- China

- /

- Metals and Mining

- /

- SZSE:002378

Chongyi Zhangyuan Tungsten Co., Ltd.'s (SZSE:002378) Earnings Haven't Escaped The Attention Of Investors

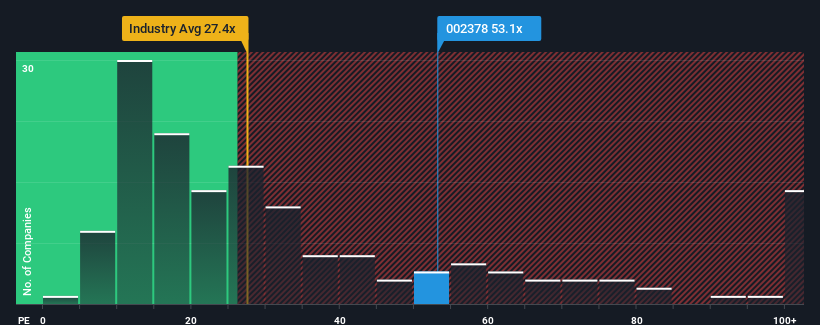

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Chongyi Zhangyuan Tungsten Co., Ltd. (SZSE:002378) as a stock to avoid entirely with its 53.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Chongyi Zhangyuan Tungsten could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Chongyi Zhangyuan Tungsten

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Chongyi Zhangyuan Tungsten's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 45% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 38% each year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 25% per annum, which is noticeably less attractive.

In light of this, it's understandable that Chongyi Zhangyuan Tungsten's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Chongyi Zhangyuan Tungsten's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Chongyi Zhangyuan Tungsten's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 4 warning signs for Chongyi Zhangyuan Tungsten (1 is significant!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002378

Chongyi Zhangyuan Tungsten

Engages in the mining of tungsten concentrate and other metal mineral products in China and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives