- China

- /

- Metals and Mining

- /

- SZSE:002428

Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) Stock Rockets 42% As Investors Are Less Pessimistic Than Expected

Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

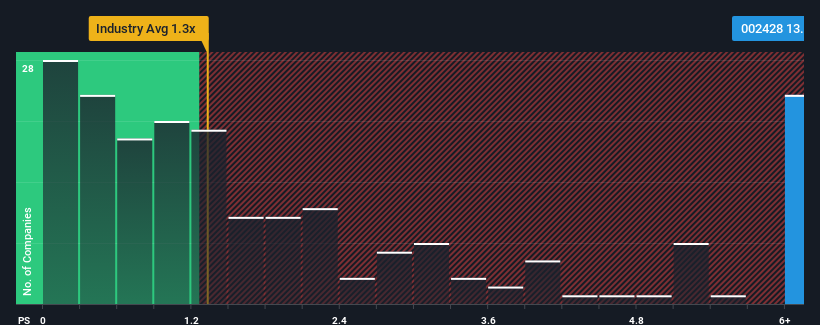

After such a large jump in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Yunnan Lincang Xinyuan Germanium IndustryLTD as a stock not worth researching with its 13.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Yunnan Lincang Xinyuan Germanium IndustryLTD

What Does Yunnan Lincang Xinyuan Germanium IndustryLTD's Recent Performance Look Like?

Recent times have been advantageous for Yunnan Lincang Xinyuan Germanium IndustryLTD as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Yunnan Lincang Xinyuan Germanium IndustryLTD will help you uncover what's on the horizon.How Is Yunnan Lincang Xinyuan Germanium IndustryLTD's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Yunnan Lincang Xinyuan Germanium IndustryLTD's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. The latest three year period has also seen an excellent 33% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.0% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 13%, which is noticeably more attractive.

In light of this, it's alarming that Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Yunnan Lincang Xinyuan Germanium IndustryLTD currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 1 warning sign for Yunnan Lincang Xinyuan Germanium IndustryLTD that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002428

Yunnan Lincang Xinyuan Germanium IndustryLTD

Engages in the research and development, deep processing, germanium mining, pyrometallurgical enrichment, hydrometallurgical purification, and zone melting refining in China.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives