- China

- /

- Auto Components

- /

- SHSE:603023

Harbin VITI Electronics Leads Our Global Penny Stock Highlights

Reviewed by Simply Wall St

Global markets have recently experienced a mix of optimism and caution, with U.S. stocks rebounding due to trade policy developments while inflation concerns remain in focus. For investors exploring beyond the major indices, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities despite their vintage label. These stocks can present a blend of affordability and growth potential when backed by strong financials, and this article will highlight several that stand out for their financial strength in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.73 | £281.51M | ✅ 5 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.035 | £454.29M | ✅ 4 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.82 | CA$4.68M | ✅ 2 ⚠️ 5 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.52 | A$72.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.13 | A$737.22M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,602 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Harbin VITI Electronics (SHSE:603023)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin VITI Electronics Co., Ltd. focuses on the research, development, manufacturing, and sale of automobile electronic products for cars and buses in China, with a market cap of CN¥2.05 billion.

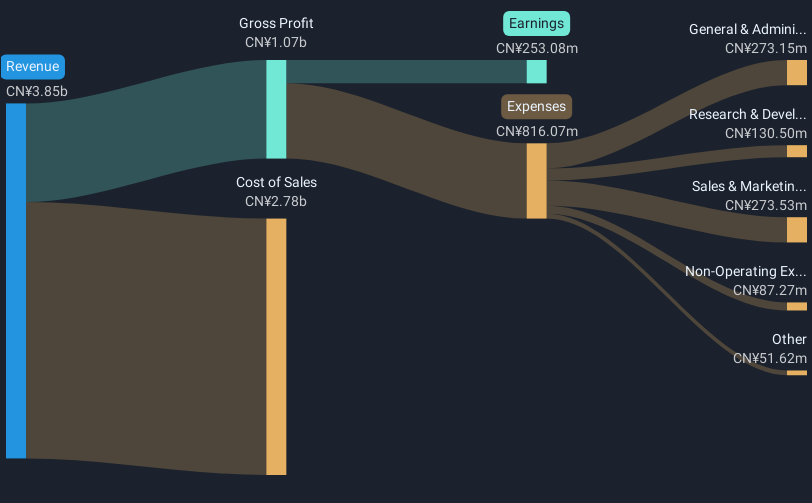

Operations: The company's revenue is primarily derived from its Computer Communications and Other Electronic Equipment Manufacturing segment, totaling CN¥82.86 million.

Market Cap: CN¥2.05B

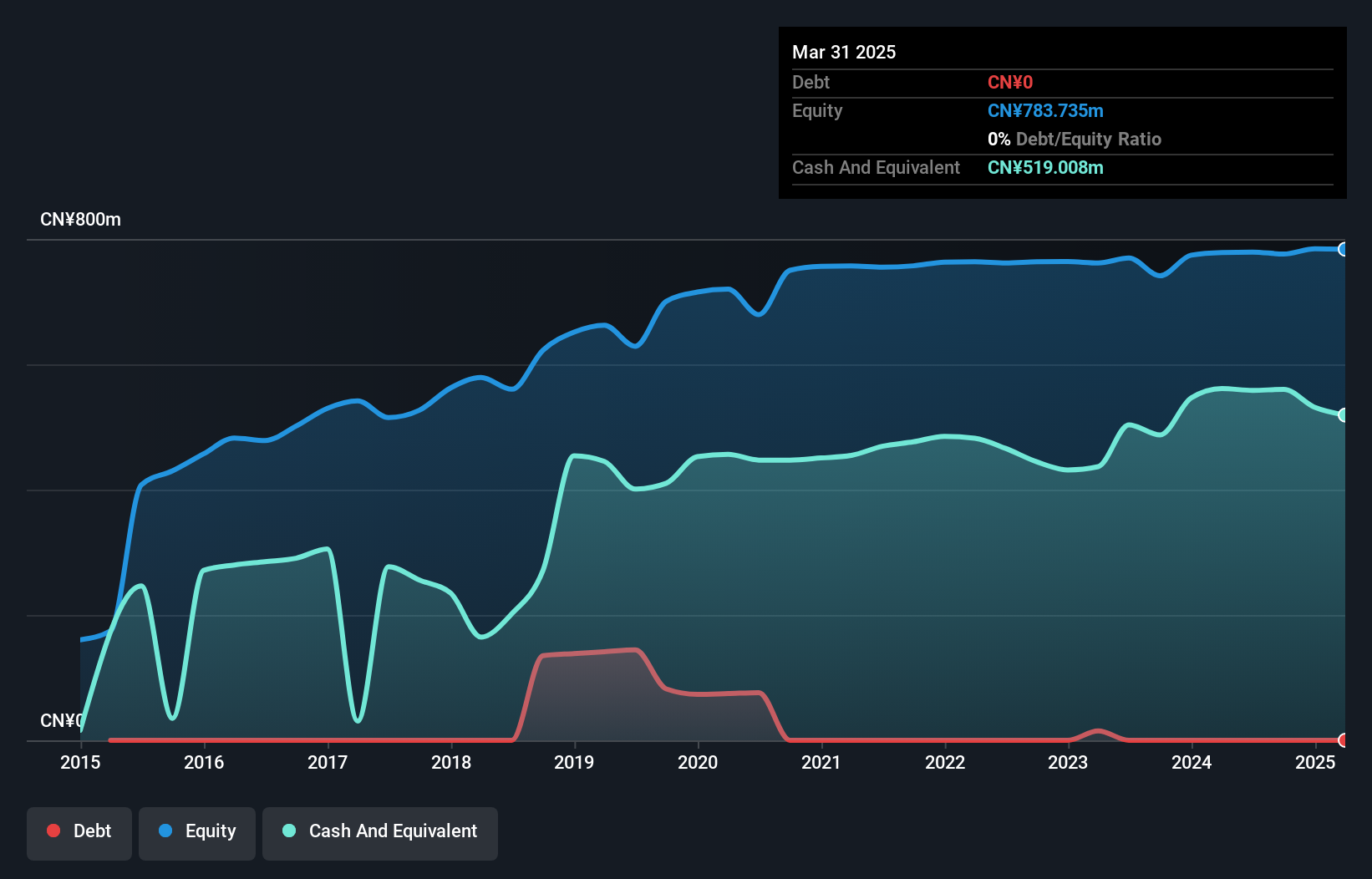

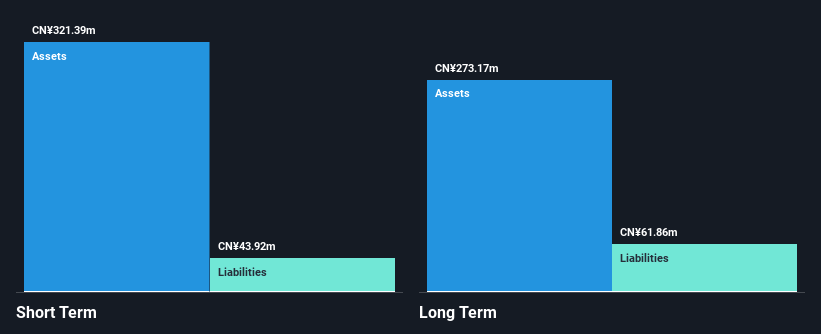

Harbin VITI Electronics has recently turned profitable, marking a significant shift in its financial trajectory. The company is debt-free, with short-term assets of CN¥691.1 million comfortably covering both short and long-term liabilities. Despite this positive development, earnings have historically declined by 52.4% annually over the past five years, and recent results show a decrease in net income from CN¥4.38 million to CN¥0.80 million year-over-year for Q1 2025. While sales increased to CN¥38.16 million from CN¥20.53 million, the low return on equity (0.2%) suggests room for operational improvement as it navigates volatility common among smaller stocks.

- Jump into the full analysis health report here for a deeper understanding of Harbin VITI Electronics.

- Learn about Harbin VITI Electronics' historical performance here.

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. is engaged in the development, production, and sale of packaging products both in China and internationally, with a market cap of CN¥5.59 billion.

Operations: MYS Group Co., Ltd. does not report specific revenue segments, but it focuses on the development, production, and sale of packaging products in China and international markets.

Market Cap: CN¥5.59B

MYS Group Co., Ltd. demonstrates financial stability with short-term assets of CN¥3.6 billion exceeding both short and long-term liabilities, supported by a cash position that surpasses total debt. The company's earnings have shown resilience, growing 28.7% over the past year despite a five-year decline trend of 8.1% annually, and recent quarterly results indicate increased sales (CN¥970.62 million) and net income (CN¥80.36 million). However, its dividend yield of 15.03% is not well covered by earnings or free cash flows, suggesting potential sustainability concerns amidst its low return on equity at 6.4%.

- Unlock comprehensive insights into our analysis of MYS Group stock in this financial health report.

- Explore historical data to track MYS Group's performance over time in our past results report.

Ningbo Xianfeng New MaterialLtd (SZSE:300163)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ningbo Xianfeng New Material Co., Ltd develops and manufactures screen fabrics globally, with a market cap of CN¥1.73 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥1.73B

Ningbo Xianfeng New Material Co., Ltd has shown financial improvement, becoming profitable in the last year with net income of CN¥25.03 million for Q1 2025, compared to a loss previously. The company is debt-free and its short-term assets (CN¥355.9M) comfortably cover both short and long-term liabilities. However, its return on equity remains low at 4.1%. Recent M&A activities include acquisitions by Li Kelei and Zhu Lin, indicating investor interest in the company's equity. Amendments to the company's articles were approved recently, potentially signaling strategic shifts or governance enhancements.

- Get an in-depth perspective on Ningbo Xianfeng New MaterialLtd's performance by reading our balance sheet health report here.

- Understand Ningbo Xianfeng New MaterialLtd's track record by examining our performance history report.

Key Takeaways

- Click through to start exploring the rest of the 5,599 Global Penny Stocks now.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin VITI Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603023

Harbin VITI Electronics

Researches and develops, manufactures, and sells automobile electronic products for cars and buses in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives