There's Reason For Concern Over Shanghai Shunho New Materials Technology Co.,Ltd.'s (SZSE:002565) Massive 27% Price Jump

Shanghai Shunho New Materials Technology Co.,Ltd. (SZSE:002565) shares have continued their recent momentum with a 27% gain in the last month alone. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

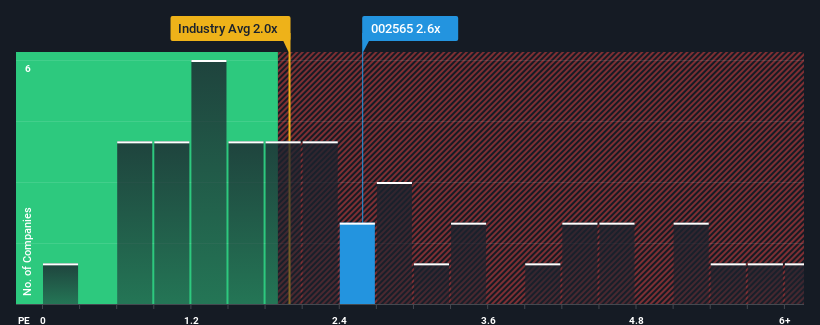

Following the firm bounce in price, when almost half of the companies in China's Packaging industry have price-to-sales ratios (or "P/S") below 2x, you may consider Shanghai Shunho New Materials TechnologyLtd as a stock probably not worth researching with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shanghai Shunho New Materials TechnologyLtd

How Shanghai Shunho New Materials TechnologyLtd Has Been Performing

Revenue has risen firmly for Shanghai Shunho New Materials TechnologyLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shanghai Shunho New Materials TechnologyLtd's earnings, revenue and cash flow.How Is Shanghai Shunho New Materials TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Shunho New Materials TechnologyLtd would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. Still, revenue has fallen 2.6% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Shanghai Shunho New Materials TechnologyLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shanghai Shunho New Materials TechnologyLtd's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shanghai Shunho New Materials TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shanghai Shunho New Materials TechnologyLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Shanghai Shunho New Materials TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002565

Shanghai Shunho New Materials TechnologyLtd

Shanghai Shunho New Materials Technology Co.,Ltd.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026