Plastic New Materials' price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Packaging industry in China, where the median P/S ratio is around 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Jiangsu Shuangxing Color Plastic New Materials

What Does Jiangsu Shuangxing Color Plastic New Materials' P/S Mean For Shareholders?

Jiangsu Shuangxing Color Plastic New Materials certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Shuangxing Color Plastic New Materials will help you uncover what's on the horizon.How Is Jiangsu Shuangxing Color Plastic New Materials' Revenue Growth Trending?

Jiangsu Shuangxing Color Plastic New Materials' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to expand by 17%, which is not materially different.

In light of this, it's understandable that Jiangsu Shuangxing Color Plastic New Materials' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Jiangsu Shuangxing Color Plastic New Materials' P/S Mean For Investors?

Its shares have lifted substantially and now Jiangsu Shuangxing Color Plastic New Materials' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Jiangsu Shuangxing Color Plastic New Materials' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Packaging industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You should always think about risks. Case in point, we've spotted 1 warning sign for Jiangsu Shuangxing Color Plastic New Materials you should be aware of.

If these risks are making you reconsider your opinion on Jiangsu Shuangxing Color Plastic New Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002585

Jiangsu Shuangxing Color Plastic New Materials

Jiangsu Shuangxing Color Plastic New Materials Co., Ltd.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives