- China

- /

- Metals and Mining

- /

- SZSE:002552

The five-year underlying earnings growth at Baoding Technology (SZSE:002552) is promising, but the shareholders are still in the red over that time

This month, we saw the Baoding Technology Co., Ltd. (SZSE:002552) up an impressive 32%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 26% in that time, significantly under-performing the market.

Since Baoding Technology has shed CN¥580m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Baoding Technology

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate half decade during which the share price slipped, Baoding Technology actually saw its earnings per share (EPS) improve by 22% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

The modest 1.7% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 35% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

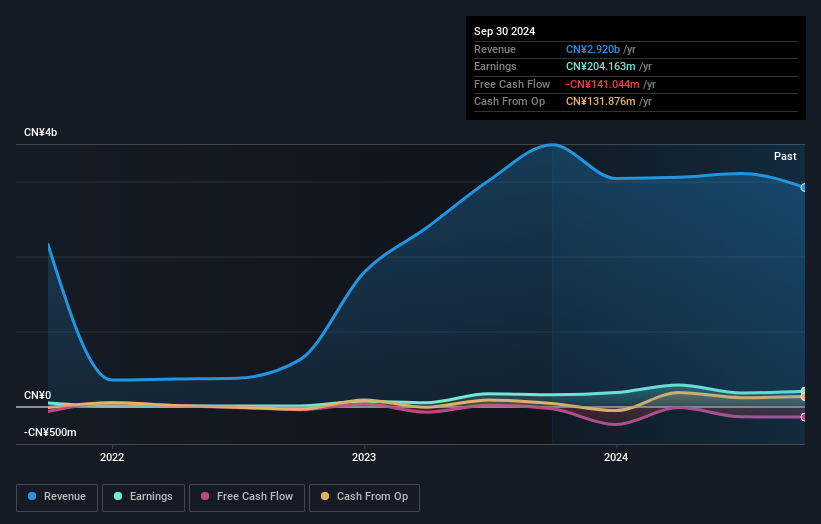

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Baoding Technology shareholders have received a total shareholder return of 21% over the last year. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Baoding Technology , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Baoding Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002552

Baoding Technology

Engages in the non-ferrous metal mining and selection, and the research, development, production, and sales of electronic copper foil and copper clad laminate products in China.

Adequate balance sheet with acceptable track record.