As global markets navigate a landscape of rising inflation and interest rate uncertainties, U.S. stock indexes are approaching record highs, with growth stocks leading the charge while small-cap stocks lag behind. In this environment, identifying promising small-cap companies can be particularly rewarding, as they may offer unique opportunities for growth that are not yet fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market cap of CN¥5.04 billion.

Operations: JPT Opto-Electronics generates revenue primarily from the computer communications and other electronic equipment segment, totaling CN¥1.39 billion.

Shenzhen JPT Opto-Electronics seems to be a promising player in the electronics sector, with its price-to-earnings ratio of 39.8x sitting comfortably below the industry average of 50.2x. The company has demonstrated robust earnings growth of 15.7% over the past year, outpacing the industry's modest 1.9%. Its debt-to-equity ratio has impressively decreased from 7.7% to just 2.8% over five years, reflecting prudent financial management and a strong cash position relative to total debt. Despite being dropped from the S&P Global BMI Index recently, its forecasted earnings growth at an impressive rate of 36% per year indicates potential for future value creation in this small-cap space.

- Take a closer look at Shenzhen JPT Opto-Electronics' potential here in our health report.

Understand Shenzhen JPT Opto-Electronics' track record by examining our Past report.

Hangzhou Toka InkLtd (SHSE:688571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Toka Ink Co., Ltd. focuses on the research, development, production, and sale of energy-saving and environmentally friendly ink products, digital materials, and functional materials with a market cap of CN¥3.40 billion.

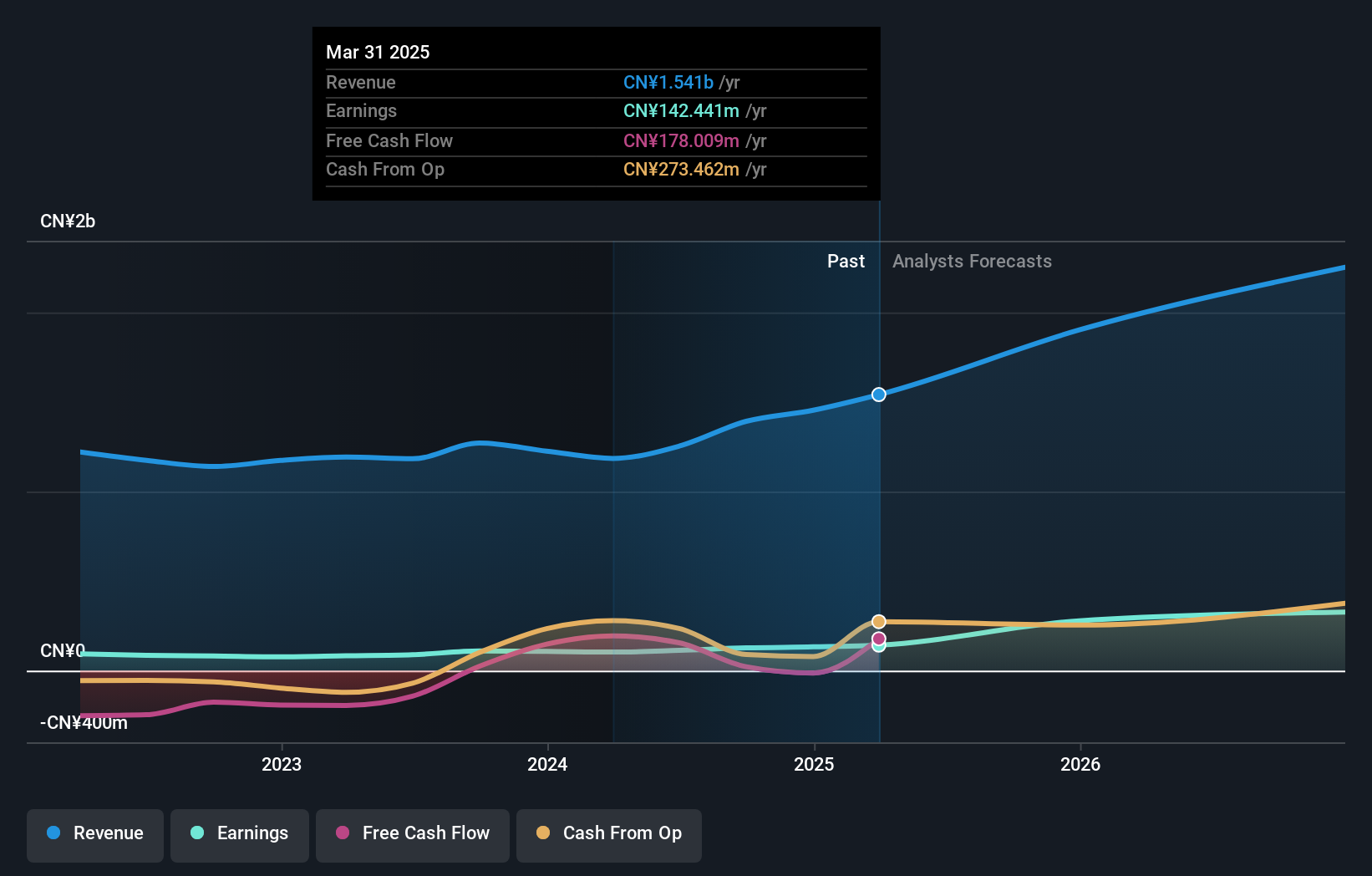

Operations: Hangzhou Toka Ink Co., Ltd. generates revenue primarily from the sale of ink products, digital materials, and functional materials. The company's net profit margin has shown variability over recent periods.

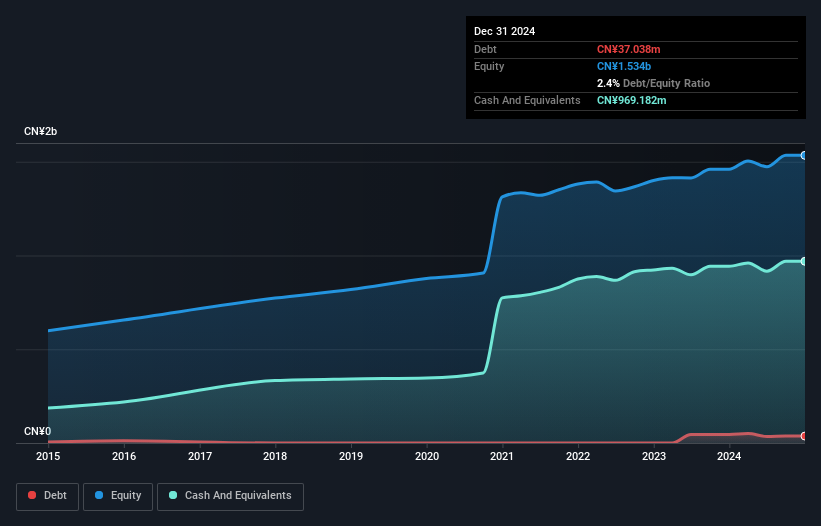

Hangzhou Toka Ink Ltd. has shown promising financial performance, with sales reaching CNY 1.27 billion, up from CNY 1.19 billion the previous year, and net income climbing to CNY 139 million from CNY 122.86 million. Basic earnings per share improved to CNY 0.34 from CNY 0.3, indicating solid growth in profitability. The company's debt-to-equity ratio increased slightly over five years to a modest 2.4%, yet its interest payments are well covered by EBIT at a robust multiple of over 106 times, showcasing strong operational efficiency and high-quality earnings that outpaced industry benchmarks last year by growing at an impressive rate of 13%.

- Delve into the full analysis health report here for a deeper understanding of Hangzhou Toka InkLtd.

Explore historical data to track Hangzhou Toka InkLtd's performance over time in our Past section.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Value Rating: ★★★★★★

Overview: NextVision Stabilized Systems, Ltd. specializes in the development, manufacturing, and marketing of stabilized day and night cameras for ground and aerial vehicles, with a market cap of ₪5.79 billion.

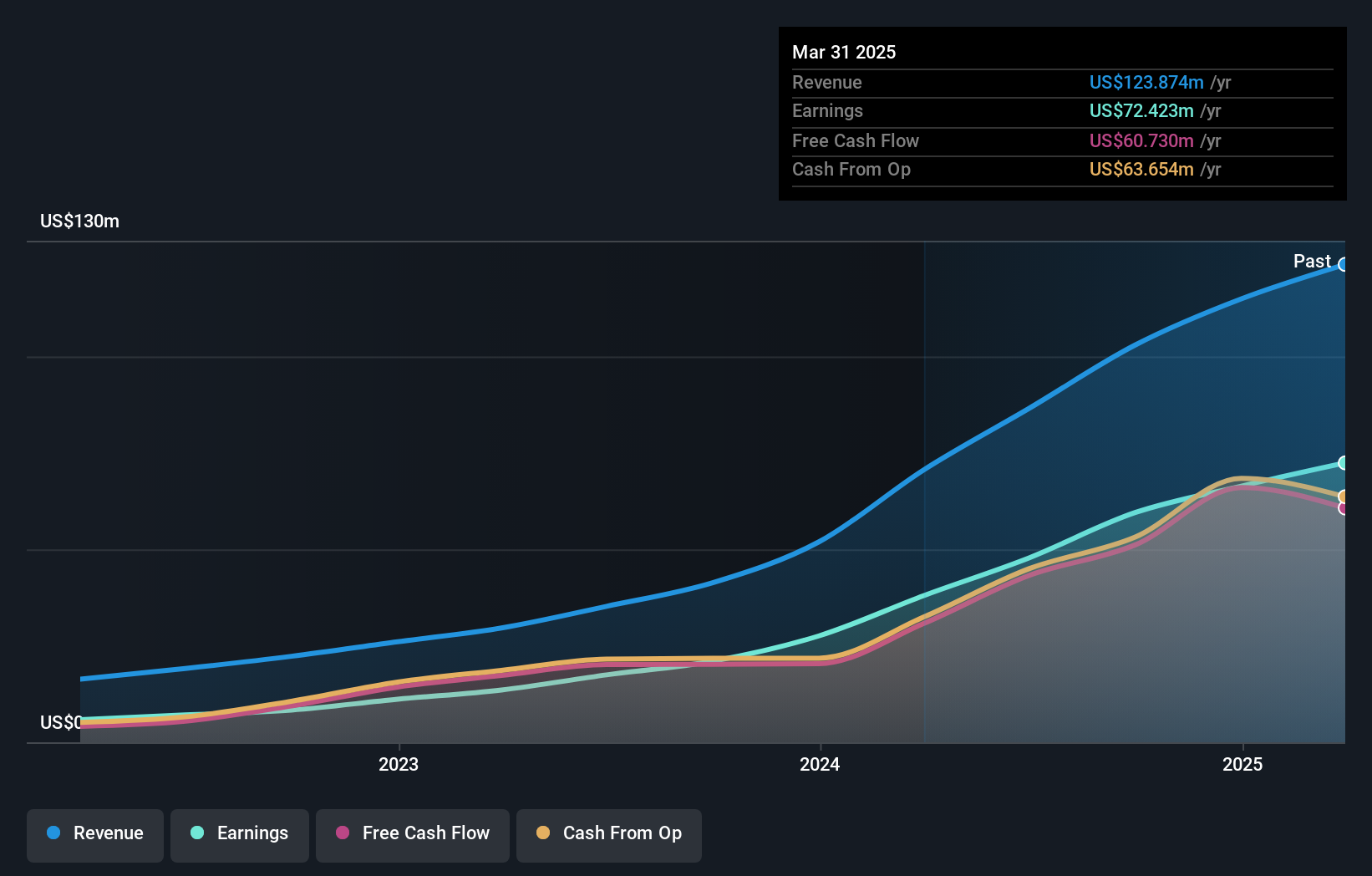

Operations: NextVision Stabilized Systems generates revenue primarily from its electronic security devices segment, totaling $102.97 million.

NextVision Stabilized Systems, a nimble player in the electronics sector, has shown impressive earnings growth of 183% over the past year, outpacing its industry. The company is trading at a notable 35.9% below its estimated fair value, suggesting potential undervaluation. With no debt on its books for five years and free cash flow consistently positive—reaching US$51.16 million recently—it seems well-positioned financially. However, investors should be aware of the highly volatile share price observed over recent months, which could impact short-term sentiment despite long-term prospects appearing promising given these fundamentals.

- Click here to discover the nuances of NextVision Stabilized Systems with our detailed analytical health report.

Learn about NextVision Stabilized Systems' historical performance.

Next Steps

- Investigate our full lineup of 4740 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Toka InkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688571

Hangzhou Toka InkLtd

Hangzhou Toka Ink Co., Ltd. engages in the research and development, produces, and sells energy-saving and environmentally friendly ink products, digital materials, and functional materials.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives