Jiangxi Black Cat Carbon Black Inc.,Ltd (SZSE:002068) Shares Fly 29% But Investors Aren't Buying For Growth

Jiangxi Black Cat Carbon Black Inc.,Ltd (SZSE:002068) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

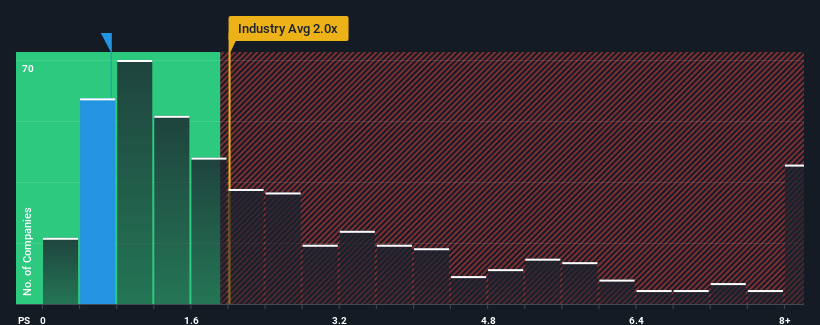

Even after such a large jump in price, Jiangxi Black Cat Carbon BlackLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Jiangxi Black Cat Carbon BlackLtd

What Does Jiangxi Black Cat Carbon BlackLtd's Recent Performance Look Like?

Jiangxi Black Cat Carbon BlackLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Jiangxi Black Cat Carbon BlackLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Jiangxi Black Cat Carbon BlackLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 77% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

In light of this, it's understandable that Jiangxi Black Cat Carbon BlackLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Jiangxi Black Cat Carbon BlackLtd's P/S

Despite Jiangxi Black Cat Carbon BlackLtd's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Jiangxi Black Cat Carbon BlackLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Jiangxi Black Cat Carbon BlackLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Jiangxi Black Cat Carbon BlackLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002068

Jiangxi Black Cat Carbon BlackLtd

Manufactures and sells carbon black products in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives