We Think COFCO Biotechnology (SZSE:000930) Has A Fair Chunk Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that COFCO Biotechnology Co., Ltd. (SZSE:000930) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for COFCO Biotechnology

What Is COFCO Biotechnology's Net Debt?

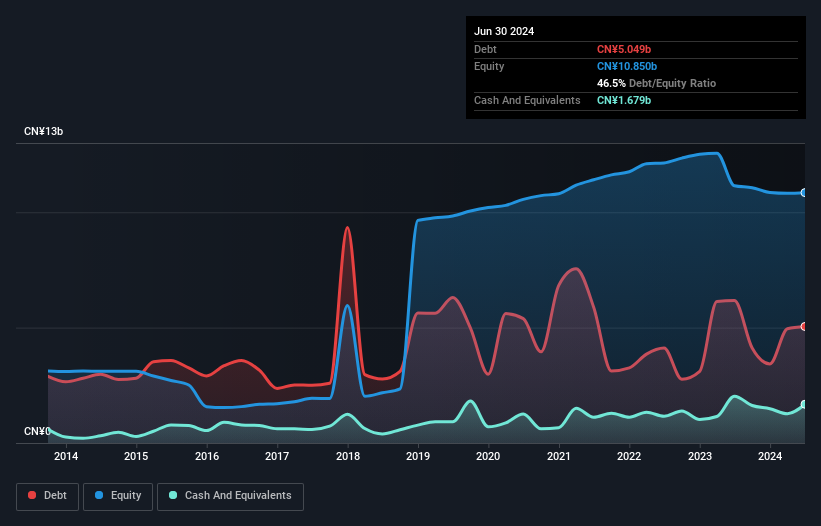

You can click the graphic below for the historical numbers, but it shows that COFCO Biotechnology had CN¥5.05b of debt in June 2024, down from CN¥6.17b, one year before. However, because it has a cash reserve of CN¥1.68b, its net debt is less, at about CN¥3.37b.

How Strong Is COFCO Biotechnology's Balance Sheet?

The latest balance sheet data shows that COFCO Biotechnology had liabilities of CN¥7.03b due within a year, and liabilities of CN¥568.4m falling due after that. On the other hand, it had cash of CN¥1.68b and CN¥1.37b worth of receivables due within a year. So its liabilities total CN¥4.55b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because COFCO Biotechnology is worth CN¥9.95b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine COFCO Biotechnology's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, COFCO Biotechnology reported revenue of CN¥21b, which is a gain of 13%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months COFCO Biotechnology produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at CN¥109m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of CN¥205m into a profit. In the meantime, we consider the stock very risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how COFCO Biotechnology's profit, revenue, and operating cashflow have changed over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000930

COFCO Biotechnology

Engages in the deep processing of agricultural products in China and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026