- China

- /

- Hospitality

- /

- SHSE:603099

Discovering Undiscovered Gems in Asia This March 2025

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and trade tensions, Asian markets present a unique landscape where small-cap stocks are gaining attention amidst broader market volatility. In this dynamic environment, identifying promising opportunities requires a keen eye for companies with strong fundamentals and the potential to thrive despite external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lumax International | NA | 4.43% | 5.77% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| BBK Test Systems | NA | 8.57% | 12.90% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Maezawa Kasei Industries | 0.80% | 2.65% | 19.59% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Eclatorq Technology | 20.08% | 26.60% | 31.78% | ★★★★★☆ |

| Yukiguni Maitake | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Changbai Mountain Tourism (SHSE:603099)

Simply Wall St Value Rating: ★★★★★★

Overview: Changbai Mountain Tourism Co., Ltd. operates in the tourism industry in China with a market capitalization of CN¥9.13 billion.

Operations: Changbai Mountain Tourism derives its revenue from various segments within the tourism industry. The company focuses on optimizing its cost structure to enhance profitability. Notably, it has shown a trend in net profit margin that warrants attention for potential investors.

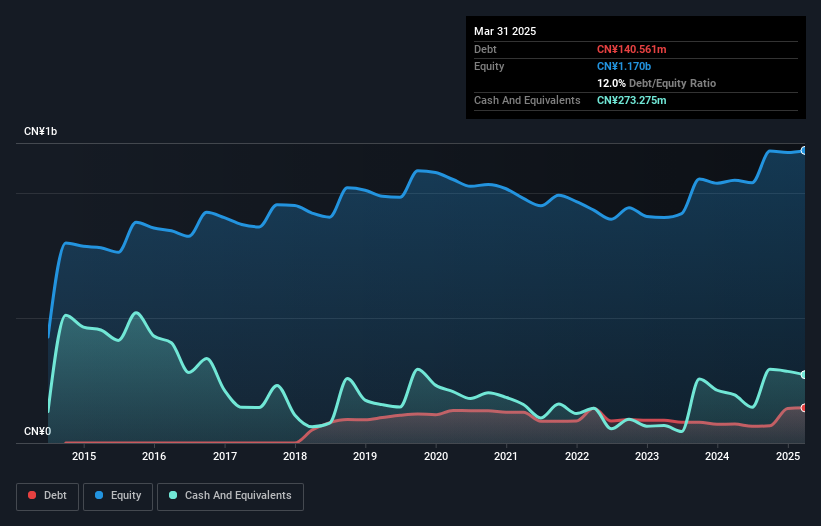

Changbai Mountain Tourism, a smaller player in the hospitality sector, showcases promising performance with its earnings growth of 12% over the past year, outpacing the industry average of -7.3%. This company has effectively reduced its debt to equity ratio from 10.7% to 5.9% over five years and maintains more cash than total debt, indicating financial prudence. With a forecasted earnings growth rate of 24%, Changbai seems poised for continued expansion. Recent events include an extraordinary shareholders meeting scheduled for February 2025, suggesting potential strategic decisions on the horizon that could impact future direction.

- Dive into the specifics of Changbai Mountain Tourism here with our thorough health report.

Learn about Changbai Mountain Tourism's historical performance.

Advanced Technology & Materials (SZSE:000969)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Technology & Materials Co., Ltd. operates in the advanced materials industry, focusing on the development and production of metal materials and products, with a market cap of CN¥14.36 billion.

Operations: The primary revenue stream for Advanced Technology & Materials comes from its Metal Materials and Products segment, generating CN¥7.99 billion.

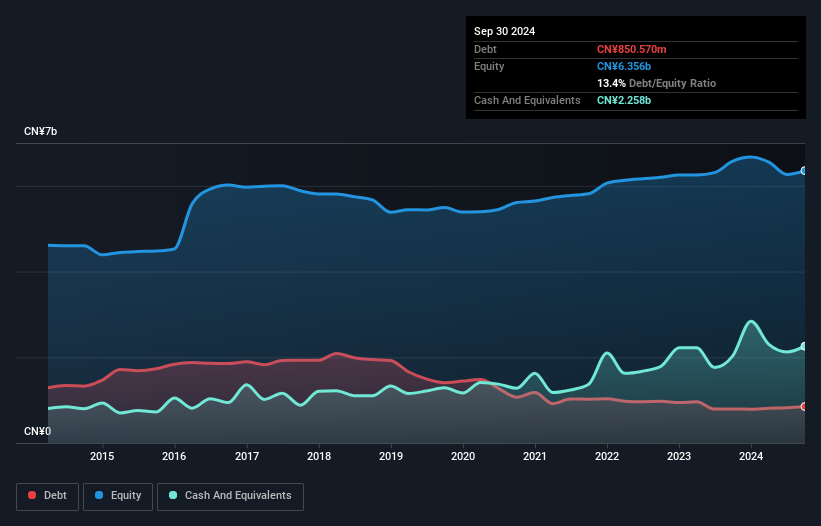

Advanced Technology & Materials, a small player in the industry, has shown impressive financial health with its debt to equity ratio decreasing from 25.6% to 13.4% over five years. The company posted a remarkable earnings growth of 67.2% last year, outpacing the Metals and Mining sector's -1.1%. It trades at 6.4% below estimated fair value, suggesting potential for undervaluation recognition by investors. With high-quality earnings and more cash than total debt, it seems well-positioned financially. Future prospects are promising as earnings are expected to grow at an annual rate of nearly 13%, indicating robust potential for continued expansion.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. operates in the production and sales of high-precision molds, injection products, and health products with a market capitalization of CN¥7.85 billion.

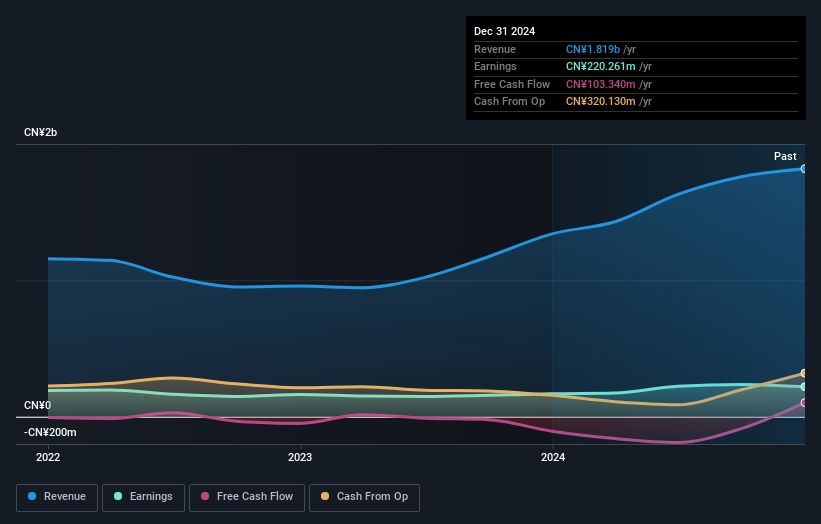

Operations: Voke Mold & Plastic Engineering generates revenue of CN¥1.76 billion from its production and sales activities in high-precision molds, injection products, and health products.

In the bustling landscape of Asian stocks, Xiamen Voke Mold & Plastic Engineering stands out with its notable performance. Over the past year, earnings surged by 50.8%, outpacing the Machinery industry average of -0.2%. This growth is supported by a reduced debt-to-equity ratio from 2.7% to 1.7% over five years, indicating improving financial health. Despite a volatile share price recently, its price-to-earnings ratio of 33x remains attractive compared to the CN market's 39x. The company also completed a significant buyback program in early 2025, repurchasing shares worth CN¥50 million, reflecting confidence in its future prospects.

Key Takeaways

- Embark on your investment journey to our 2619 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603099

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives