In a global market marked by inflation concerns and political uncertainty, small-cap stocks have notably struggled, with the Russell 2000 Index dipping into correction territory. Amid this volatility, investors are increasingly on the lookout for undiscovered gems—stocks that may offer potential value due to strong fundamentals or unique market positioning despite broader economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Innovana Thinklabs | 6.09% | 12.62% | 20.18% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Vestjysk Bank (CPSE:VJBA)

Simply Wall St Value Rating: ★★★★☆☆

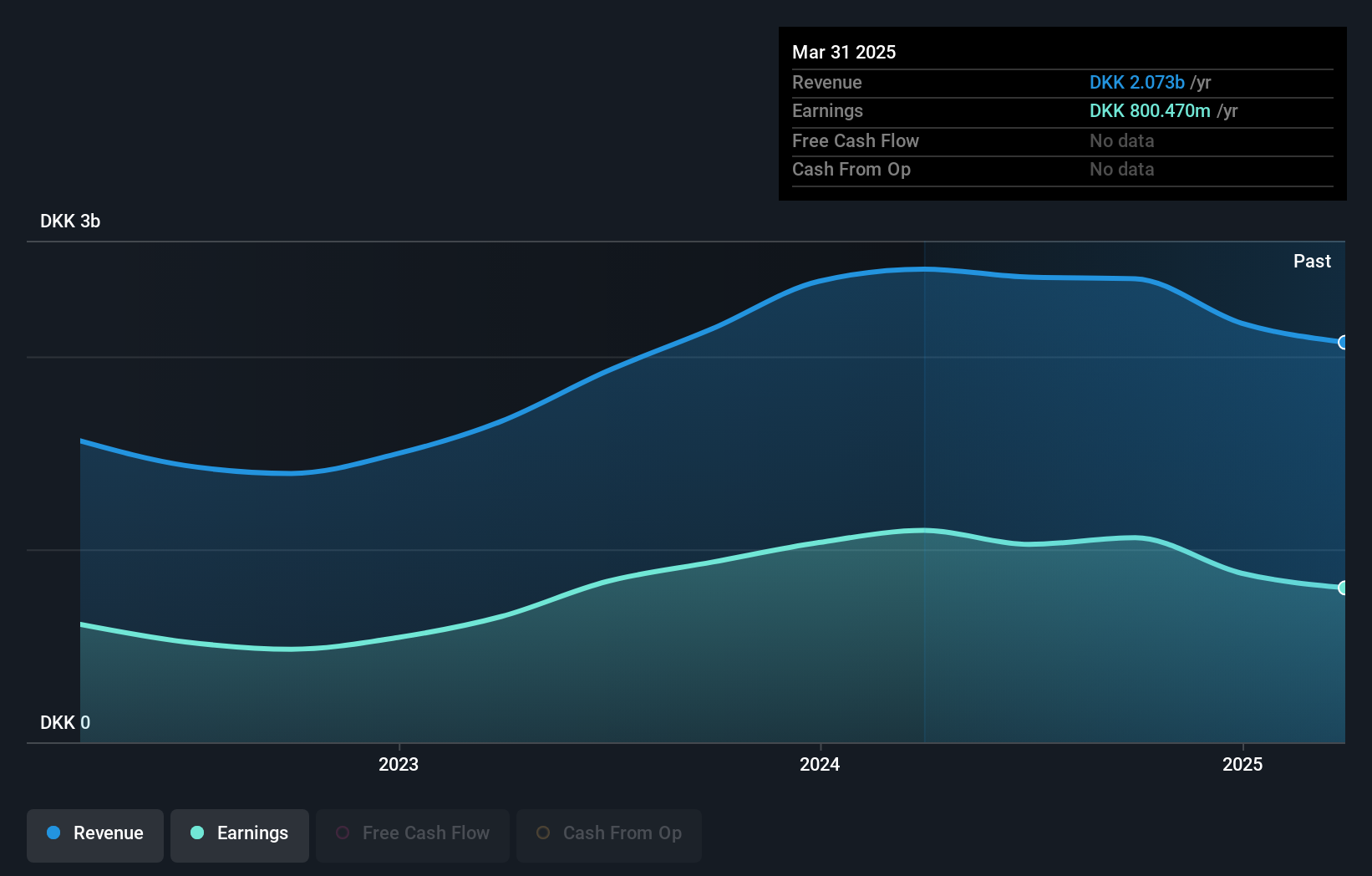

Overview: Vestjysk Bank A/S offers a range of banking products and services to both private and business clients in Denmark, with a market capitalization of DKK5.54 billion.

Operations: Vestjysk Bank generates revenue primarily from its banking activities, amounting to DKK2.40 billion. The company's financial performance is reflected in its net profit margin, which stands at 15%.

Vestjysk Bank, a smaller player in the banking sector, showcases solid financial health with total assets of DKK47.3 billion and equity of DKK7.1 billion. The bank operates with a low-risk funding structure, as 90% of its liabilities are customer deposits, reducing reliance on external borrowing. Despite earnings growth of 13.5% not matching the industry average of 16.7%, it maintains high-quality past earnings and trades at an attractive valuation—69.3% below estimated fair value. With total loans at DKK20.3 billion against deposits of DKK36.1 billion, Vestjysk's potential for future growth remains promising in its niche market space.

Zhejiang Dehong Automotive Electronic & Electrical (SHSE:603701)

Simply Wall St Value Rating: ★★★★★☆

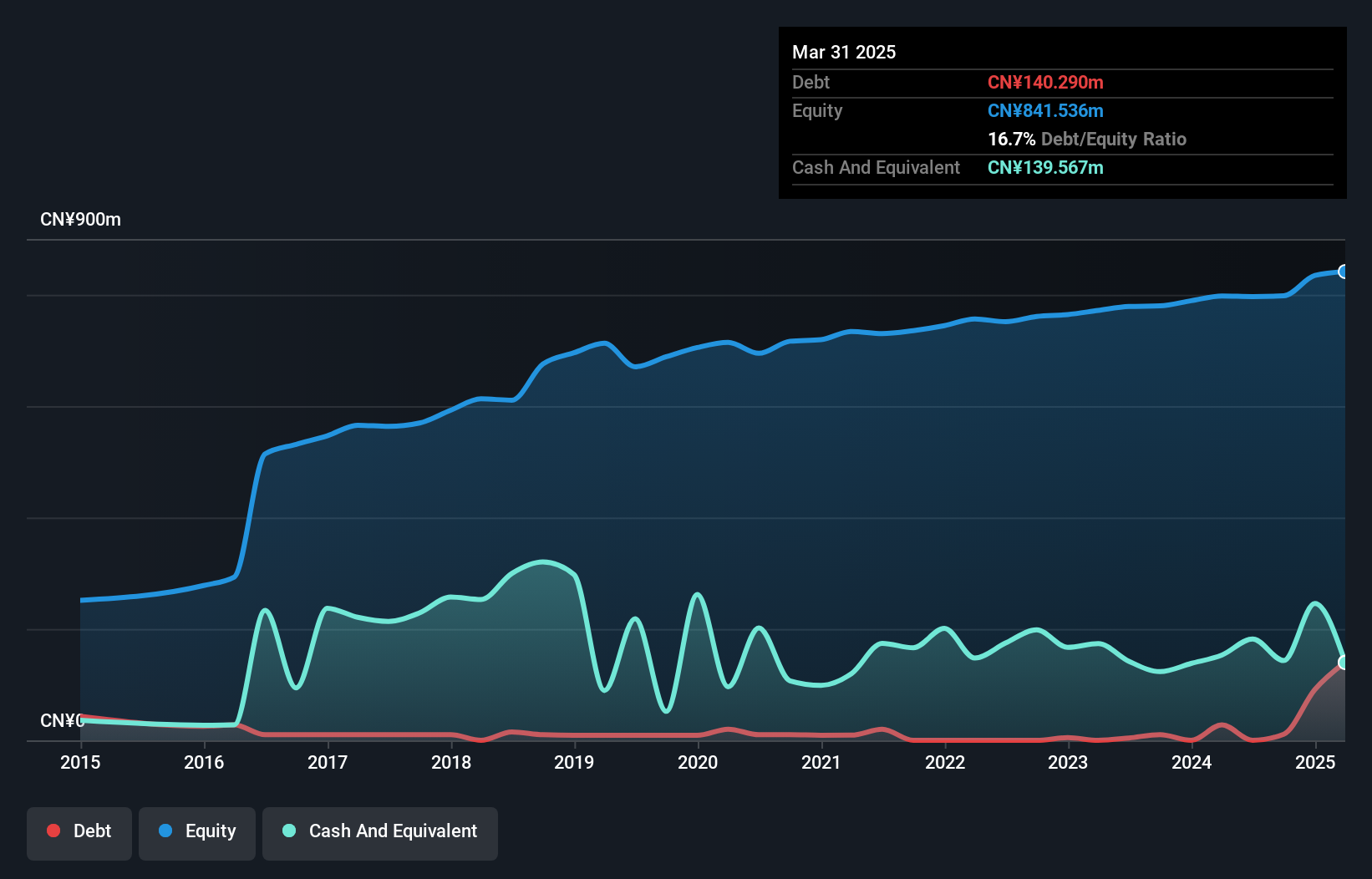

Overview: Zhejiang Dehong Automotive Electronic & Electrical Co., Ltd. operates in the automotive electronics and electrical sector with a market cap of CN¥3.43 billion.

Operations: The company generates revenue primarily from its automotive electronics and electrical products. It has a market cap of CN¥3.43 billion, reflecting its position within the industry.

Zhejiang Dehong, a small player in the auto components sector, has demonstrated robust earnings growth of 55% over the past year, outpacing the industry's 10.5%. Despite this impressive performance, its debt to equity ratio slightly increased from 1.3 to 1.4 over five years. The company remains profitable with more cash than total debt and no concerns about interest coverage. Recent earnings announcements reveal sales reached CNY 487 million for nine months ending September 2024, up from CNY 440 million a year prior, while net income nudged up to CNY 14.71 million from CNY 14.27 million last year.

Jiangsu Huachang Chemical (SZSE:002274)

Simply Wall St Value Rating: ★★★★★★

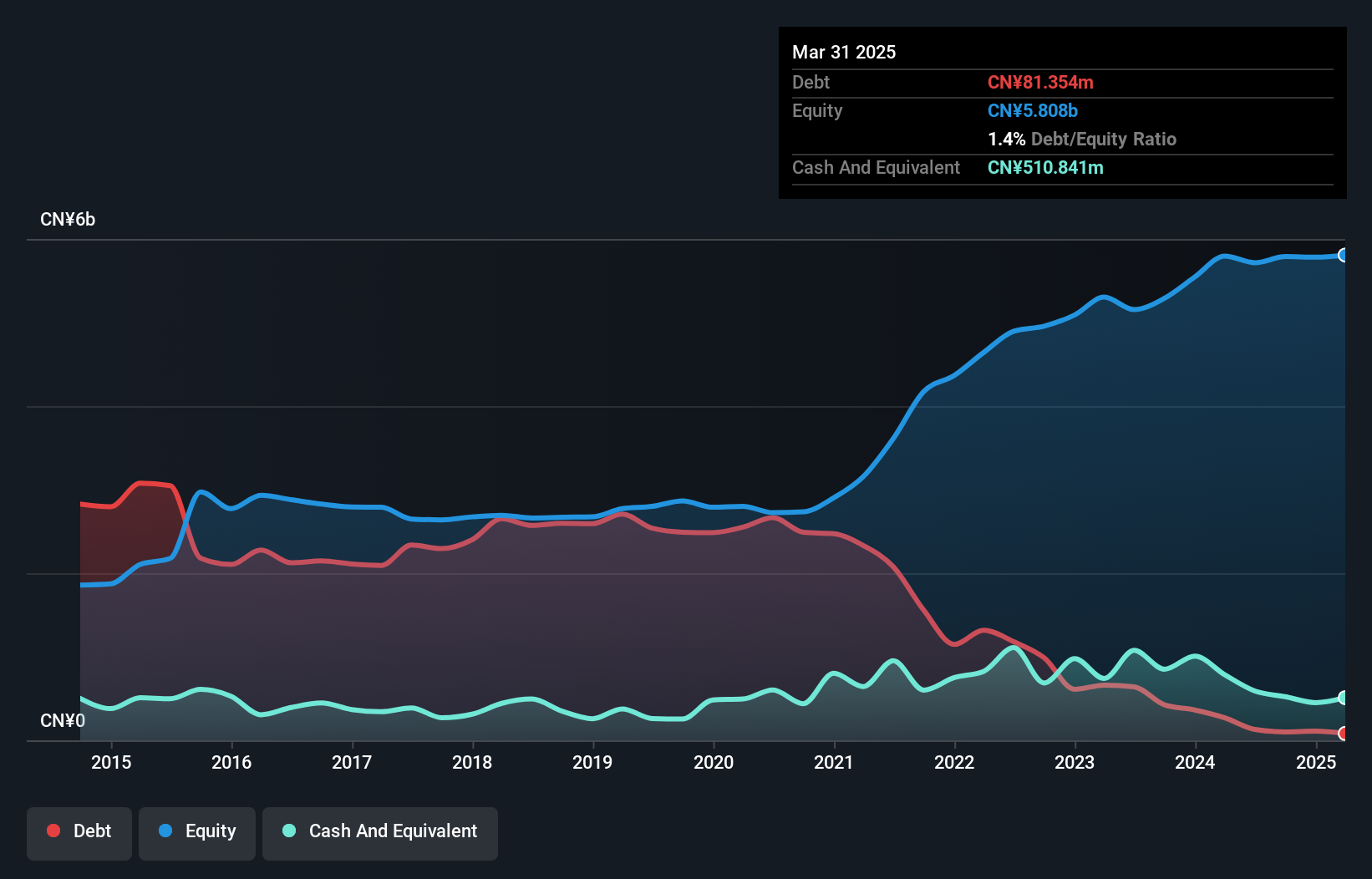

Overview: Jiangsu Huachang Chemical Co., Ltd is engaged in the manufacturing and sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products in China with a market cap of CN¥7.30 billion.

Operations: Huachang Chemical's revenue is primarily derived from the sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products. The company exhibits a net profit margin trend that reflects its operational efficiency in managing costs relative to its revenue streams.

Jiangsu Huachang Chemical, a dynamic player in the chemicals sector, shows promising financial health with its debt to equity ratio dropping from 87% to 1.7% over five years. The company is profitable and boasts more cash than total debt, ensuring a solid footing. Over the past year, earnings surged by 35.6%, outpacing the industry’s -4.7%. Recent earnings results reveal sales of CNY 6.27 billion and net income of CNY 529.99 million for nine months ending September 2024, compared to last year's figures of CNY 5.99 billion and CNY 469.43 million respectively—an encouraging trend for potential investors.

Turning Ideas Into Actions

- Gain an insight into the universe of 4556 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002274

Jiangsu Huachang Chemical

Manufactures and sells agrochemicals, basic chemicals, fine chemicals, and biochemical products in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives