Investors Still Waiting For A Pull Back In Suzhou Nanomicro Technology Co., Ltd. (SHSE:688690)

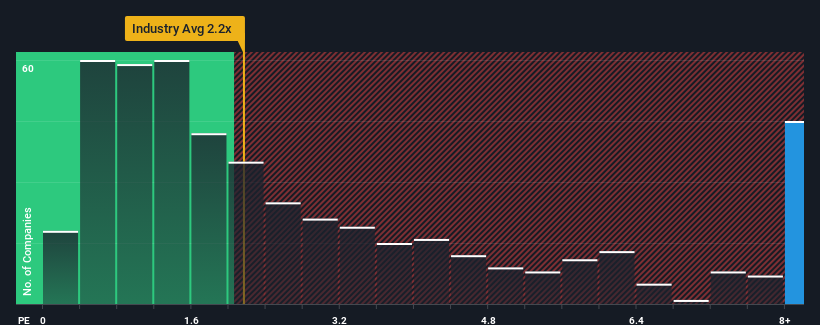

Suzhou Nanomicro Technology Co., Ltd.'s (SHSE:688690) price-to-sales (or "P/S") ratio of 15.4x may look like a poor investment opportunity when you consider close to half the companies in the Chemicals industry in China have P/S ratios below 2.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Suzhou Nanomicro Technology

How Suzhou Nanomicro Technology Has Been Performing

While the industry has experienced revenue growth lately, Suzhou Nanomicro Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Nanomicro Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Suzhou Nanomicro Technology?

The only time you'd be truly comfortable seeing a P/S as steep as Suzhou Nanomicro Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Even so, admirably revenue has lifted 186% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 44% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why Suzhou Nanomicro Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Suzhou Nanomicro Technology's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Suzhou Nanomicro Technology shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Suzhou Nanomicro Technology is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688690

Suzhou Nanomicro Technology

Manufactures and supplies spherical, mono-disperse particles for various industries and applications worldwide.

Flawless balance sheet with acceptable track record.