- China

- /

- Metals and Mining

- /

- SZSE:002428

Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

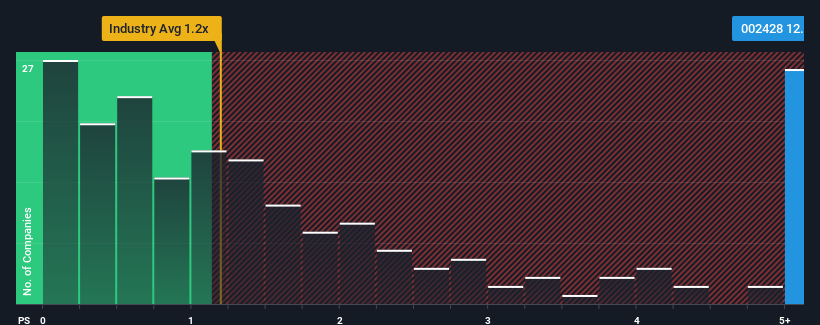

Since its price has surged higher, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Yunnan Lincang Xinyuan Germanium IndustryLTD as a stock not worth researching with its 12.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Yunnan Lincang Xinyuan Germanium IndustryLTD

What Does Yunnan Lincang Xinyuan Germanium IndustryLTD's Recent Performance Look Like?

Recent times have been advantageous for Yunnan Lincang Xinyuan Germanium IndustryLTD as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Yunnan Lincang Xinyuan Germanium IndustryLTD will help you uncover what's on the horizon.How Is Yunnan Lincang Xinyuan Germanium IndustryLTD's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Yunnan Lincang Xinyuan Germanium IndustryLTD's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Revenue has also lifted 6.4% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 13% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S

Shares in Yunnan Lincang Xinyuan Germanium IndustryLTD have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Yunnan Lincang Xinyuan Germanium IndustryLTD's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Yunnan Lincang Xinyuan Germanium IndustryLTD that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002428

Yunnan Lincang Xinyuan Germanium IndustryLTD

Engages in the research and development, deep processing, germanium mining, pyrometallurgical enrichment, hydrometallurgical purification, and zone melting refining in China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives