3 Stocks Estimated To Be Undervalued By Up To 41.6% Presenting A Unique Opportunity

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed economic signals, investors are keenly observing the performance of major indices, with the Nasdaq Composite reaching a new milestone despite broader market declines. Amidst these fluctuations, identifying undervalued stocks can present unique opportunities for investors seeking potential value in an evolving market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| UMB Financial (NasdaqGS:UMBF) | US$122.18 | US$244.23 | 50% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$46.49 | US$92.69 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.298 | €0.59 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.64 | A$9.16 | 49.3% |

| Equifax (NYSE:EFX) | US$265.81 | US$530.33 | 49.9% |

| QD Laser (TSE:6613) | ¥297.00 | ¥591.10 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.32 | €64.59 | 50% |

Let's dive into some prime choices out of the screener.

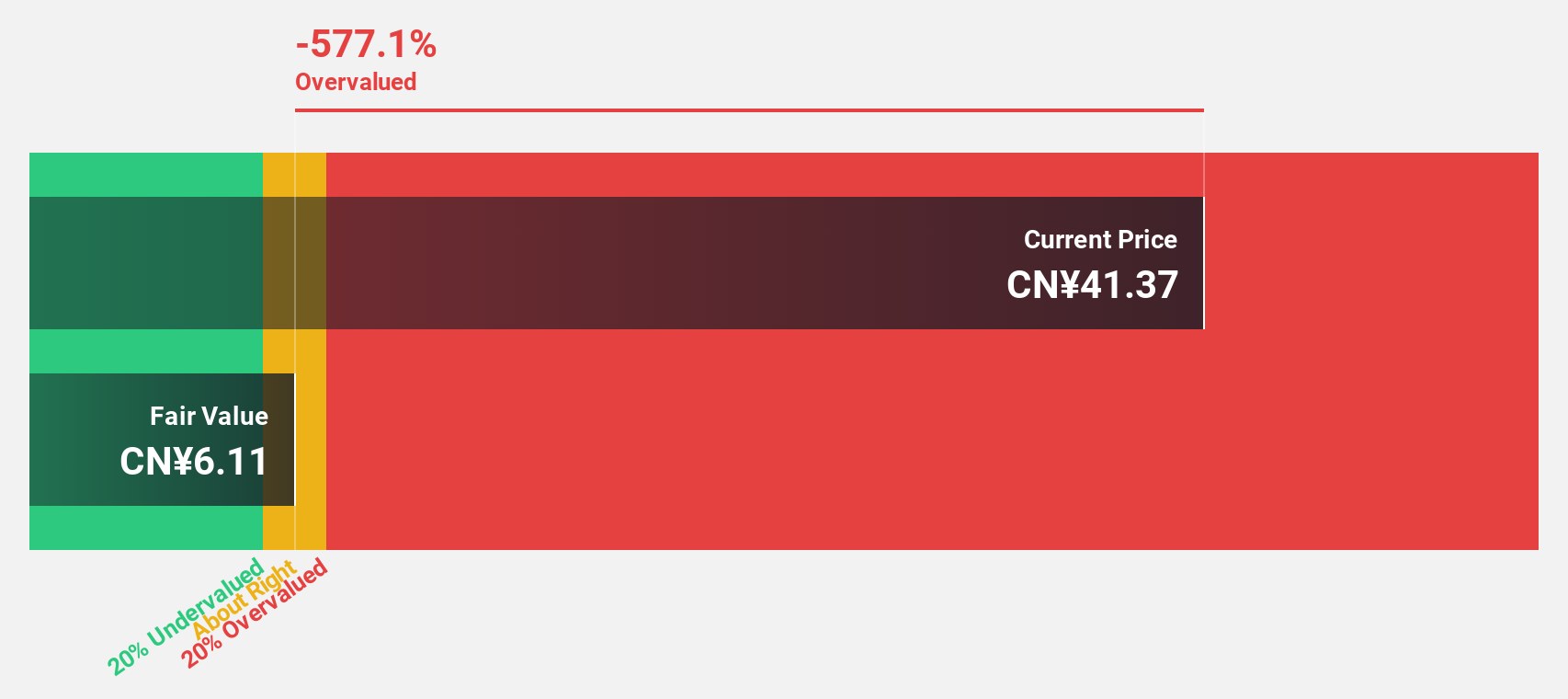

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates, with a market capitalization of CN¥5.65 billion.

Operations: The company generates revenue of CN¥1.37 billion from its specialty chemicals segment.

Estimated Discount To Fair Value: 41.6%

Xi'an Manareco New Materials Ltd. shows potential as an undervalued stock based on cash flows, trading at CN¥32.69, significantly below its estimated fair value of CN¥55.95. The company reported strong earnings growth with net income increasing to CN¥185.3 million for the first nine months of 2024 from CN¥98.06 million a year ago, and revenue rising to CNY 1.09 billion from CNY 931.98 million, reflecting robust financial performance despite an unstable dividend track record and modest future ROE projections.

- In light of our recent growth report, it seems possible that Xi'an Manareco New MaterialsLtd's financial performance will exceed current levels.

- Dive into the specifics of Xi'an Manareco New MaterialsLtd here with our thorough financial health report.

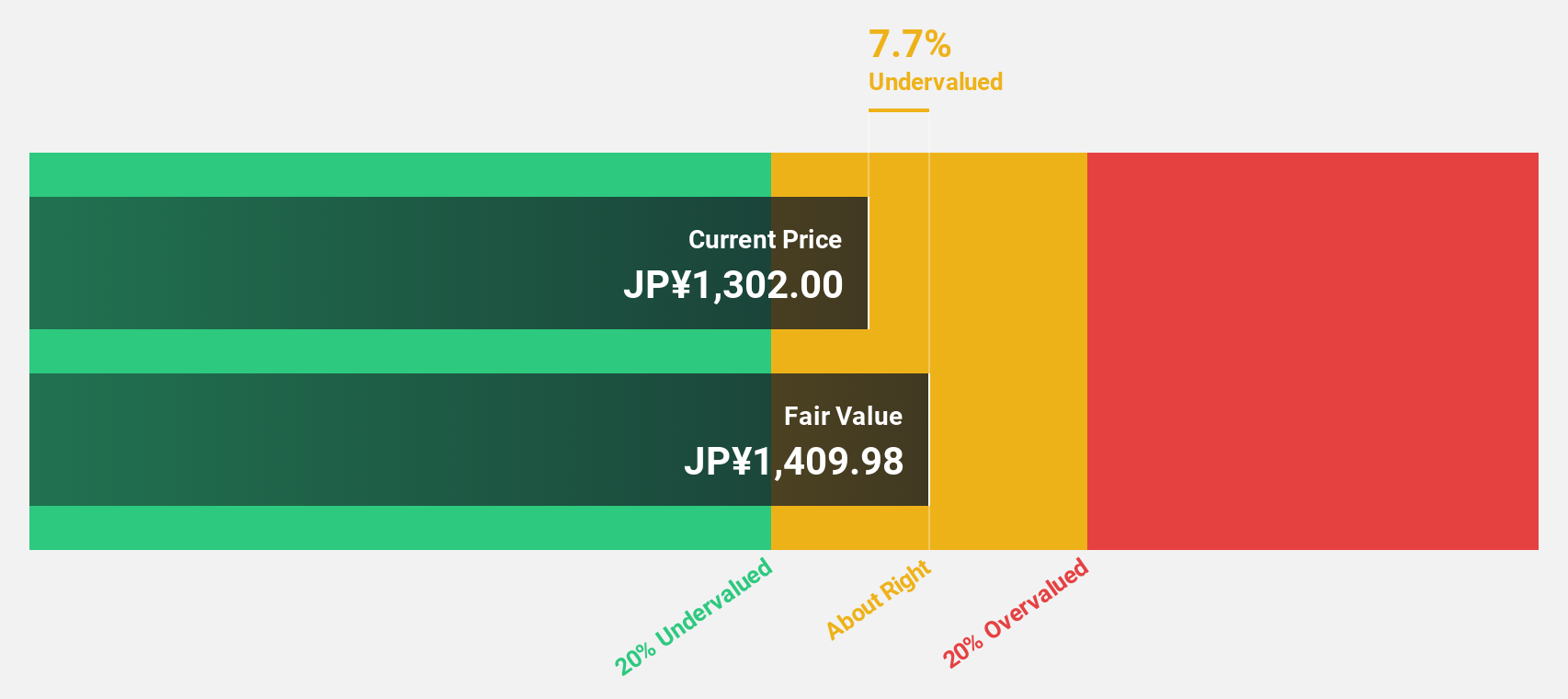

Nissha (TSE:7915)

Overview: Nissha Co., Ltd. operates in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics sectors both in Japan and internationally with a market cap of ¥75.44 billion.

Operations: The company's revenue segments consist of ¥73.12 billion from industrial materials, ¥67.26 billion from devices, and ¥43.39 billion from medical technology.

Estimated Discount To Fair Value: 25%

Nissha Co., Ltd. is trading at ¥1,575, below its estimated fair value of ¥2,100.91, suggesting it may be undervalued based on cash flows. Forecasted earnings growth of 27.7% annually outpaces the JP market's 7.9%. However, revenue growth remains modest at 4.1% per year with low future ROE projections of 7.1%. Recent share buybacks aim to enhance shareholder returns and capital efficiency by repurchasing up to ¥1 billion in shares by March 2025.

- Insights from our recent growth report point to a promising forecast for Nissha's business outlook.

- Take a closer look at Nissha's balance sheet health here in our report.

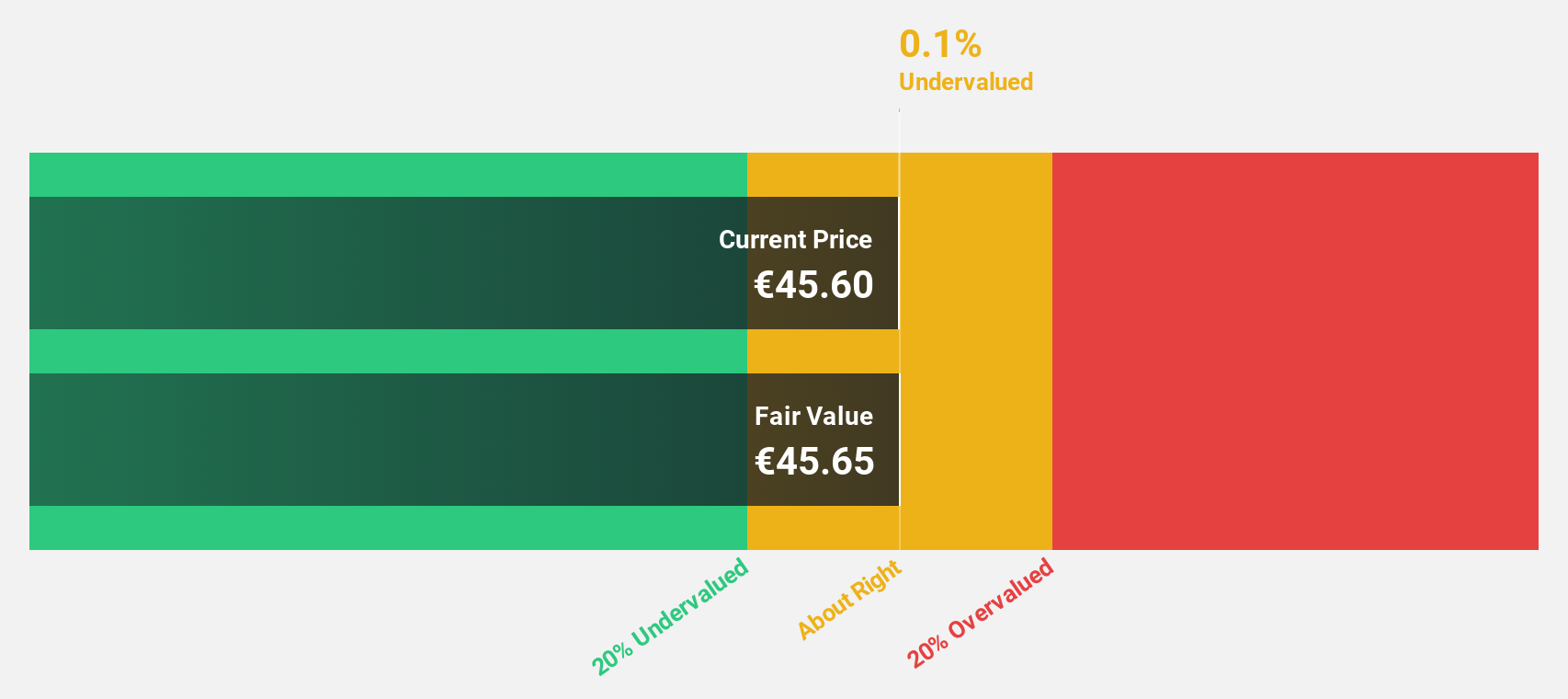

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of approximately €375.29 million.

Operations: The company's revenue is primarily derived from its Wireless Communications Equipment segment, which generated €245.89 million.

Estimated Discount To Fair Value: 21.2%

init innovation in traffic systems is trading at €38, below its estimated fair value of €48.2, highlighting potential undervaluation based on cash flows. Despite a slight dip in quarterly net income to €3.32 million, nine-month earnings rose significantly to €8.14 million from the previous year. Earnings are expected to grow 27.78% annually, outpacing the German market's 20.6%, although revenue growth is slower than 20% per year and dividend coverage by free cash flow remains inadequate.

- According our earnings growth report, there's an indication that init innovation in traffic systems might be ready to expand.

- Navigate through the intricacies of init innovation in traffic systems with our comprehensive financial health report here.

Make It Happen

- Click this link to deep-dive into the 909 companies within our Undervalued Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

Undervalued with high growth potential.