- China

- /

- Basic Materials

- /

- SZSE:002066

Why Investors Shouldn't Be Surprised By Ruitai Materials Technology Co., Ltd.'s (SZSE:002066) 26% Share Price Plunge

The Ruitai Materials Technology Co., Ltd. (SZSE:002066) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

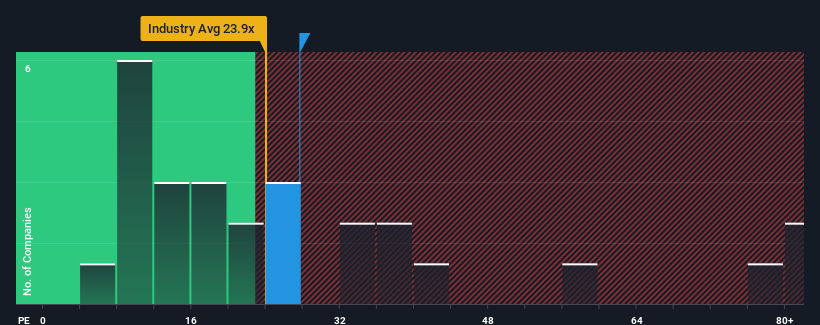

Since its price has dipped substantially, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may consider Ruitai Materials Technology as an attractive investment with its 27.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Ruitai Materials Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Ruitai Materials Technology

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ruitai Materials Technology's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. The latest three year period has also seen an excellent 154% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 36% over the next year. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that Ruitai Materials Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Ruitai Materials Technology's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ruitai Materials Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ruitai Materials Technology (1 doesn't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Ruitai Materials Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002066

Ruitai Materials Technology

Engages in the research, production, sale, and service of refractories in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives