Global markets have recently experienced fluctuations due to tariff uncertainties and mixed economic data, with U.S. stocks ending the week lower amid concerns over trade policies. In such a climate, investors often seek opportunities in diverse areas of the market, including penny stocks. While the term "penny stock" might seem outdated, it still represents smaller or newer companies that can offer potential value when they are built on strong financials and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,697 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Jiangsu Hongdou IndustrialLTD (SHSE:600400)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Hongdou Industrial Co., LTD, with a market cap of approximately CN¥5.59 billion, manufactures and sells clothing products.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥5.59B

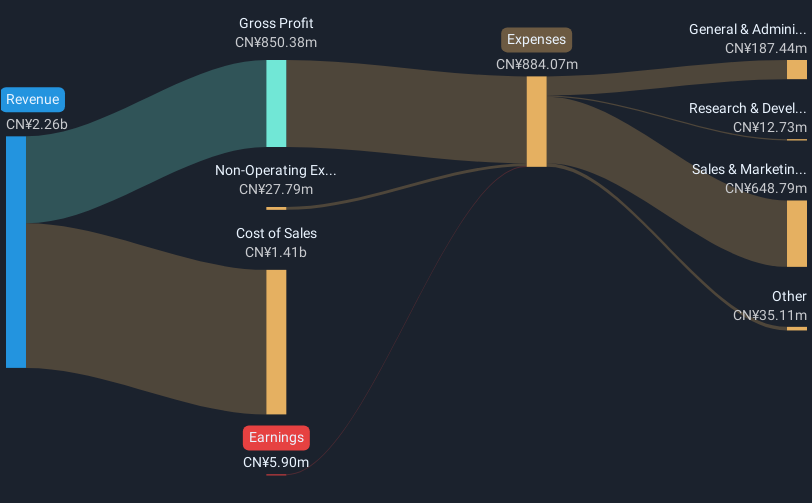

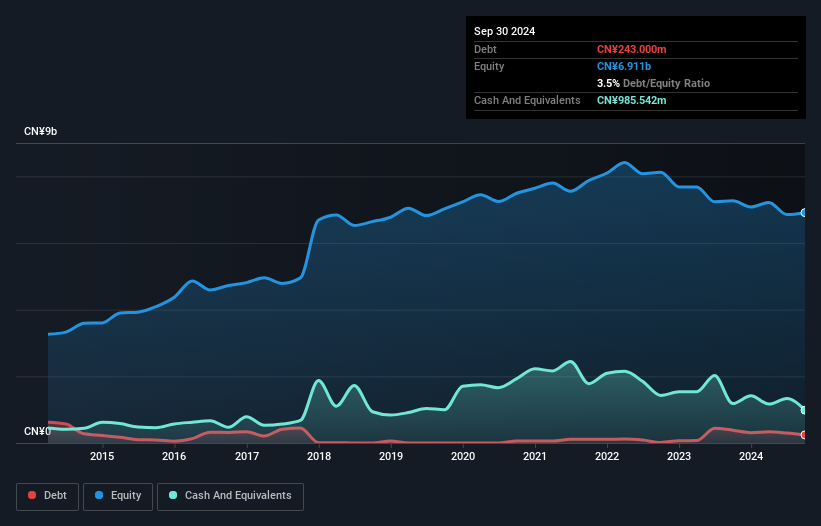

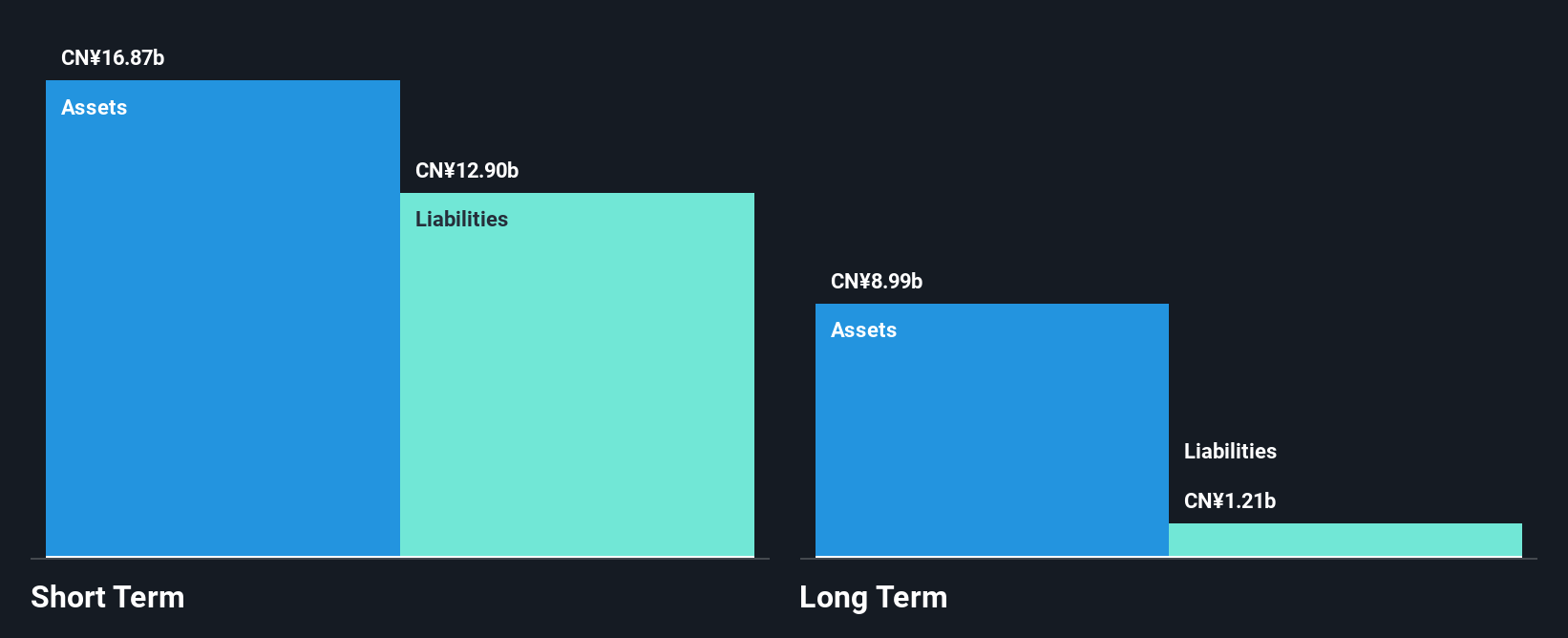

Jiangsu Hongdou Industrial Co., LTD, with a market cap of CN¥5.59 billion, remains unprofitable and has seen losses increase by 48.6% annually over the past five years. Despite this, the company holds more cash than its total debt and its short-term assets (CN¥2.3B) exceed both short-term (CN¥1.4B) and long-term liabilities (CN¥286.2M). The management team is seasoned with an average tenure of 9.5 years, suggesting stability in leadership amidst financial challenges. Recent share buybacks totaling CN¥13.68 million indicate efforts to bolster shareholder value despite a volatile share price environment.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Hongdou IndustrialLTD.

- Assess Jiangsu Hongdou IndustrialLTD's previous results with our detailed historical performance reports.

Shenzhen Jinjia GroupLtd (SZSE:002191)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Jinjia Group Co., Ltd. specializes in the research, development, and production of packaging materials in China, with a market cap of CN¥5.99 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥3.18 billion.

Market Cap: CN¥6B

Shenzhen Jinjia Group Co., Ltd. has recently achieved profitability, overcoming a challenging period marked by a 38% annual decline in earnings over the past five years. The company's short-term assets of CN¥3.9 billion comfortably cover both its short-term and long-term liabilities, indicating solid financial footing despite negative operating cash flow. Although the dividend yield of 7.08% is not well-supported by current earnings or free cash flows, Shenzhen Jinjia's debt levels remain manageable with more cash than total debt and interest payments covered by profits. However, recent results were impacted by a significant one-off loss of CN¥244.9 million.

- Unlock comprehensive insights into our analysis of Shenzhen Jinjia GroupLtd stock in this financial health report.

- Learn about Shenzhen Jinjia GroupLtd's future growth trajectory here.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhefu Holding Group Co., Ltd. operates through its subsidiaries in the research, development, manufacture, installation, and service of hydropower equipment both in China and internationally, with a market capitalization of approximately CN¥16.22 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥16.22B

Zhefu Holding Group faces challenges with negative earnings growth of 42.2% over the past year, but its financial structure shows resilience. The company's short-term assets of CN¥15.9 billion exceed both its short and long-term liabilities, providing a solid liquidity position. Despite an increased debt-to-equity ratio to 38.2%, interest payments are well covered by EBIT at 12.2 times coverage, and the company holds more cash than total debt, indicating manageable leverage levels. However, profit margins have declined from last year due to large one-off gains impacting recent financial results, highlighting potential volatility in earnings quality.

- Dive into the specifics of Zhefu Holding Group here with our thorough balance sheet health report.

- Understand Zhefu Holding Group's earnings outlook by examining our growth report.

Taking Advantage

- Access the full spectrum of 5,697 Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002191

Shenzhen Jinjia GroupLtd

Engages in the research, development, and production of packaging materials in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives