As global markets navigate a volatile landscape marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap stocks remain under the radar despite their potential for growth. In this environment, identifying promising opportunities requires a keen eye for companies with strong fundamentals and resilience amid economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Kuo Yang Construction | 83.40% | -32.54% | -39.68% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Guangxi Huaxi Nonferrous MetalLtd (SHSE:600301)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Huaxi Nonferrous Metal Co., Ltd operates in China, engaging in the trading of steel, bulk commodities, and other products with a market capitalization of CN¥11.25 billion.

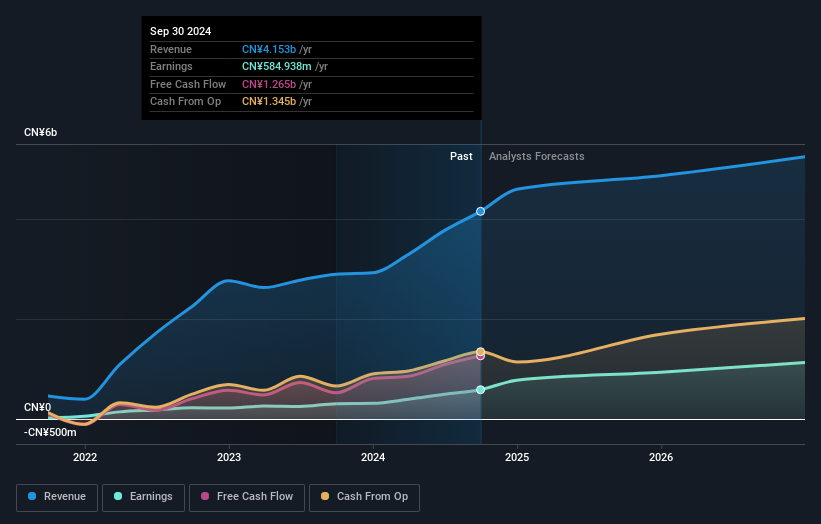

Operations: The company generates revenue primarily from the chlorine alkali chemical industry, amounting to CN¥4.15 billion.

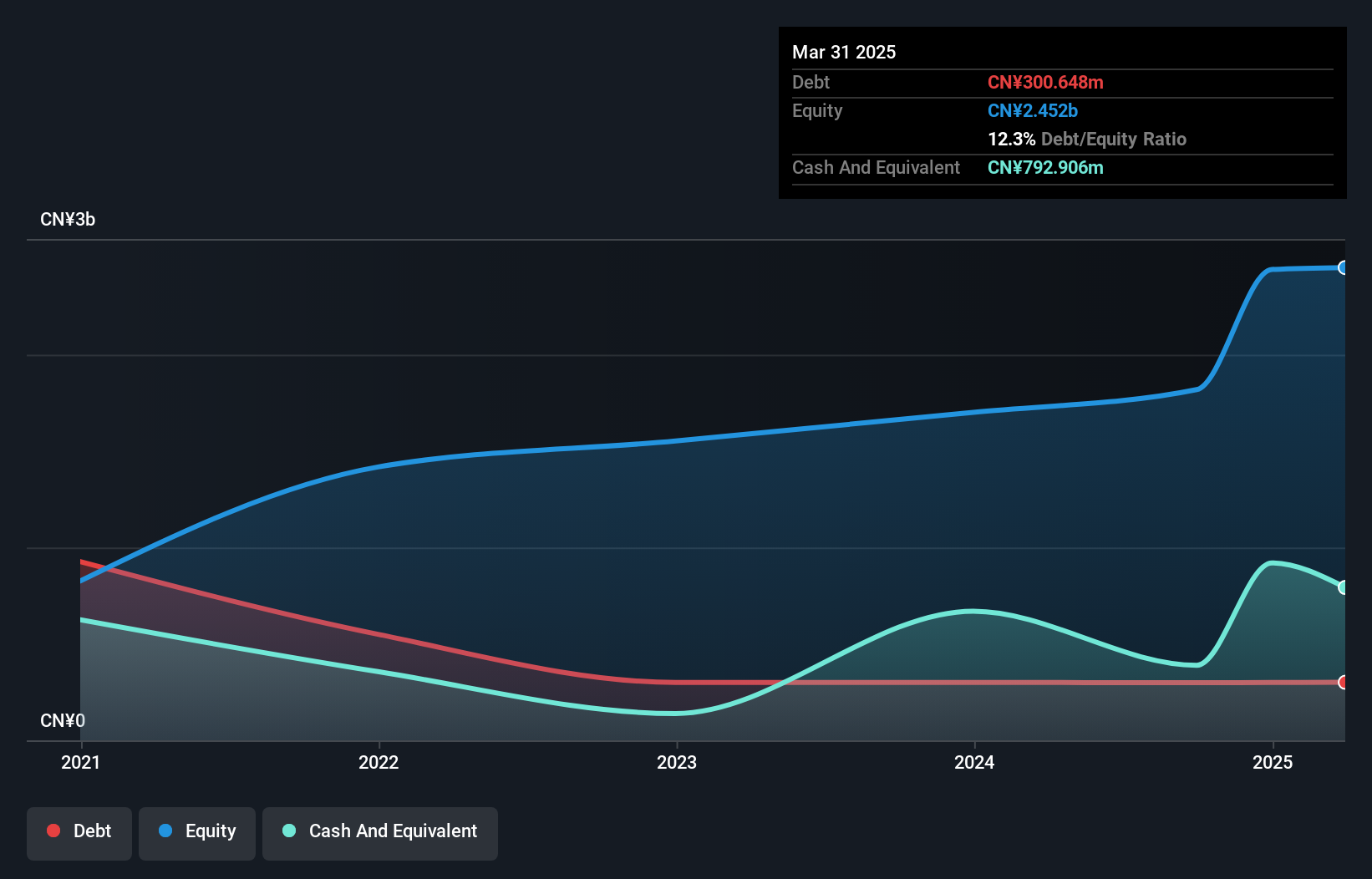

Guangxi Huaxi, a dynamic player in the nonferrous metals sector, has shown impressive growth with earnings surging 90.9% last year, outpacing the industry average of -5.4%. The company is trading at a significant discount, 82.2% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. With a net debt to equity ratio of just 4%, financial health appears robust and interest payments are well covered by EBIT at 26.3 times coverage. Future earnings are projected to grow annually by 25.43%, indicating promising prospects in an evolving market landscape.

Hunan Xiangtou Goldsky Titanium Industry Technology (SHSE:688750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hunan Xiangtou Goldsky Titanium Industry Technology Co., Ltd. is a company involved in the processing and fabrication of metal products, with a market capitalization of approximately CN¥9.38 billion.

Operations: The primary revenue stream for Goldsky Titanium Industry Technology comes from its metal processing and fabrication segment, generating approximately CN¥855.13 million. The company has a market capitalization of around CN¥9.38 billion.

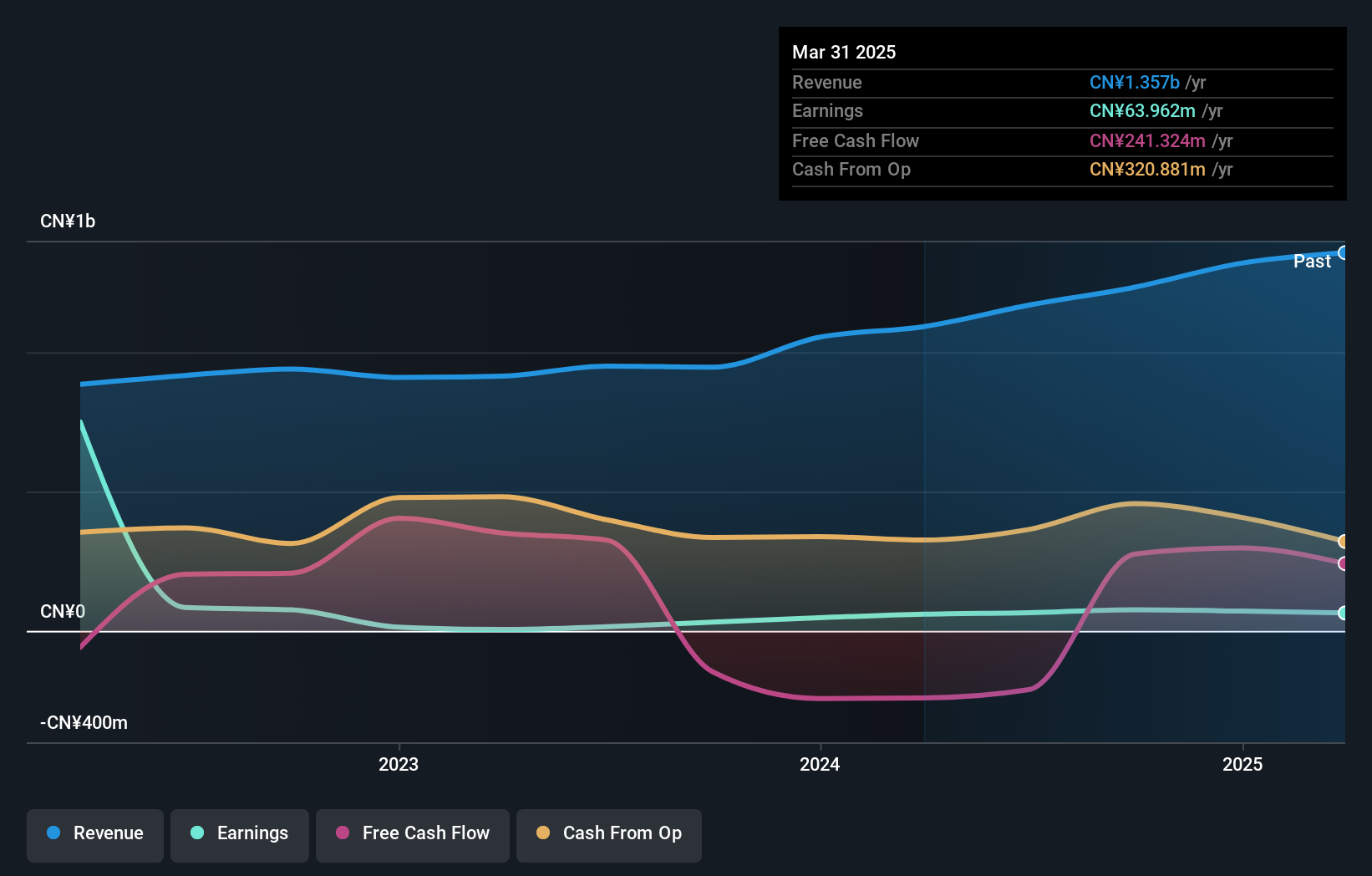

Hunan Xiangtou Goldsky Titanium Industry Technology, a small player in the metals and mining sector, has shown promising growth with earnings increasing by 17.9% over the past year, outpacing the industry average of -2.3%. The company recently completed an IPO raising CNY 662 million, which may bolster its financial position further. For the first nine months of 2024, sales reached CNY 617.86 million compared to CNY 563.86 million in the previous year, while net income rose to CNY 116.85 million from CNY 94.8 million. With more cash than debt and positive free cash flow of approximately US$112 million as of September 2024, it seems well-positioned for future endeavors.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China and has a market capitalization of CN¥7.41 billion.

Operations: Haite High-tech generates revenue primarily through aircraft airborne equipment maintenance services. The company's financial performance is influenced by its cost structure and market dynamics, with a focus on maintaining competitive service offerings in the aviation sector.

Sichuan Haite High-tech Ltd., a smaller player in the market, shows intriguing potential with its recent financial performance. Over the past year, earnings surged by 139%, significantly outpacing the infrastructure industry's 4% growth. This company has high-quality earnings and a satisfactory net debt to equity ratio of 37.9%. Despite these positives, interest payments are not well covered by EBIT, which stands at 2.2 times coverage against an ideal of at least three times. The reduction in its debt to equity ratio from 57.9% to 49.9% over five years suggests prudent financial management strategies are being employed effectively.

Make It Happen

- Get an in-depth perspective on all 4717 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600301

Guangxi Huaxi Nonferrous MetalLtd

Trades in steel, bulk commodities, and other products in China.

Outstanding track record and undervalued.

Market Insights

Community Narratives