- Japan

- /

- Commercial Services

- /

- TSE:4666

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

In a week where major U.S. stock indexes hit record highs, growth stocks have notably outperformed value stocks, highlighting a strong investor appetite for companies with promising expansion potential. Amidst this backdrop of market divergence and economic updates, insider ownership can serve as a compelling indicator of confidence in a company's future prospects, making it an important factor to consider when evaluating growth investments.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27.9% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Anhui Huaheng Biotechnology (SHSE:688639)

Simply Wall St Growth Rating: ★★★★★★

Overview: Anhui Huaheng Biotechnology Co., Ltd. is involved in the development, production, and sale of amino acids and other organic acids both in China and internationally, with a market cap of CN¥8.48 billion.

Operations: The company's revenue from the Bio Manufacturing Industry segment amounts to CN¥2.11 billion.

Insider Ownership: 34.4%

Earnings Growth Forecast: 49.9% p.a.

Anhui Huaheng Biotechnology shows promising growth potential, with revenue expected to grow 33.5% annually, surpassing the CN market's average. Despite recent earnings declines, its price-to-earnings ratio of 28.2x suggests it trades at a good value compared to peers. The company recently raised CNY 683.81 million through a private placement, indicating solid financial backing for future expansion. However, profit margins have decreased and debt coverage by operating cash flow is inadequate, presenting some risks.

- Click here and access our complete growth analysis report to understand the dynamics of Anhui Huaheng Biotechnology.

- Our valuation report unveils the possibility Anhui Huaheng Biotechnology's shares may be trading at a discount.

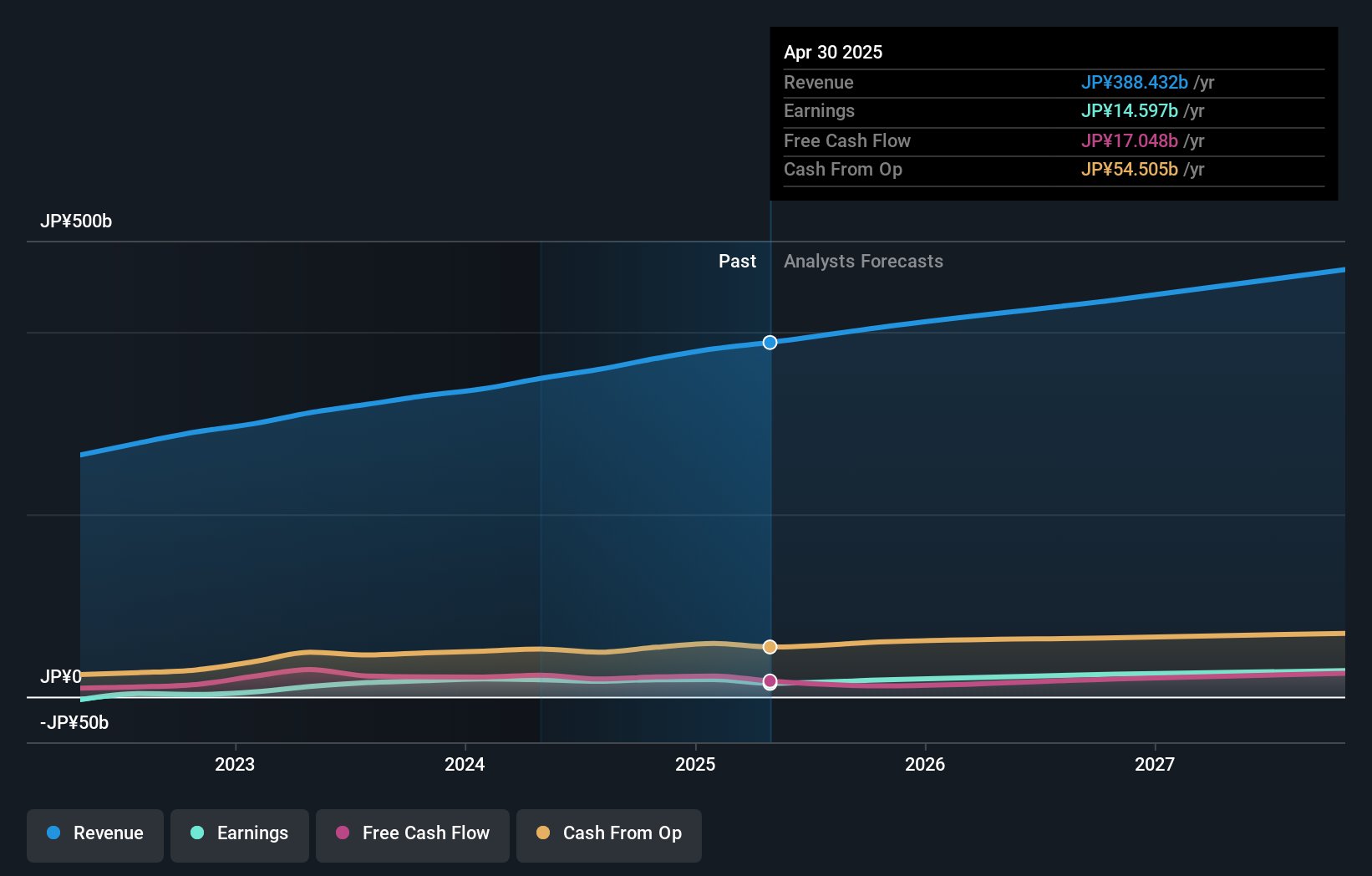

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacturing, wholesale, and retail of men's and women's clothing and accessories with a market cap of ¥283.48 billion.

Operations: The company generates revenue through the planning, manufacturing, wholesale, and retail of men's and women's clothing and accessories in Japan.

Insider Ownership: 10.9%

Earnings Growth Forecast: 11.9% p.a.

PAL GROUP Holdings demonstrates growth potential with earnings forecasted to rise 11.88% annually, outpacing the JP market's 7.9%. Revenue is expected to grow at 8.2% per year, higher than the market average but below high-growth benchmarks. Despite recent share price volatility, it trades at a discount of 18.9% to estimated fair value. The company projects JPY 209 billion in net sales for fiscal year ending February 2025, reflecting steady financial guidance amidst stable dividends.

- Click here to discover the nuances of PAL GROUP Holdings with our detailed analytical future growth report.

- Our valuation report here indicates PAL GROUP Holdings may be overvalued.

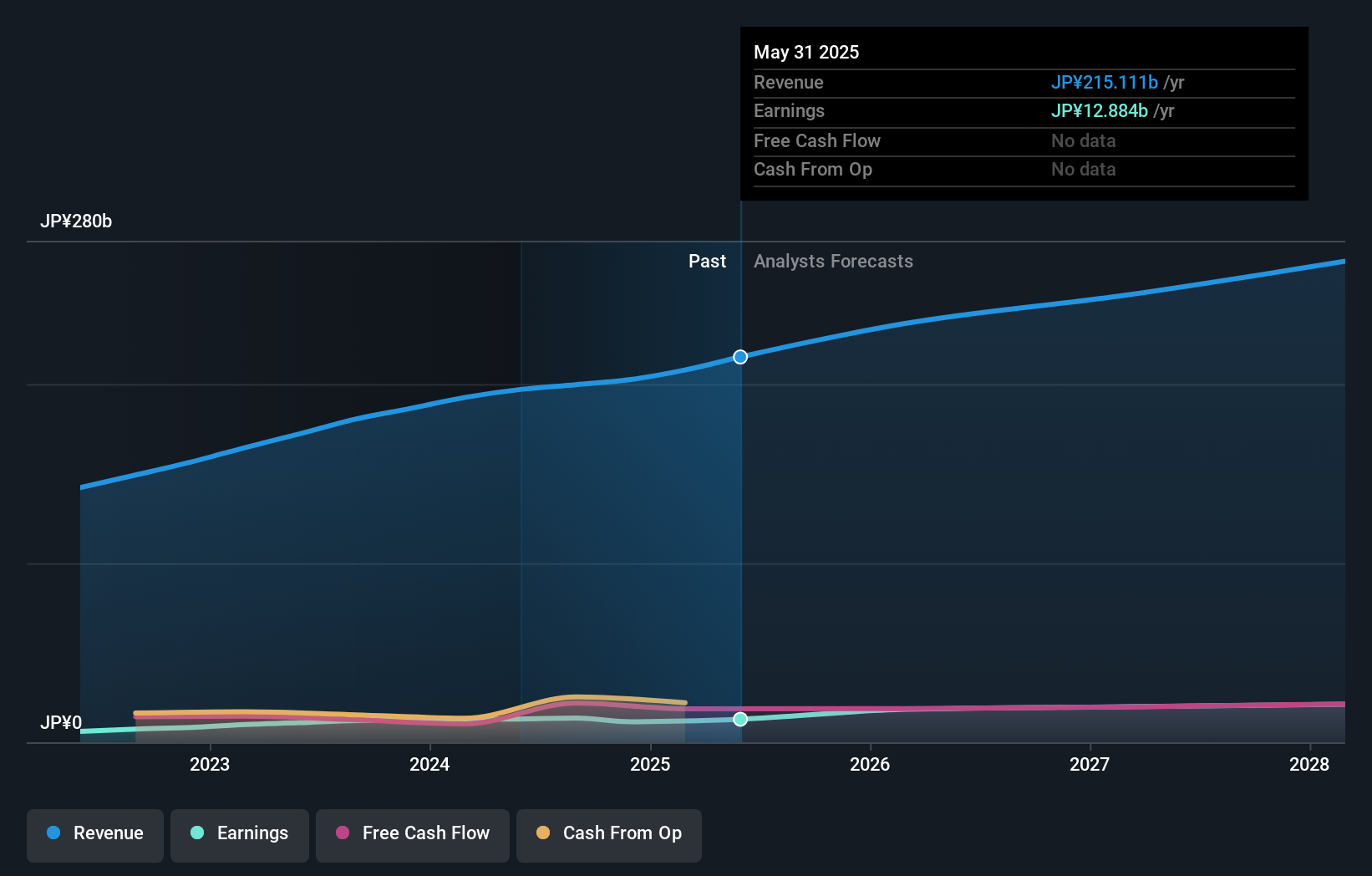

PARK24 (TSE:4666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PARK24 Co., Ltd. operates and manages parking facilities in Japan and internationally, with a market cap of ¥307.58 billion.

Operations: The company's revenue segments include the Mobility Business at ¥107.36 billion, Parking Lot Business in Japan at ¥178.06 billion, and Parking Lot Business Overseas at ¥79.23 billion.

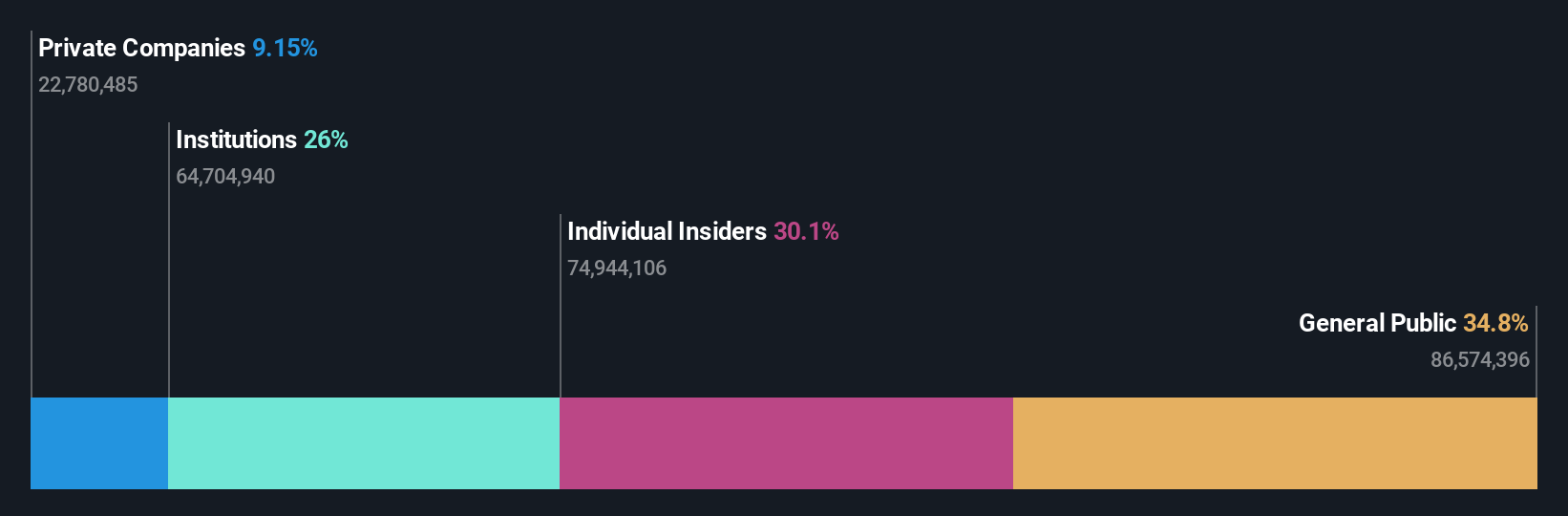

Insider Ownership: 10.5%

Earnings Growth Forecast: 16.3% p.a.

PARK24's earnings are projected to grow at 16.3% annually, surpassing the JP market average of 7.9%. Despite a slower revenue growth forecast of 5.7% per year, it remains above the market's 4.1%. The stock is trading at a significant discount of 26.3% below its estimated fair value, suggesting potential upside for investors. While there has been no substantial insider trading activity recently, high insider ownership may align management interests with shareholders'.

- Take a closer look at PARK24's potential here in our earnings growth report.

- The valuation report we've compiled suggests that PARK24's current price could be quite moderate.

Summing It All Up

- Embark on your investment journey to our 1513 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4666

PARK24

Operates and manages parking facilities in Japan and Internationally.

Reasonable growth potential and fair value.