As global markets face challenges from geopolitical tensions and consumer spending concerns, investors are keeping a close eye on potential opportunities amidst the volatility. Penny stocks, despite their old-fashioned name, remain a relevant area for investment as they often represent smaller or newer companies with the potential for significant growth. By focusing on those with strong financial foundations, investors can uncover hidden value and potential long-term success in these under-the-radar opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.80 | HK$43.62B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.295 | MYR820.74M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.95 | SEK295.44M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.04 | THB2.42B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.90 | £319.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.90 | £450.22M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.155 | £303.34M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.39 | A$370.18M | ★★★★★☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Luzhou Bank (SEHK:1983)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China offering corporate and retail banking, financial market, and other services, with a market cap of HK$4.46 billion.

Operations: Luzhou Bank Co., Ltd. has not reported specific revenue segments for its operations in the People’s Republic of China.

Market Cap: HK$4.46B

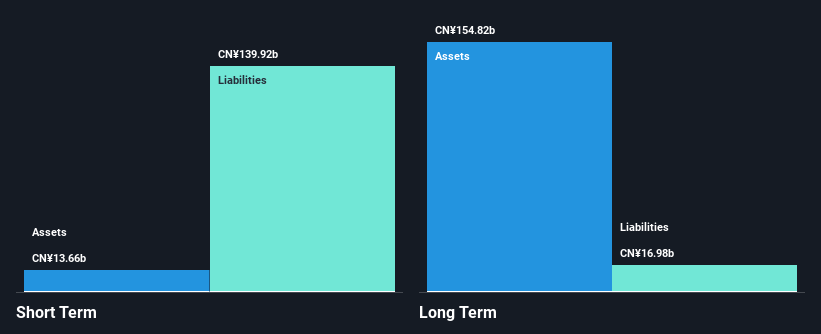

Luzhou Bank, with a market cap of HK$4.46 billion, demonstrates several strengths and challenges typical of penny stocks. The bank's earnings growth over the past year has been significant, outpacing industry averages, and its net profit margins have improved. It maintains an appropriate level of bad loans and a stable loans-to-deposits ratio, indicating sound financial management. However, its return on equity is considered low compared to ideal benchmarks. Recent board changes could influence strategic direction; the appointment of new directors may bring fresh perspectives but also introduces some uncertainty in leadership continuity.

- Click here to discover the nuances of Luzhou Bank with our detailed analytical financial health report.

- Learn about Luzhou Bank's historical performance here.

Jiangsu JIXIN Wind Energy Technology (SHSE:601218)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. operates in the wind energy sector and has a market cap of approximately CN¥3.08 billion.

Operations: As there are no specific revenue segments reported for Jiangsu JIXIN Wind Energy Technology Co., Ltd., detailed financial breakdowns by geographical or business lines are not available.

Market Cap: CN¥3.08B

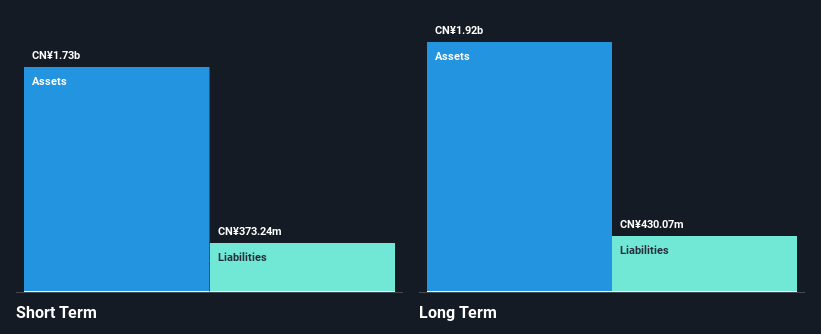

Jiangsu JIXIN Wind Energy Technology, with a market cap of CN¥3.08 billion, presents a mixed profile typical of penny stocks. The company is trading below its estimated fair value and has high-quality earnings despite negative earnings growth over the past year. Its financial stability is underscored by short-term assets exceeding both short and long-term liabilities, along with more cash than total debt. However, the return on equity remains low at 2.6%, and profit margins have declined from 10.3% to 5.6%. The management team lacks experience, potentially affecting strategic execution in an evolving wind energy sector landscape.

- Unlock comprehensive insights into our analysis of Jiangsu JIXIN Wind Energy Technology stock in this financial health report.

- Understand Jiangsu JIXIN Wind Energy Technology's track record by examining our performance history report.

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. develops, produces, and sells packaging products both in China and internationally, with a market cap of CN¥5.07 billion.

Operations: MYS Group Co., Ltd. has not reported any specific revenue segments at this time.

Market Cap: CN¥5.07B

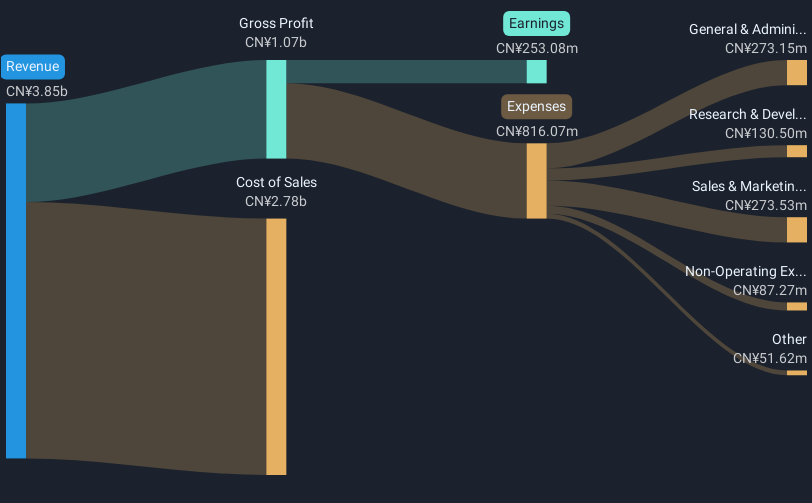

MYS Group, with a market cap of CN¥5.07 billion, reflects characteristics common in penny stocks. The company is trading at 25.9% below its estimated fair value and has seen a significant earnings growth of 36% over the past year, despite a decline over five years. Its financial health is strong with short-term assets covering both short and long-term liabilities, and more cash than total debt. However, the dividend yield of 14.5% isn't well-supported by free cash flows and return on equity remains low at 5.5%. A recent acquisition saw a 10% stake sold for approximately CN¥420 million.

- Dive into the specifics of MYS Group here with our thorough balance sheet health report.

- Gain insights into MYS Group's historical outcomes by reviewing our past performance report.

Next Steps

- Discover the full array of 5,713 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002303

MYS Group

Develops, produces, and sells packaging products in China and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives