Rayitek Hi-Tech Film Company Ltd., Shenzhen (SHSE:688323) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

Rayitek Hi-Tech Film Company Ltd., Shenzhen (SHSE:688323) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

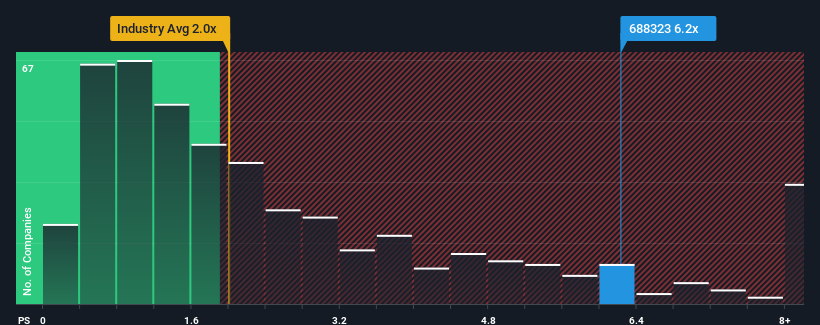

In spite of the heavy fall in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may still consider Rayitek Hi-Tech Film Company Shenzhen as a stock to avoid entirely with its 6.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Rayitek Hi-Tech Film Company Shenzhen

How Has Rayitek Hi-Tech Film Company Shenzhen Performed Recently?

With revenue growth that's superior to most other companies of late, Rayitek Hi-Tech Film Company Shenzhen has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Rayitek Hi-Tech Film Company Shenzhen will help you uncover what's on the horizon.How Is Rayitek Hi-Tech Film Company Shenzhen's Revenue Growth Trending?

In order to justify its P/S ratio, Rayitek Hi-Tech Film Company Shenzhen would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 7.6% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 23% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 75% as estimated by the two analysts watching the company. With the industry only predicted to deliver 23%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Rayitek Hi-Tech Film Company Shenzhen's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Rayitek Hi-Tech Film Company Shenzhen's P/S?

A significant share price dive has done very little to deflate Rayitek Hi-Tech Film Company Shenzhen's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Rayitek Hi-Tech Film Company Shenzhen's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Rayitek Hi-Tech Film Company Shenzhen, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688323

Rayitek Hi-Tech Film Company Shenzhen

Engages in the research and development, manufacture, service, and sale of PI films in China.

High growth potential with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.