- China

- /

- Medical Equipment

- /

- SHSE:603309

3 Global Dividend Stocks Yielding Up To 4.4%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile equity movements, easing monetary policies, and mixed economic signals from major regions like the U.S., Europe, and China, investors are increasingly drawn to dividend stocks for their potential stability and income generation. In such an environment, identifying dividend stocks with solid fundamentals can be a strategic approach to weather market fluctuations while benefiting from consistent yield returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Torigoe (TSE:2009) | 4.04% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.80% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.82% | ★★★★★★ |

| NCD (TSE:4783) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.64% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1346 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

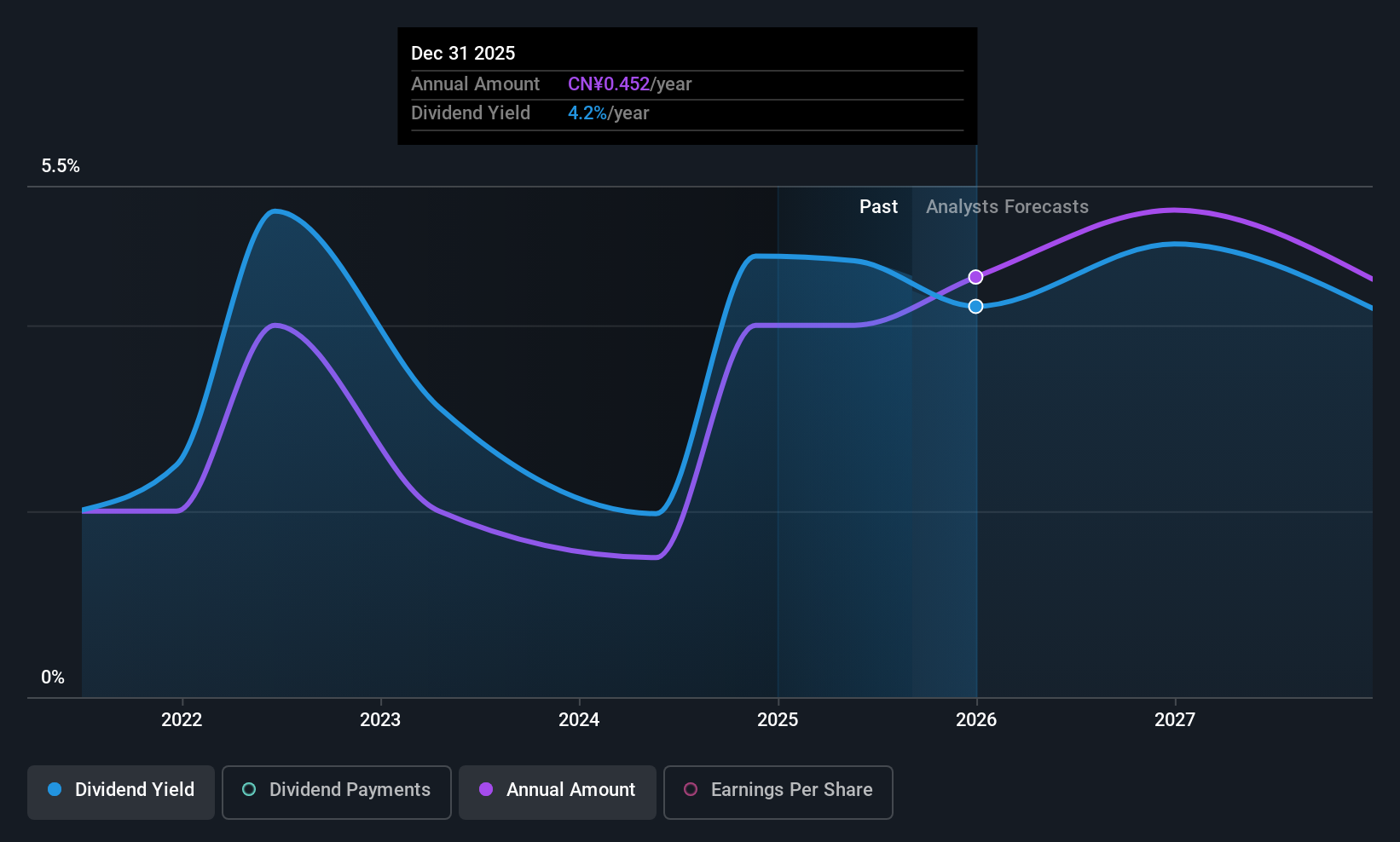

Shanghai Tunnel Engineering (SHSE:600820)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Tunnel Engineering Co., Ltd. is involved in the consulting, planning, design, investment, construction, and operation of urban infrastructure across China and internationally with a market cap of CN¥21.85 billion.

Operations: Shanghai Tunnel Engineering Co., Ltd. generates revenue through its diverse activities in urban infrastructure, including consulting, planning, design, investment, construction, and operation across various regions such as China, Hong Kong, India, Singapore, and Macau.

Dividend Yield: 4.5%

Shanghai Tunnel Engineering offers a dividend yield of 4.48%, placing it in the top 25% of CN market dividend payers. The company's dividends are well-covered by earnings, with a payout ratio of 35.8%, and by cash flows, with a cash payout ratio of 29.3%. Despite trading at good value—22.3% below estimated fair value—its dividend history has been volatile over the past decade, raising concerns about reliability despite recent earnings stability.

- Delve into the full analysis dividend report here for a deeper understanding of Shanghai Tunnel Engineering.

- In light of our recent valuation report, it seems possible that Shanghai Tunnel Engineering is trading behind its estimated value.

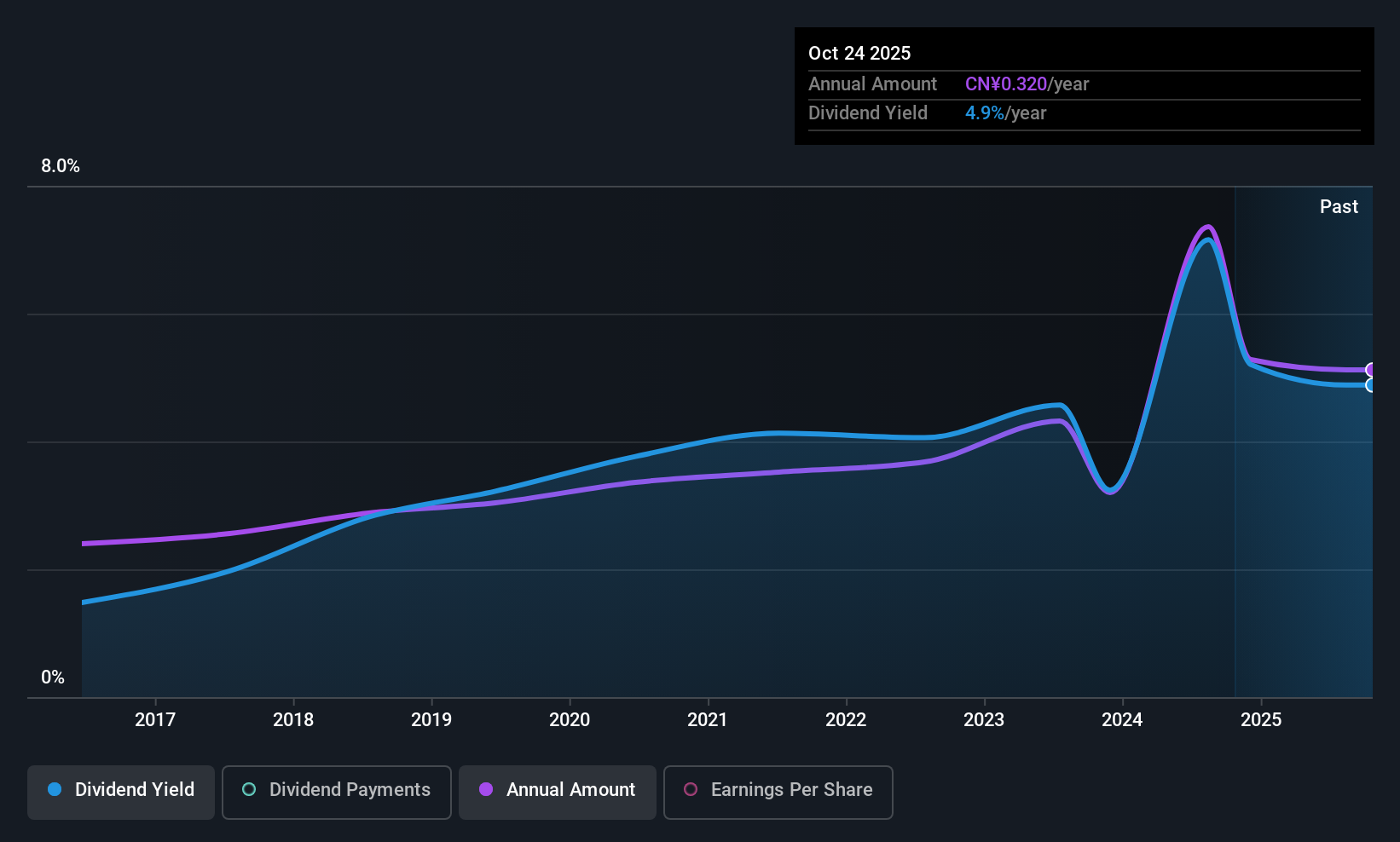

Well Lead Medical (SHSE:603309)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Well Lead Medical Co., Ltd. develops, produces, and sells medical devices across various specialties including urology, anaesthesia, and respiratory care globally with a market cap of CN¥4.11 billion.

Operations: Well Lead Medical Co., Ltd. generates revenue through its development, production, and sale of medical devices in the fields of endourology, anaesthesia, respiratory care, hemodialysis, and pain management on a global scale.

Dividend Yield: 3.5%

Well Lead Medical's dividend yield of 3.46% is among the top 25% in the CN market, yet its dividends are not consistently reliable due to volatility over the past decade. The payout ratio of 60.2% suggests coverage by earnings, but a high cash payout ratio of 147.9% indicates inadequate free cash flow support. Recent earnings growth, with net income rising to CNY 191.64 million for nine months ending September 2025, may offer some optimism amidst these concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Well Lead Medical.

- The analysis detailed in our Well Lead Medical valuation report hints at an inflated share price compared to its estimated value.

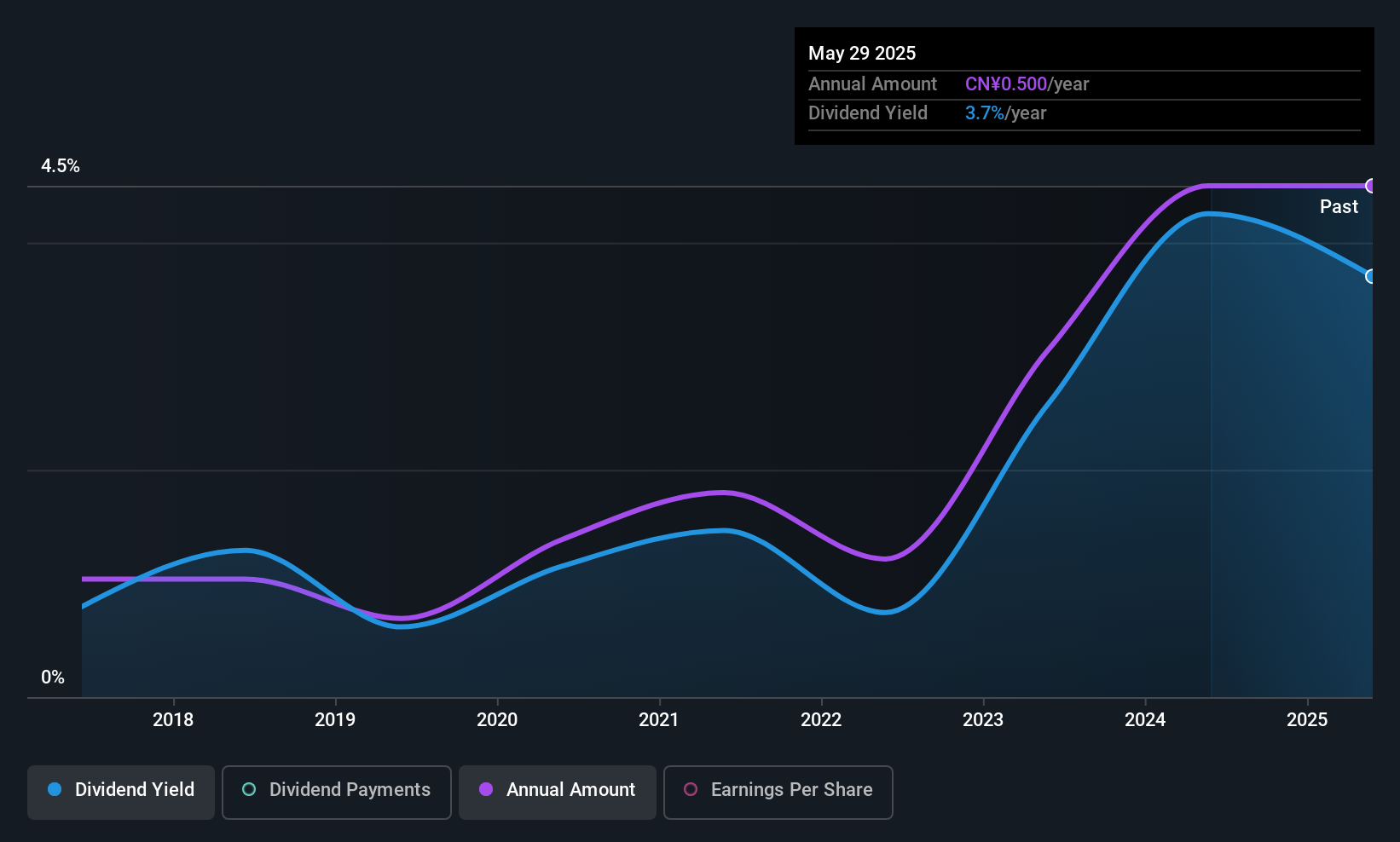

Tianshan Aluminum GroupLtd (SZSE:002532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianshan Aluminum Group Co., Ltd, with a market cap of CN¥57.05 billion, operates in the production and sale of primary aluminum, alumina, prebaked anodes, high-purity aluminum, and aluminum deep-processed products both in China and internationally.

Operations: Tianshan Aluminum Group Co., Ltd generates revenue from several segments, including CN¥19.23 billion from Original Aluminum Plate (excluding High-Purity Aluminum), CN¥7.76 billion from Aluminum Oxide Plate, CN¥1.46 billion from Sales of Aluminum Foil and Aluminum Foil Blanks, and CN¥693.30 million from High-Purity Aluminum.

Dividend Yield: 3.1%

Tianshan Aluminum Group's dividend yield of 3.09% ranks in the top 25% in China, supported by a low payout ratio of 41.7% and cash payout ratio of 36.3%, indicating strong earnings and cash flow coverage. However, its dividend history is volatile, with payments over five years showing instability. Recent interim dividends at CNY 2 per 10 shares were affirmed amidst a completed buyback program worth CNY 200 million, suggesting shareholder return focus despite inconsistent past payments.

- Get an in-depth perspective on Tianshan Aluminum GroupLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report Tianshan Aluminum GroupLtd implies its share price may be lower than expected.

Make It Happen

- Delve into our full catalog of 1346 Top Global Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Well Lead Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603309

Well Lead Medical

Engages in the development, production, and sale of medical devices in urology, endourology, anaesthesia, respiratory, hemodialysis, and pain management areas worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives