- China

- /

- Metals and Mining

- /

- SZSE:000807

Biofarm And Two Other Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. stocks closing out a strong year despite recent slumps and European indices showing varied performances, investors are increasingly seeking stability in dividend stocks. In such an environment, companies that consistently offer reliable dividends can serve as a buffer against market volatility, making them attractive options for those looking to balance risk and return in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.02% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

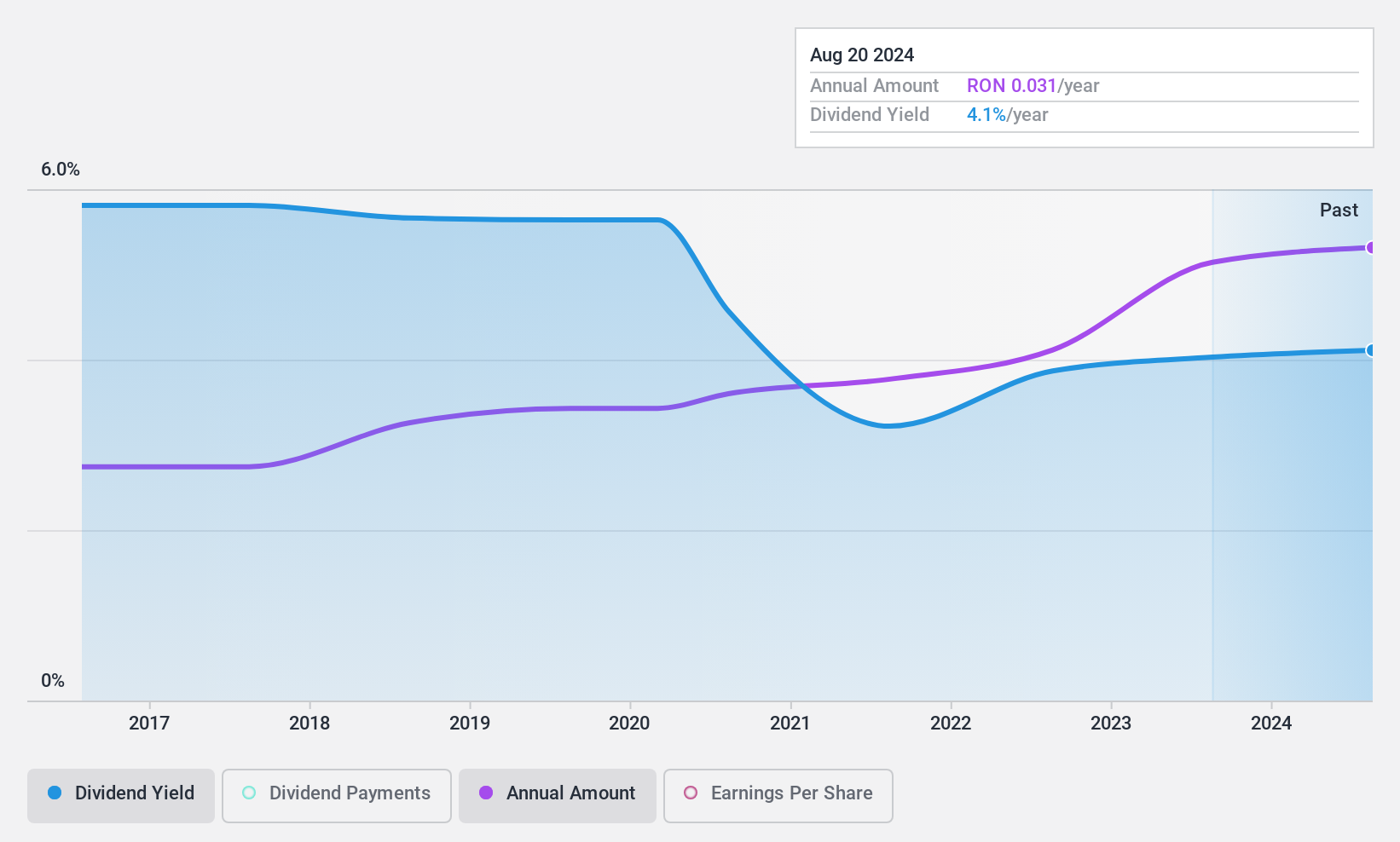

Biofarm (BVB:BIO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Biofarm S.A. is a Romanian company involved in the manufacture and sale of medicines, with a market cap of RON707.49 million.

Operations: Biofarm S.A.'s revenue is primarily derived from its Pharmaceuticals segment, which generated RON282.13 million.

Dividend Yield: 4.3%

Biofarm's dividend stability and reliability are notable, with consistent growth over the past decade. However, its dividends are not well-covered by cash flows due to a high cash payout ratio of 125.2%, despite being covered by earnings with a low payout ratio of 38%. The recent earnings report showed modest sales growth to RON 231.14 million and net income increase to RON 73.25 million, indicating steady financial performance amidst undervaluation concerns at current trading levels.

- Unlock comprehensive insights into our analysis of Biofarm stock in this dividend report.

- Our expertly prepared valuation report Biofarm implies its share price may be lower than expected.

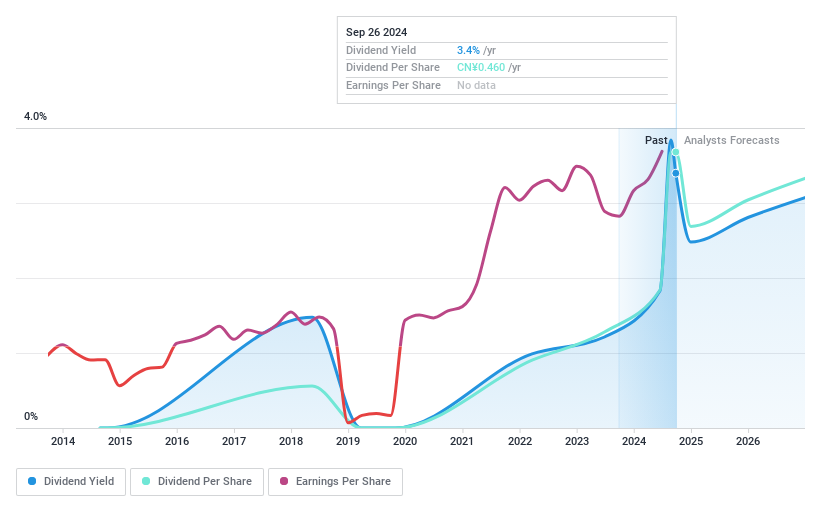

Yunnan Aluminium (SZSE:000807)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yunnan Aluminium Co., Ltd. manufactures and sells aluminum in China with a market cap of CN¥51.85 billion.

Operations: Yunnan Aluminium Co., Ltd. generates its revenue primarily from the manufacturing and sale of aluminum products in China.

Dividend Yield: 3.1%

Yunnan Aluminium's dividend payments have been volatile over its 7-year history, though they are well-covered by earnings and cash flows, with payout ratios of 30.3% and 25.5%, respectively. The company's recent earnings report shows significant growth, with net income rising to CNY 3.82 billion for the nine months ended September 2024, indicating robust financial health despite an unstable dividend track record. Trading at a substantial discount to its estimated fair value enhances its appeal among peers.

- Dive into the specifics of Yunnan Aluminium here with our thorough dividend report.

- The valuation report we've compiled suggests that Yunnan Aluminium's current price could be quite moderate.

Nihon DenkeiLtd (TSE:9908)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Denkei Co., Ltd. is engaged in the trading of electronic measuring instruments both in Japan and internationally, with a market cap of ¥21.54 billion.

Operations: Nihon Denkei Ltd. generates revenue from electronic measuring instruments with ¥91.46 billion coming from Japan and ¥15.31 billion from China.

Dividend Yield: 4.5%

Nihon Denkei's dividends are well-covered by earnings and cash flows, with payout ratios of 38% and 24.9%, respectively. The dividend yield of 4.51% is among the top in Japan, supported by stable growth over the past decade. Recent share buybacks totaling ¥77.2 million indicate a commitment to enhancing shareholder value and capital efficiency, while trading below estimated fair value suggests potential attractiveness relative to peers in the market.

- Take a closer look at Nihon DenkeiLtd's potential here in our dividend report.

- The analysis detailed in our Nihon DenkeiLtd valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Explore the 1994 names from our Top Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000807

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives