As Asian markets experience a mix of optimism and caution, with technology sectors showing resilience amid broader economic concerns, investors are increasingly looking at smaller-cap stocks for potential opportunities. Penny stocks, though an older term, continue to represent companies that may offer significant value due to their untapped potential and lower market valuations. By focusing on financial strength and growth prospects, these penny stocks can present intriguing opportunities for those willing to explore beyond the more established players in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.095 | SGD49.73M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

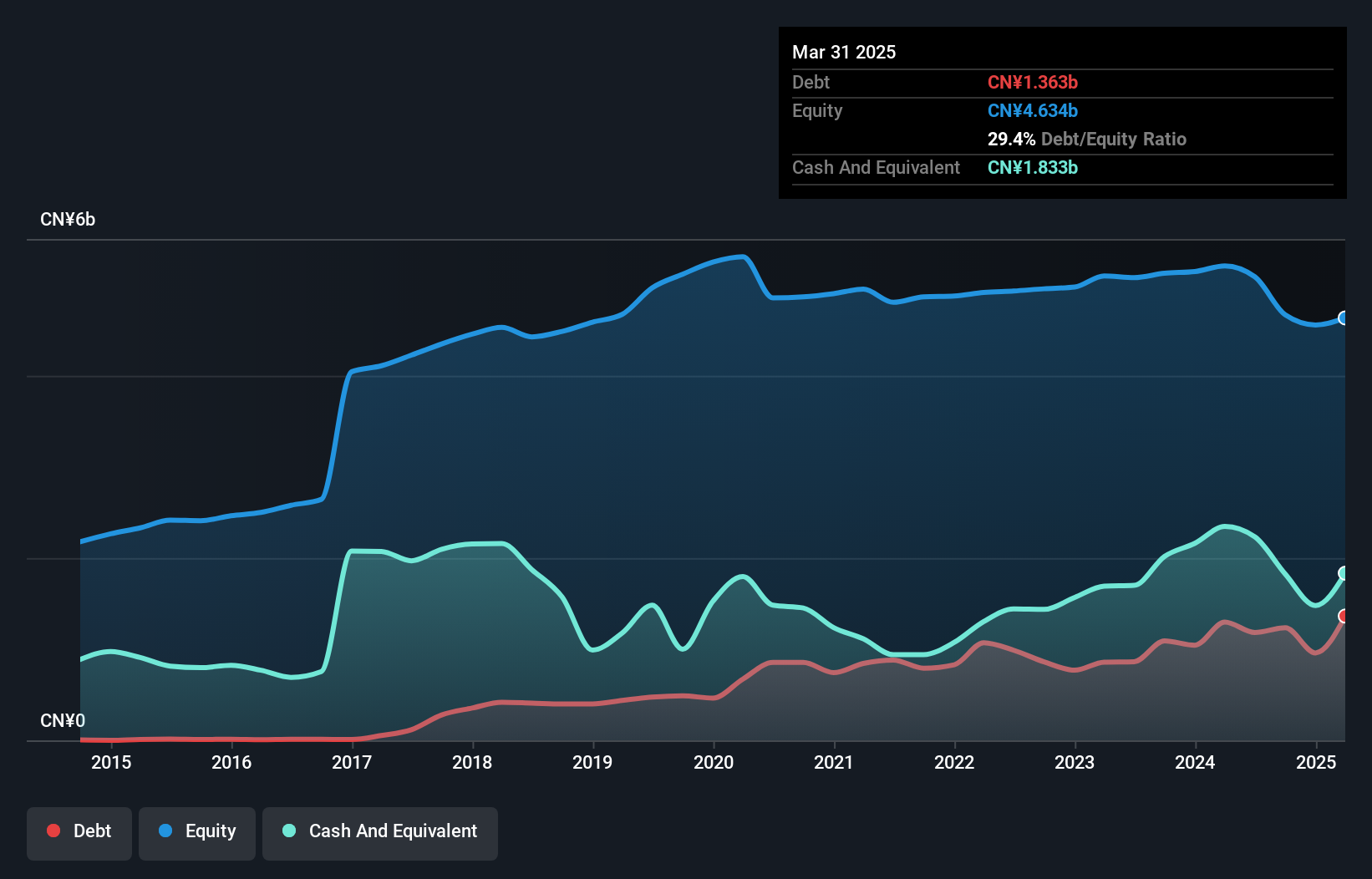

Tengda Construction Group (SHSE:600512)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tengda Construction Group Co., Ltd. operates in the infrastructure construction sector in China with a market capitalization of CN¥4.12 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥3.92 billion.

Market Cap: CN¥4.12B

Tengda Construction Group, with a market cap of CN¥4.12 billion, recently reported revenue of CN¥2.55 billion for the first nine months of 2025, a modest increase from the previous year. Despite having more cash than debt and reducing its debt-to-equity ratio over five years, Tengda faces challenges with declining profit margins and negative earnings growth over the past year. The company's dividend yield is not well covered by earnings or free cash flow, while operating cash flow remains negative. However, short-term assets significantly exceed both short-term and long-term liabilities, providing some financial stability amidst volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Tengda Construction Group.

- Examine Tengda Construction Group's past performance report to understand how it has performed in prior years.

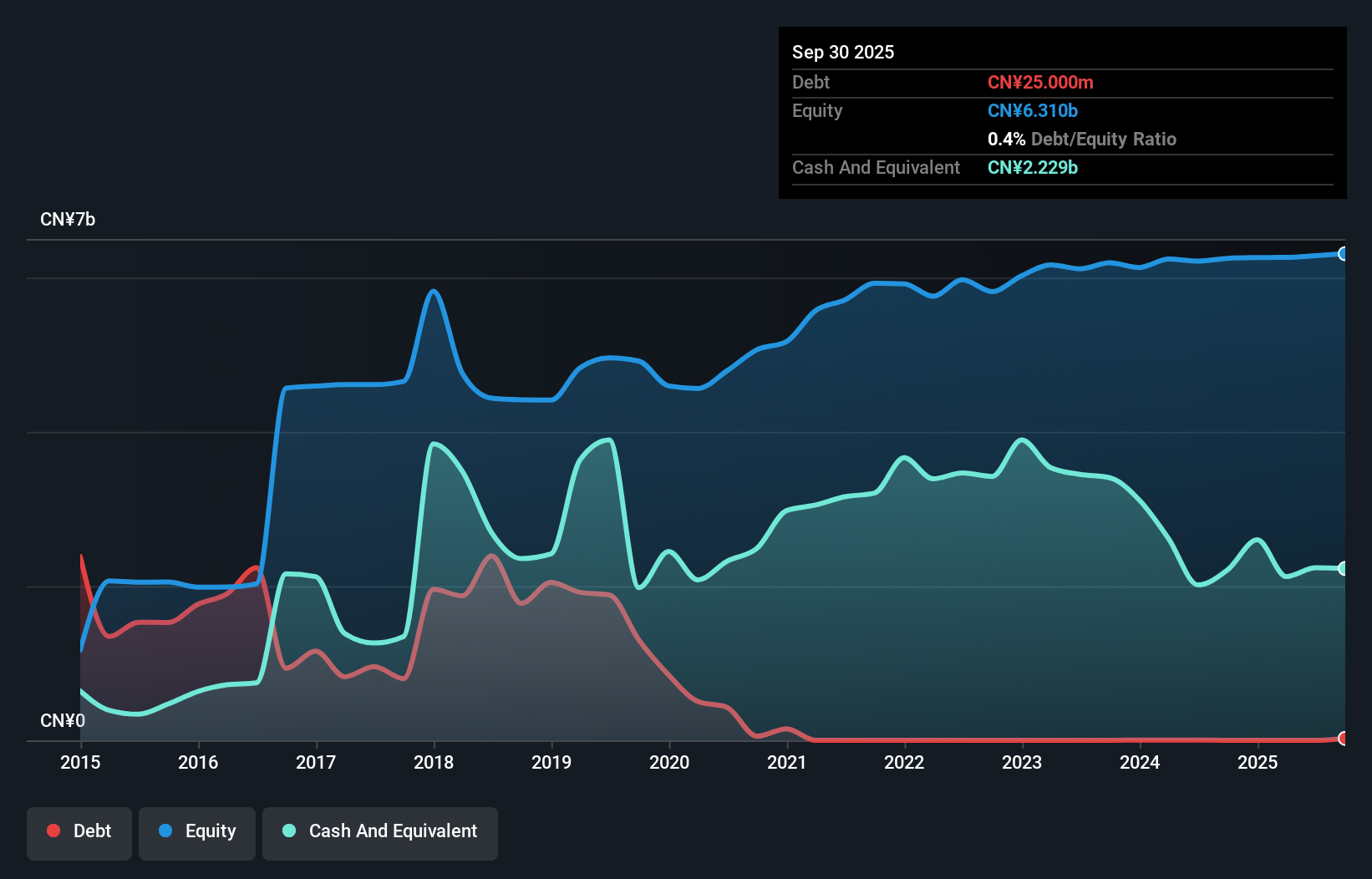

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. develops, produces, and sells packaging products both in China and internationally with a market cap of CN¥6.51 billion.

Operations: MYS Group Co., Ltd. has not reported specific revenue segments, but it is involved in the development, production, and sale of packaging products both domestically and internationally.

Market Cap: CN¥6.51B

MYS Group, with a market cap of CN¥6.51 billion, has demonstrated solid financial performance in the packaging industry. The company reported revenue of CN¥3 billion for the first nine months of 2025, showing growth from the previous year. Its earnings increased by 27.6% over the past year, outpacing both its historical average and industry trends. MYS Group's short-term assets exceed liabilities significantly, and it maintains more cash than total debt, ensuring financial stability despite an increasing debt-to-equity ratio over five years. However, its dividend yield is not well covered by earnings or free cash flow.

- Unlock comprehensive insights into our analysis of MYS Group stock in this financial health report.

- Explore historical data to track MYS Group's performance over time in our past results report.

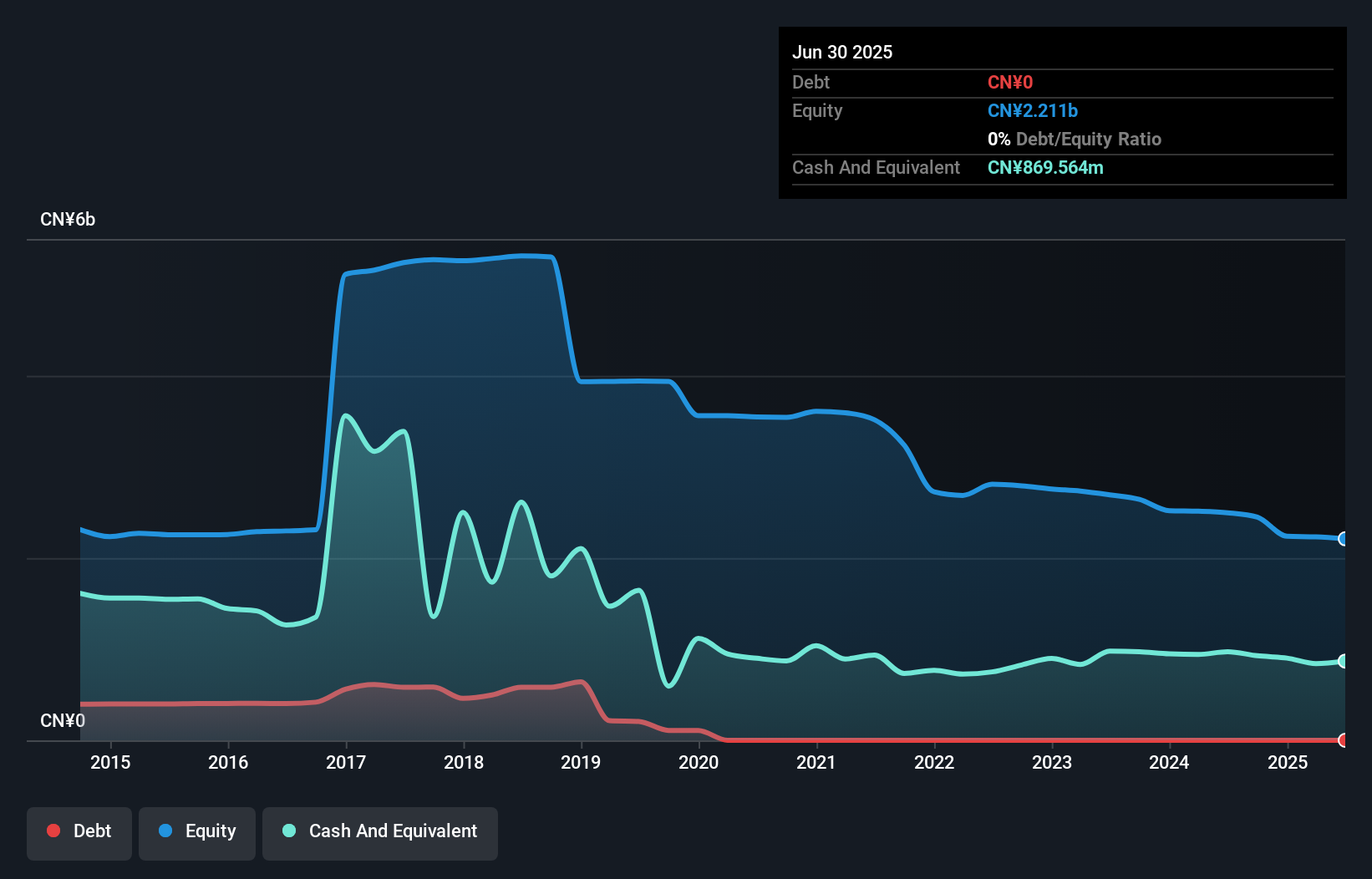

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. manufactures and sells LED lighting products both in China and internationally, with a market cap of CN¥4.70 billion.

Operations: The company generates revenue from its Semiconductor Lighting segment, totaling CN¥399.21 million.

Market Cap: CN¥4.7B

Dongguan Kingsun Optoelectronic Co., Ltd. has a market cap of CN¥4.70 billion and generates revenue primarily from its Semiconductor Lighting segment, reporting CN¥310.9 million in sales for the first nine months of 2025, though it remains unprofitable with a net loss of CN¥178.56 million. Despite this, the company benefits from a strong cash position with sufficient runway for over three years and no debt obligations. Recent proposals to amend corporate governance structures may impact future operations positively or negatively depending on implementation outcomes; however, volatility remains high compared to most Chinese stocks, indicating potential risks for investors seeking stability.

- Jump into the full analysis health report here for a deeper understanding of Dongguan Kingsun OptoelectronicLtd.

- Gain insights into Dongguan Kingsun OptoelectronicLtd's historical outcomes by reviewing our past performance report.

Summing It All Up

- Access the full spectrum of 953 Asian Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002303

MYS Group

Develops, produces, and sells packaging products in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026