As global markets navigate a landscape marked by geopolitical tensions and fluctuating economic forecasts, investors are increasingly exploring diverse opportunities. Penny stocks, despite being an outdated term, continue to offer intriguing prospects for those looking beyond established giants. These smaller or newer companies can provide unique growth potential when supported by strong financials and solid fundamentals. In this article, we explore several penny stocks that stand out for their resilience and potential in today's market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.49 | A$125.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.27 | HK$807.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.03 | £452.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$155.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,916 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong DFP New Material Group Co., Ltd. (SHSE:601515) operates in the materials sector, focusing on the production and distribution of advanced materials, with a market cap of approximately CN¥6.75 billion.

Operations: No specific revenue segments are reported for Guangdong DFP New Material Group (SHSE:601515).

Market Cap: CN¥6.75B

Guangdong DFP New Material Group has experienced financial challenges, reporting a net loss of CN¥9.85 million in Q1 2025 and CN¥489.49 million for 2024, with revenues declining significantly from the previous year. Despite this, the company maintains strong liquidity with short-term assets of CN¥3.3 billion exceeding both short and long-term liabilities, and its debt is well covered by operating cash flow. The recent acquisition of a 29.90% stake by Quzhou Zhishang Enterprise Management indicates investor interest despite current unprofitability, while its stock trades at a significant discount to estimated fair value.

- Click to explore a detailed breakdown of our findings in Guangdong DFP New Material Group's financial health report.

- Review our growth performance report to gain insights into Guangdong DFP New Material Group's future.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd, along with its subsidiaries, produces and sells rutile titanium dioxide products both in China and internationally, with a market cap of CN¥15.20 billion.

Operations: The company does not report specific revenue segments.

Market Cap: CN¥15.2B

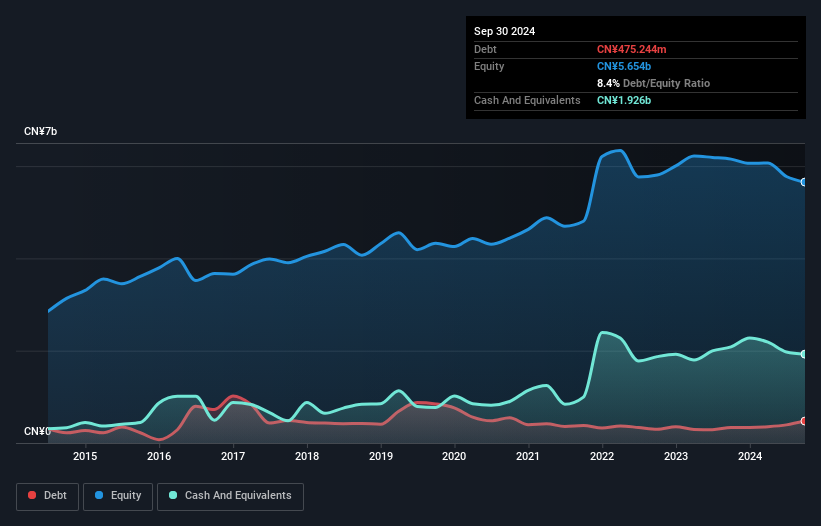

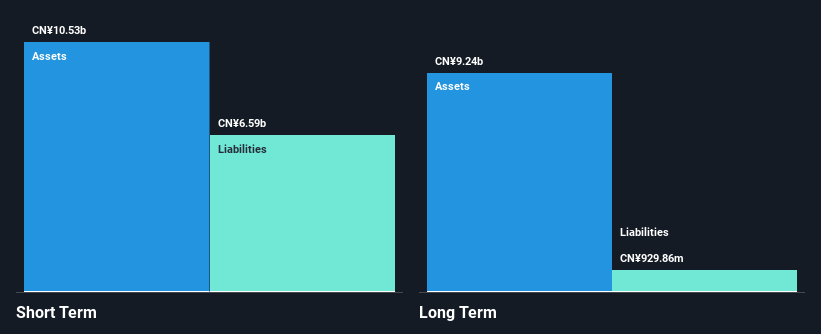

CNNC Hua Yuan Titanium Dioxide has demonstrated resilience with a recent earnings growth of 27.2%, outpacing the chemicals industry. The company's short-term assets of CN¥10.5 billion comfortably cover both short and long-term liabilities, indicating strong liquidity. However, its debt-to-equity ratio has slightly increased over five years, and operating cash flow does not sufficiently cover its debt, suggesting potential financial strain if not addressed. Recent shareholder meetings focused on strategic changes to optimize capital use and governance structure adjustments reflect proactive management efforts to enhance operational efficiency amidst evolving market conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of CNNC Hua Yuan Titanium Dioxide.

- Review our historical performance report to gain insights into CNNC Hua Yuan Titanium Dioxide's track record.

Nanfang Pump Industry (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanfang Pump Industry Co., Ltd., with a market cap of CN¥6.59 billion, operates in the general equipment manufacturing sector through its subsidiaries.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥6.59B

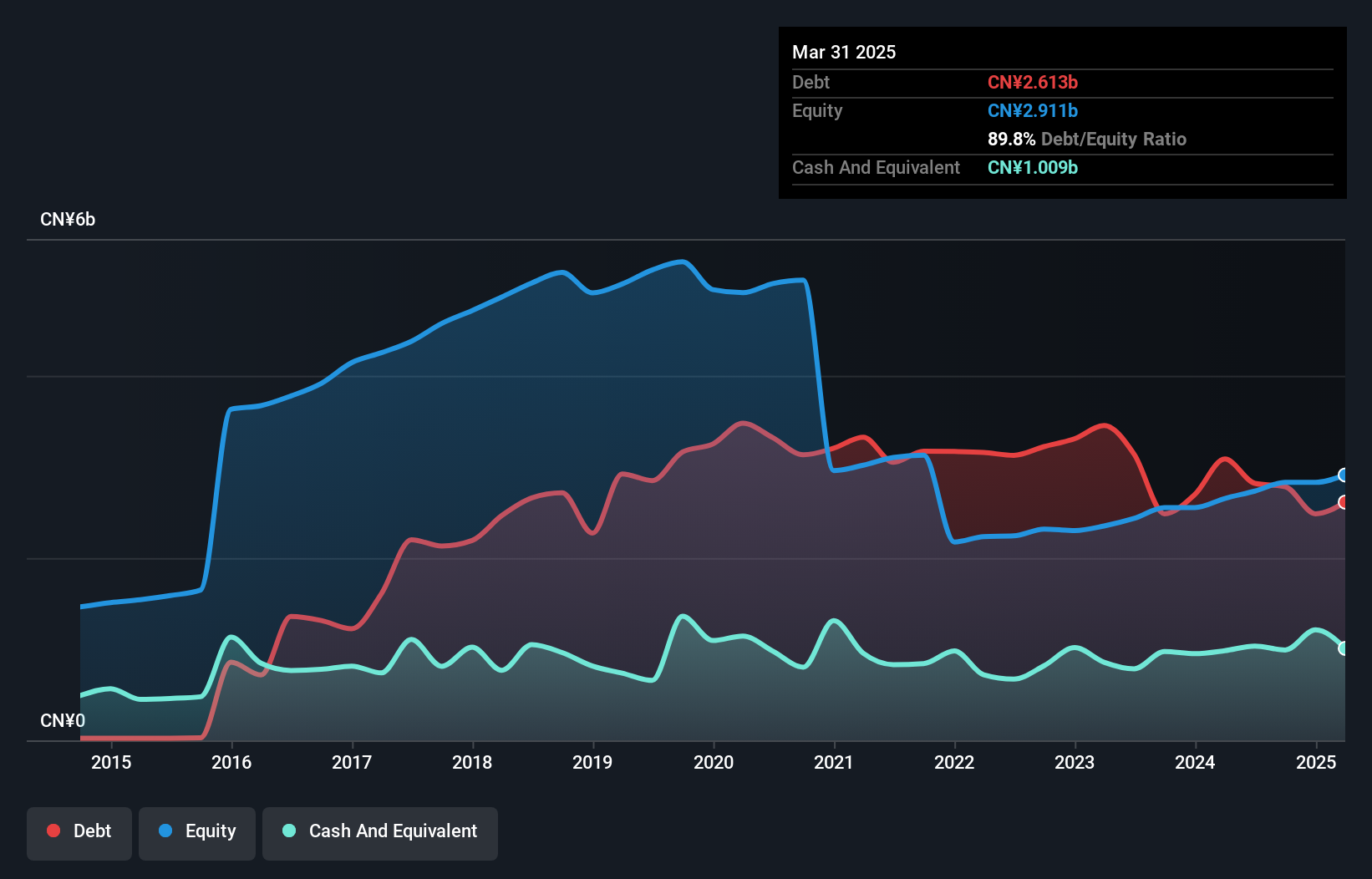

Nanfang Pump Industry Co., Ltd. has shown stable weekly volatility over the past year, indicating consistent stock performance despite negative earnings growth of 21.7%. The company operates with a high net debt-to-equity ratio of 55.1%, though its short-term assets (CN¥5.2 billion) cover both short and long-term liabilities, suggesting manageable financial health in the near term. Recent shareholder meetings approved changes to the company's name and articles of association, reflecting strategic governance adjustments. While trading below estimated fair value by 11.4%, Nanfang's return on equity remains low at 7.7%, highlighting potential areas for improvement in profitability metrics.

- Unlock comprehensive insights into our analysis of Nanfang Pump Industry stock in this financial health report.

- Gain insights into Nanfang Pump Industry's future direction by reviewing our growth report.

Taking Advantage

- Discover the full array of 3,916 Global Penny Stocks right here.

- Contemplating Other Strategies? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002145

CNNC Hua Yuan Titanium Dioxide

Produces and sells rutile titanium dioxide products in China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives