Undiscovered Gems And 2 Other Promising Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the current landscape, global markets are experiencing fluctuations as rising U.S. Treasury yields weigh on stocks, with large-cap equities showing more resilience than their small-cap counterparts. The S&P 500 Index has seen a dip following a six-week rally, while economic indicators like the Fed's Beige Book suggest tepid growth and moderated inflation across the U.S., impacting market sentiment. In this environment, identifying promising stocks requires careful consideration of factors such as financial stability and growth potential within sectors that may be undervalued or overlooked by mainstream investors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.64% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi is a Turkish food company with a market capitalization of TRY37.51 billion.

Operations: Banvit generates revenue primarily from its food processing segment, which reported TRY22.03 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

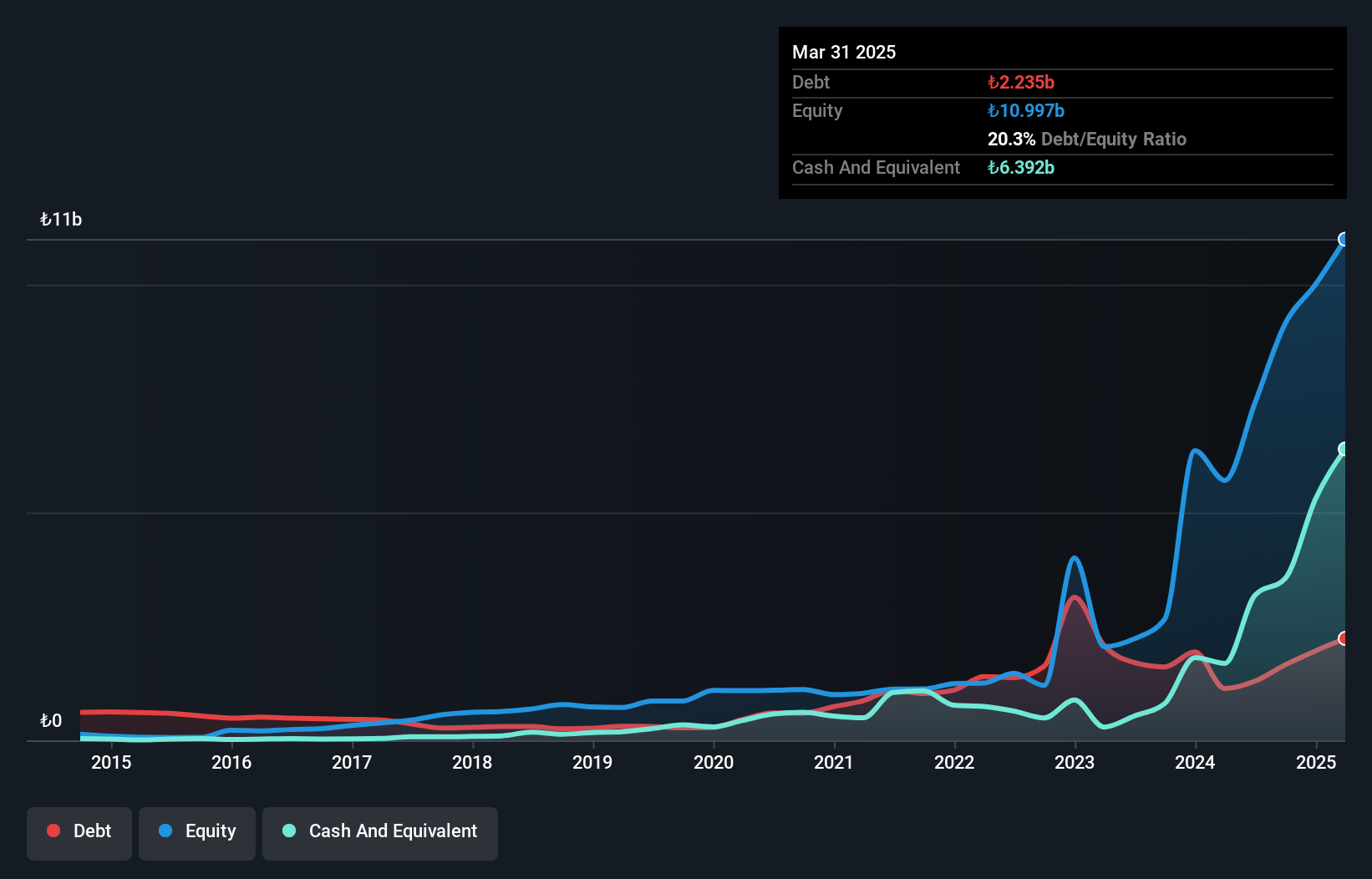

Banvit, a player in the food industry, has made significant strides in reducing its debt to equity ratio from 35.3% to 17.5% over five years, reflecting financial prudence. The company turned profitable recently, distinguishing itself from an industry that saw a -20.4% earnings growth last year. Despite high non-cash earnings and volatile share prices recently, Banvit's price-to-earnings ratio of 13.8x remains attractive compared to the TR market average of 14.9x. Recent earnings reports show robust performance with TRY 7 billion in sales for Q2 and net income soaring to TRY 1.19 billion from TRY 238 million last year.

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Skychem Technology Co., Ltd. focuses on the research, development, and manufacturing of electronic materials for industries such as printed circuit boards, semiconductors, and touch screens, with a market capitalization of CN¥5.43 billion.

Operations: Skychem Technology generates revenue primarily from the sale of electronic materials used in printed circuit boards, semiconductors, and touch screens. The company's net profit margin has shown variability over recent periods.

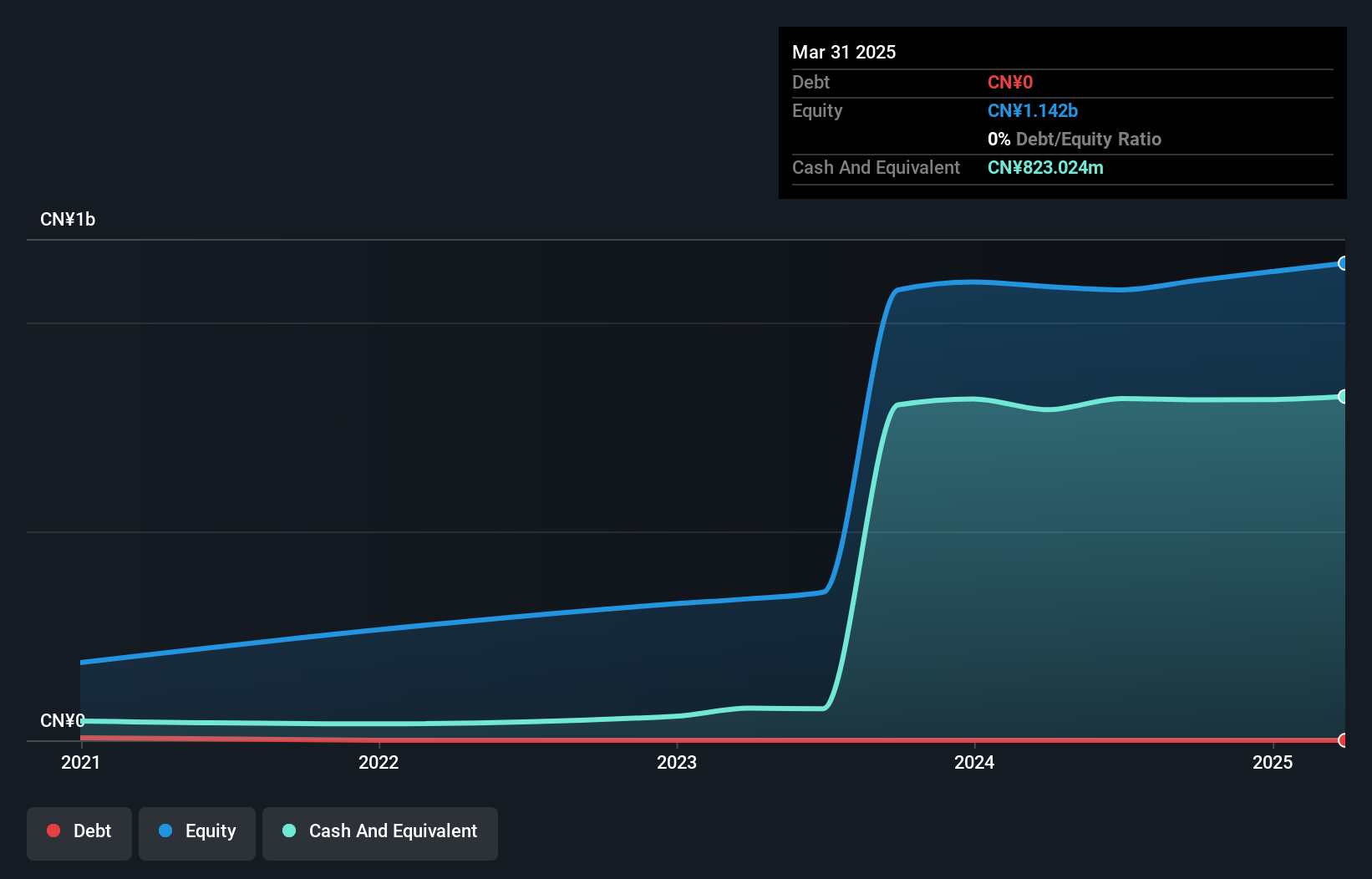

Guangdong Skychem Technology, a modestly-sized player in the chemicals industry, has shown promising financial health with no debt over the past five years and positive free cash flow. The company reported CNY 273.12 million in sales for the first nine months of 2024, up from CNY 247.1 million last year, while net income rose to CNY 57.17 million from CNY 41.65 million. Basic earnings per share improved to CNY 0.98 from CNY 0.89 a year ago, reflecting solid profitability amidst industry challenges where its earnings growth of 27% outpaced the sector's decline by nearly -5%.

- Delve into the full analysis health report here for a deeper understanding of Guangdong Skychem Technology.

Learn about Guangdong Skychem Technology's historical performance.

Jiangsu Yawei Machine Tool (SZSE:002559)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Yawei Machine Tool Co., Ltd. manufactures and sells metal forming machine tools in China and internationally, with a market cap of CN¥5.43 billion.

Operations: Jiangsu Yawei Machine Tool generates its revenue primarily from the sale of metal forming machine tools both domestically and internationally. The company has reported a net profit margin of 7.5%, indicating its efficiency in converting sales into actual profit.

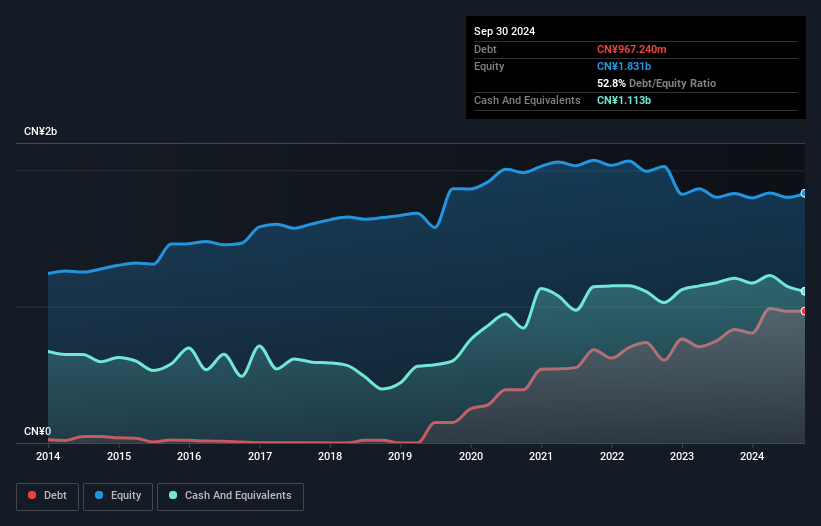

Jiangsu Yawei Machine Tool, a smaller player in the machinery sector, has shown an impressive earnings growth of 5296.9% over the past year, outpacing the industry average. Despite a notable one-off loss of CN¥29.1 million impacting recent financial results, the company remains profitable with more cash than total debt. Recent buyback activities saw 6.21 million shares repurchased for CN¥50.1 million to enhance long-term incentives and management enthusiasm. However, its debt-to-equity ratio has risen significantly from 8% to 52.8% over five years, which may warrant attention moving forward in its strategic planning efforts.

Summing It All Up

- Navigate through the entire inventory of 4732 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BANVT

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi

Operates as a food company in Turkey.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives