Jiangsu Eastern Shenghong Co.,Ltd.'s (SZSE:000301) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Jiangsu Eastern Shenghong Co.,Ltd. (SZSE:000301) shares have continued their recent momentum with a 27% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.4% over the last year.

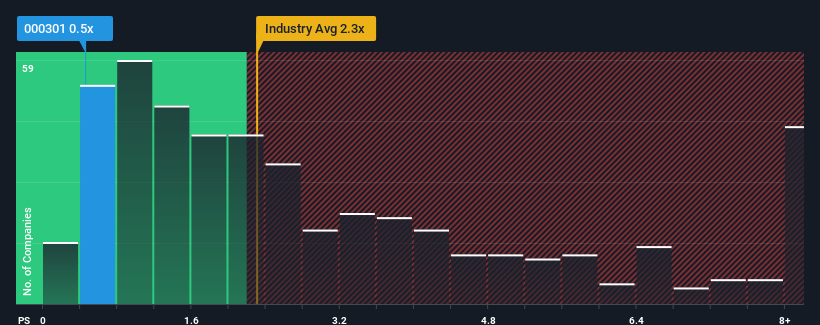

Although its price has surged higher, Jiangsu Eastern ShenghongLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2.3x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Jiangsu Eastern ShenghongLtd

How Has Jiangsu Eastern ShenghongLtd Performed Recently?

Jiangsu Eastern ShenghongLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu Eastern ShenghongLtd.Do Revenue Forecasts Match The Low P/S Ratio?

Jiangsu Eastern ShenghongLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Pleasingly, revenue has also lifted 149% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.8% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 25%, which is noticeably more attractive.

In light of this, it's understandable that Jiangsu Eastern ShenghongLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Jiangsu Eastern ShenghongLtd's P/S?

Despite Jiangsu Eastern ShenghongLtd's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Eastern ShenghongLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Jiangsu Eastern ShenghongLtd that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000301

Jiangsu Eastern ShenghongLtd

Engages in the research, development, production, and sale of polyester filament, petrochemical, and new chemical materials.

Fair value with moderate growth potential.

Market Insights

Community Narratives