- China

- /

- Metals and Mining

- /

- SZSE:000426

Improved Earnings Required Before Inner Mongolia Xingye Silver &Tin Mining Co.,Ltd (SZSE:000426) Shares Find Their Feet

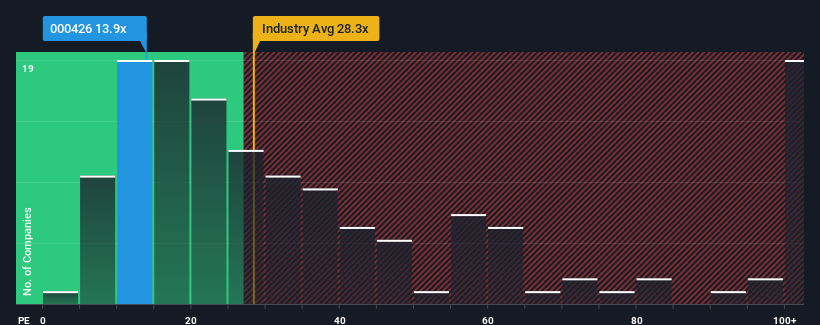

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may consider Inner Mongolia Xingye Silver &Tin Mining Co.,Ltd (SZSE:000426) as a highly attractive investment with its 13.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Inner Mongolia Xingye Silver &Tin MiningLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Inner Mongolia Xingye Silver &Tin MiningLtd

How Is Inner Mongolia Xingye Silver &Tin MiningLtd's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Inner Mongolia Xingye Silver &Tin MiningLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 254%. The strong recent performance means it was also able to grow EPS by 751% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 17% during the coming year according to the dual analysts following the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Inner Mongolia Xingye Silver &Tin MiningLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Inner Mongolia Xingye Silver &Tin MiningLtd's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Inner Mongolia Xingye Silver &Tin MiningLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Inner Mongolia Xingye Silver &Tin MiningLtd with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.