- Japan

- /

- Semiconductors

- /

- TSE:3436

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and near-record highs in major stock indexes, investors are keenly observing the potential impacts on monetary policy and trade negotiations. In this environment, identifying stocks that may be trading below their estimated value can offer opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.02 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96047.78 | 49.7% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

| Hindustan Foods (BSE:519126) | ₹572.85 | ₹1143.64 | 49.9% |

Here's a peek at a few of the choices from the screener.

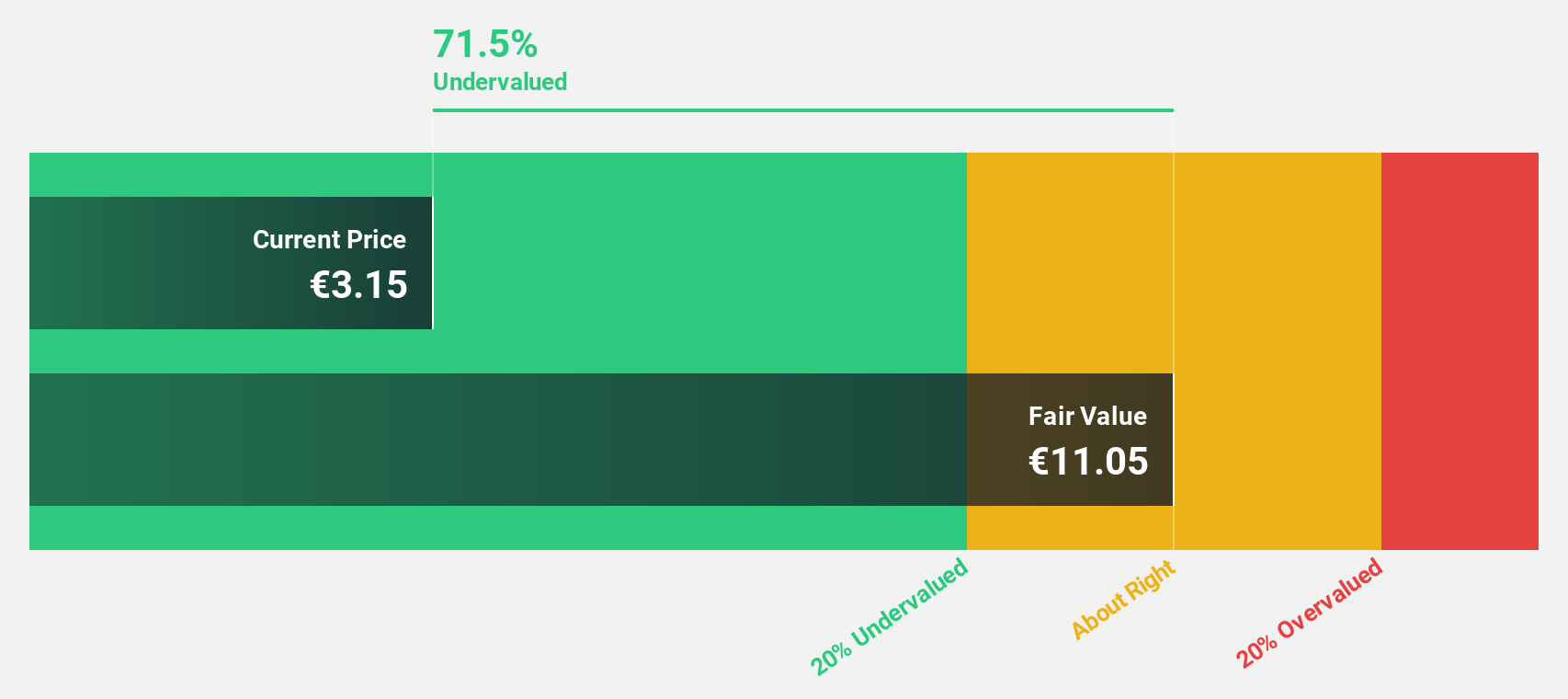

Metsä Board Oyj (HLSE:METSB)

Overview: Metsä Board Oyj operates in the global folding boxboard, fresh fibre linerboard, and market pulp sectors, with a market capitalization of €1.54 billion.

Operations: The company's revenue from its folding boxboard, fresh fibre linerboard, and market pulp sectors amounts to €1.94 billion.

Estimated Discount To Fair Value: 37.2%

Metsä Board Oyj, trading at €4.22, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of €6.72. Despite a recent net loss in Q4 2024 and reduced profit margins compared to the previous year, the company's earnings are forecasted to grow substantially by 39.67% annually over the next three years, outpacing both Finnish market revenue and profit growth rates. Recent strategic initiatives include potential product line changes at its Husum mill and operational efficiency improvements through downsizing efforts.

- Upon reviewing our latest growth report, Metsä Board Oyj's projected financial performance appears quite optimistic.

- Take a closer look at Metsä Board Oyj's balance sheet health here in our report.

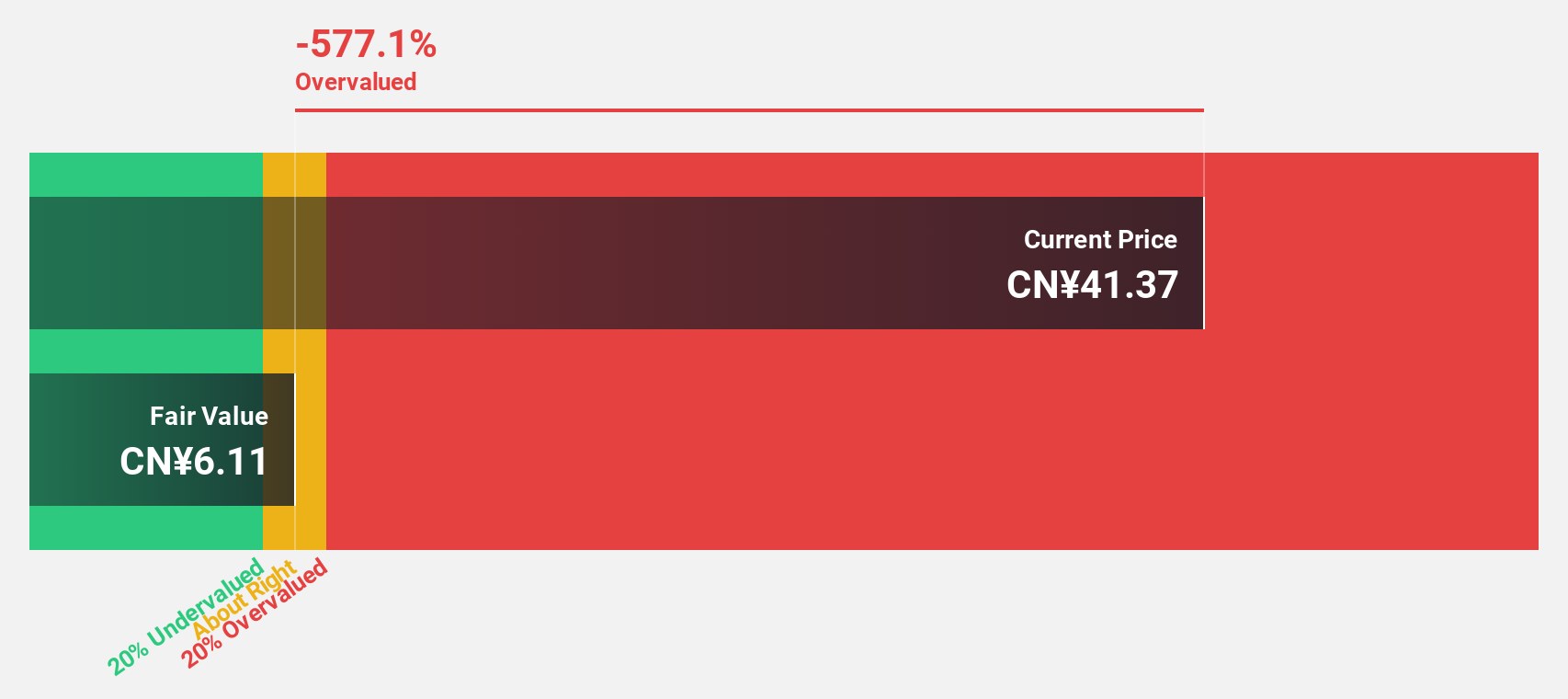

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates, with a market capitalization of approximately CN¥5.93 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, totaling CN¥1.37 billion.

Estimated Discount To Fair Value: 34.2%

Xi'an Manareco New Materials Ltd., trading at CN¥34.26, is significantly undervalued with a fair value of CN¥52.06 based on discounted cash flow analysis. Its earnings are forecast to grow significantly at 25% annually, outpacing the Chinese market's growth rate. Despite an unstable dividend track record and low future return on equity (10%), revenue is expected to grow at 23.9% per year, surpassing the market average of 13.3%.

- Our comprehensive growth report raises the possibility that Xi'an Manareco New MaterialsLtd is poised for substantial financial growth.

- Dive into the specifics of Xi'an Manareco New MaterialsLtd here with our thorough financial health report.

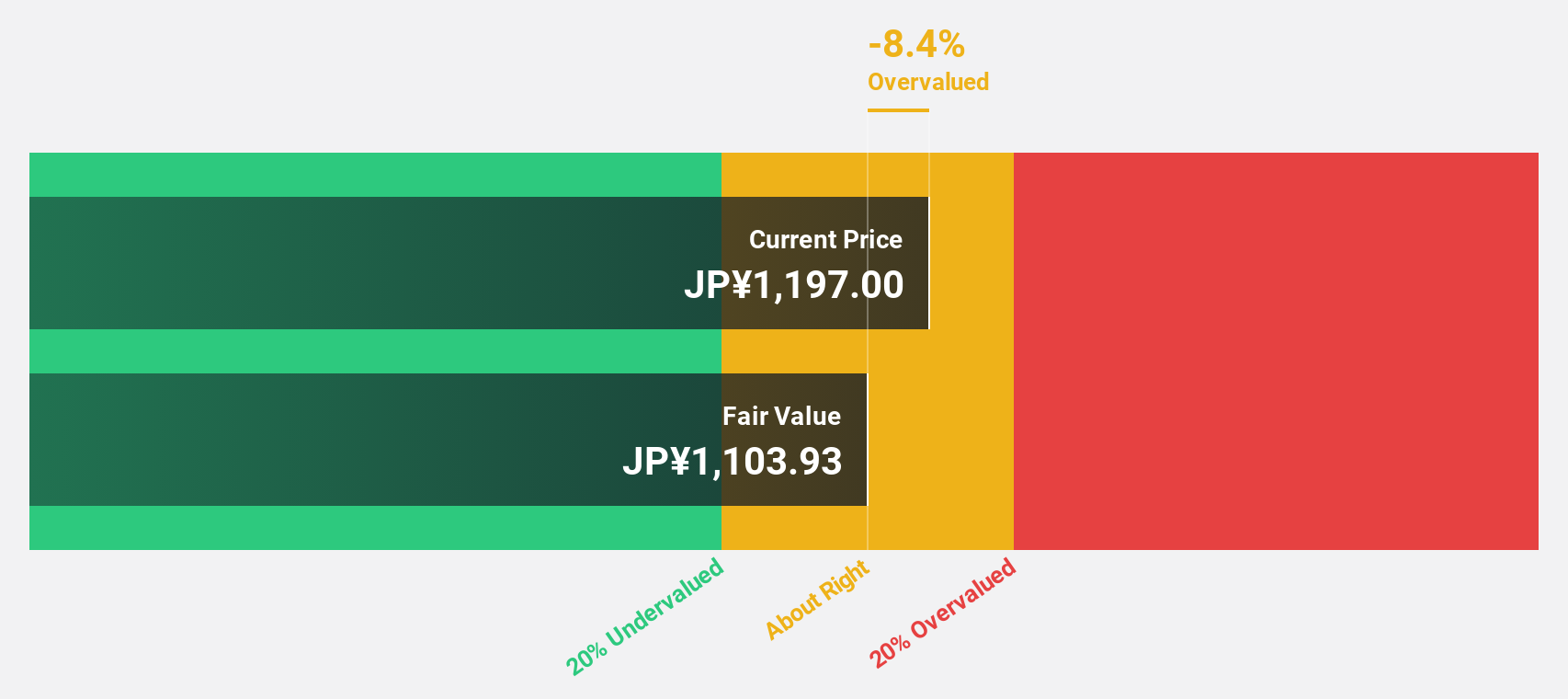

Sumco (TSE:3436)

Overview: Sumco Corporation manufactures and sells silicon wafers for the semiconductor industry across Japan, the United States, China, Taiwan, Korea, and internationally with a market cap of ¥407.41 billion.

Operations: Sumco Corporation generates revenue from the sale of crystalline silicon, amounting to ¥396.62 billion.

Estimated Discount To Fair Value: 21.3%

Sumco, trading at ¥1,165, is undervalued by over 20% compared to its fair value of ¥1,479.99. Earnings are projected to grow at 28.21% annually, outpacing the Japanese market's 8%. However, recent dividend cuts and a low return on equity forecast (9%) are concerns. Revenue growth of 8.3% per year exceeds the market's rate but remains below high-growth thresholds. Profit margins have decreased from last year’s levels amidst share price volatility and non-cash earnings issues.

- According our earnings growth report, there's an indication that Sumco might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Sumco.

Make It Happen

- Get an in-depth perspective on all 927 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3436

Sumco

Manufactures and sells silicon wafers for the semiconductor industry in Japan, the United States, China, Taiwan, Korea, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives