Unveiling High Insider Ownership Growth Stocks On Chinese Exchange July 2024

Reviewed by Simply Wall St

As of July 2024, Chinese equities have experienced fluctuations, with recent underwhelming manufacturing data highlighting concerns about the economy's momentum. This backdrop sets a critical stage for investors looking at growth companies with high insider ownership, as these entities often demonstrate a strong alignment between management’s interests and shareholder value, potentially offering stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 38.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Goodwill E-Health Info (SHSE:688246)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. specializes in the research and development of medical information software in China, with a market capitalization of approximately CN¥2.74 billion.

Operations: The company primarily generates revenue from the development of medical information software in China.

Insider Ownership: 20.1%

Earnings Growth Forecast: 39.9% p.a.

Goodwill E-Health Info, despite its recent drop from the S&P Global BMI Index, shows promising growth prospects in China's healthcare sector. The company's earnings are expected to grow by 39.9% annually, outpacing both the industry and broader market forecasts significantly. Revenue growth is also strong at 22.4% per year. However, its return on equity is projected to remain low at 7.3%. These factors highlight a mixed yet optimistic outlook for Goodwill E-Health Info as a growth-oriented firm with substantial insider ownership.

- Get an in-depth perspective on Goodwill E-Health Info's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Goodwill E-Health Info shares in the market.

China Catalyst Holding (SHSE:688267)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Catalyst Holding Co., Ltd. operates in the research, development, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both domestically and internationally, with a market capitalization of approximately CN¥3.38 billion.

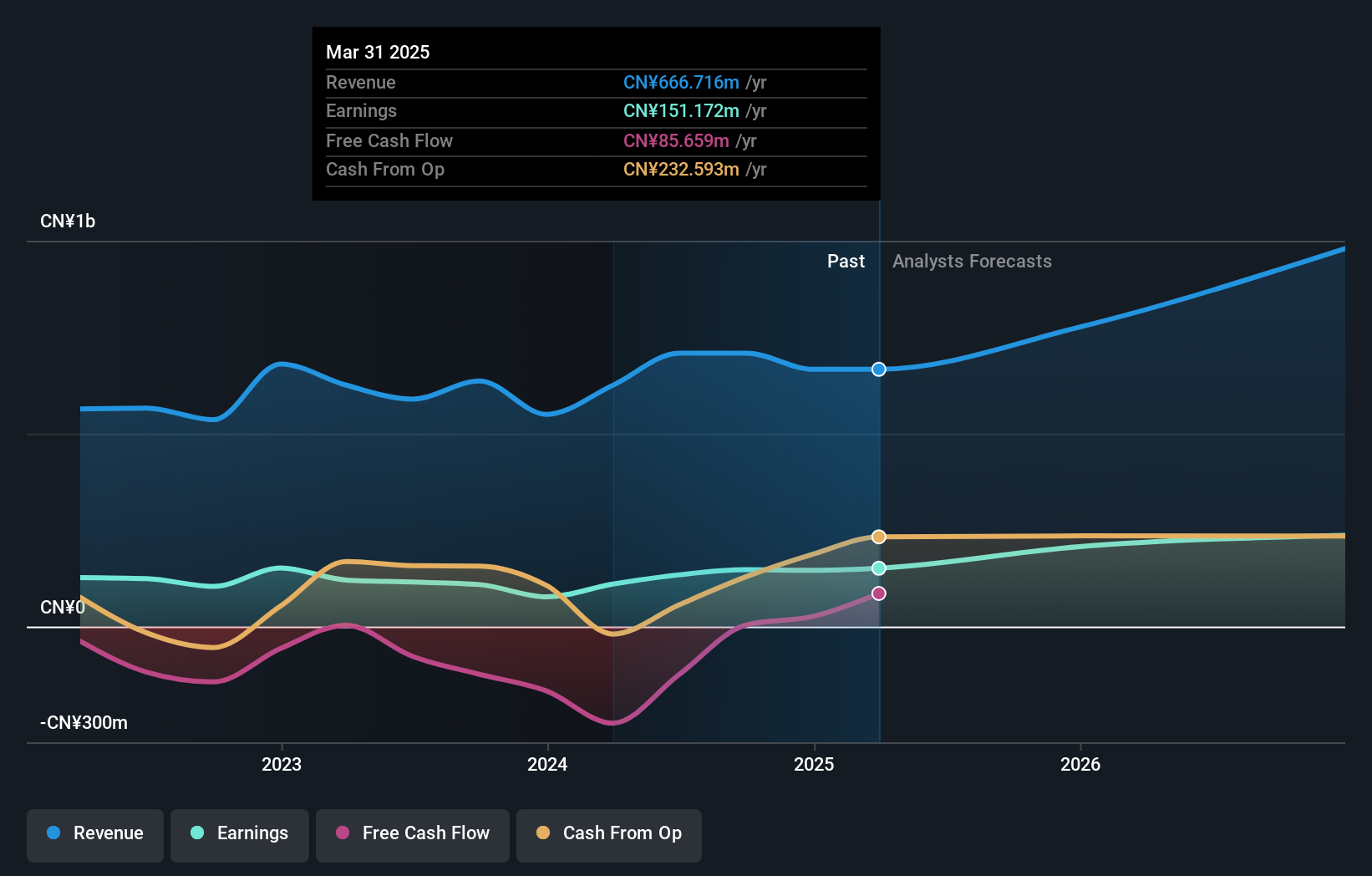

Operations: The company generates revenue primarily through its chemical reagent and auxiliary manufacturing segment, which accounted for CN¥625.39 million.

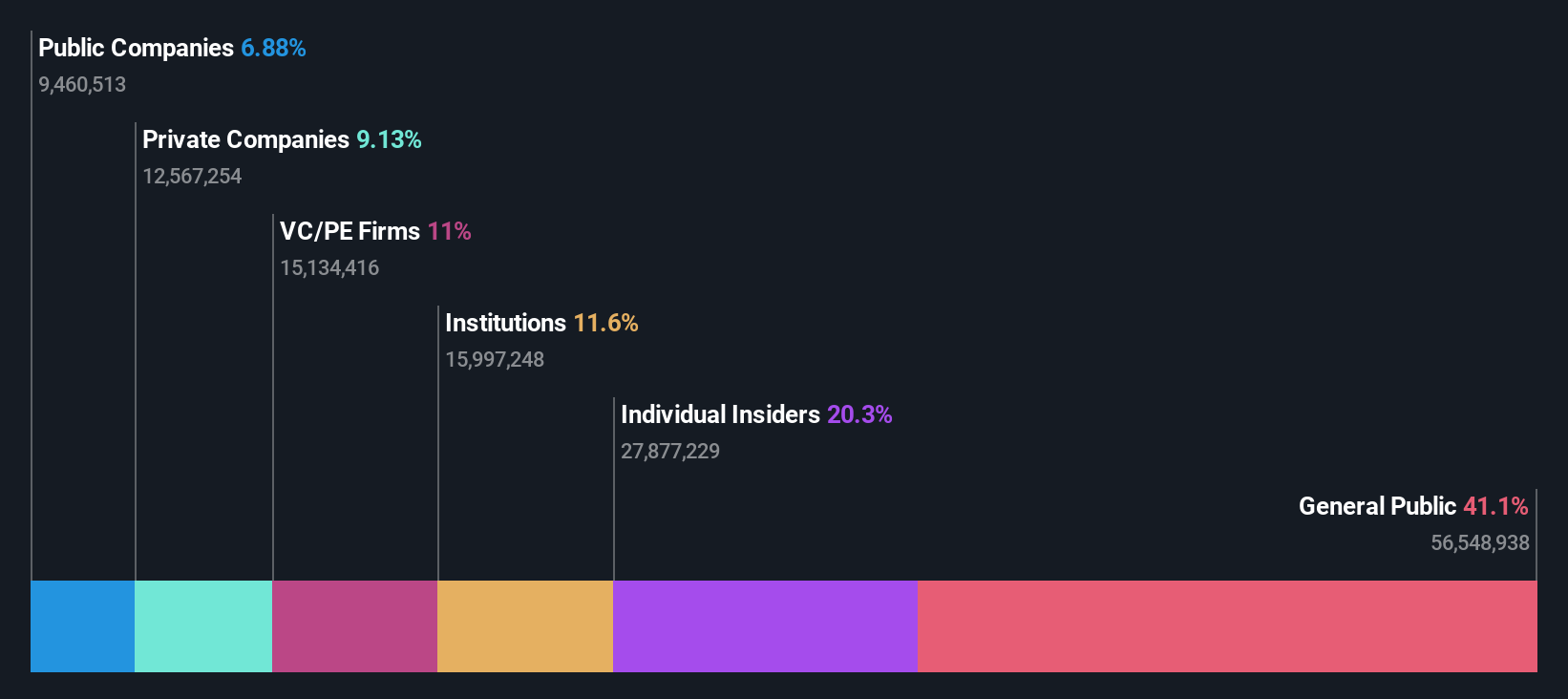

Insider Ownership: 31.7%

Earnings Growth Forecast: 23% p.a.

China Catalyst Holding has demonstrated robust growth with a significant increase in quarterly revenue and net income, rising from CNY 123.41 million to CNY 198.92 million and CNY 2.05 million to CNY 35.07 million respectively. Earnings per share also saw substantial growth from CNY 0.01 to CNY 0.2. Despite these gains, its forecasted return on equity remains low at 6.1%. Additionally, the company's dividend coverage by cash flows appears weak, suggesting potential sustainability issues for payouts.

- Unlock comprehensive insights into our analysis of China Catalyst Holding stock in this growth report.

- Our valuation report here indicates China Catalyst Holding may be overvalued.

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MCLON JEWELLERY Co., Ltd. operates as a jewelry retailer in China and internationally, with a market capitalization of approximately CN¥2.29 billion.

Operations: The company generates revenue through jewelry retail operations both domestically and globally.

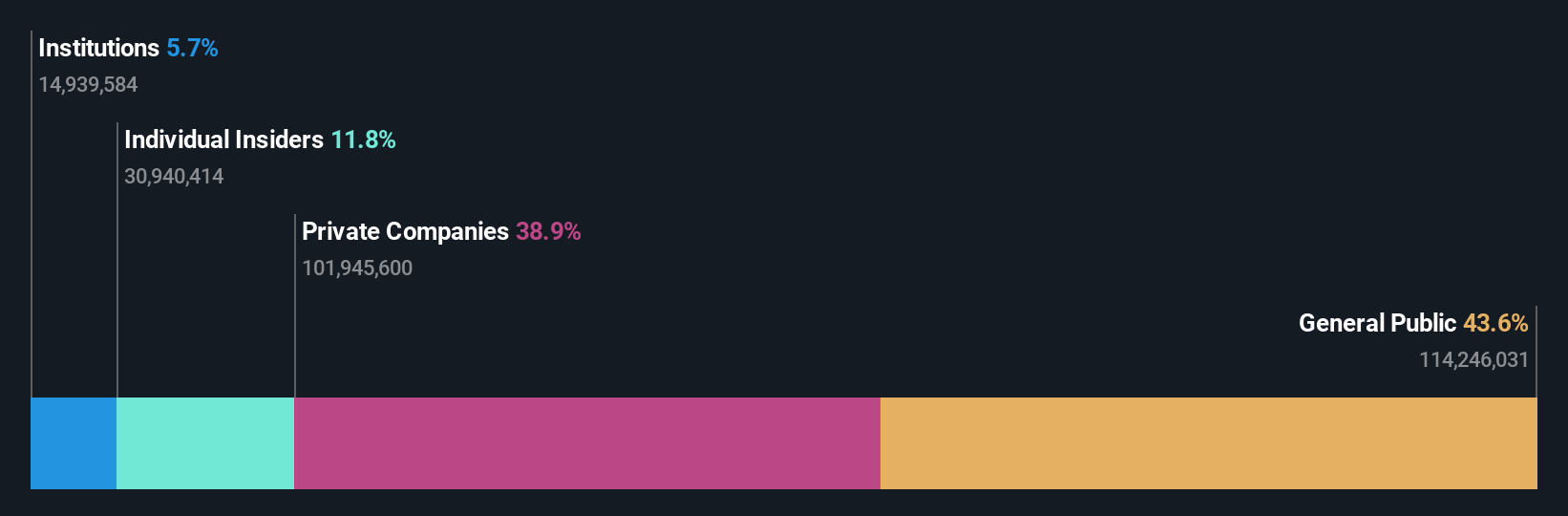

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.8% p.a.

MCLON JEWELLERY Ltd., while experiencing highly volatile share prices, has shown promising growth with a 42.1% earnings increase over the past year and an expected 20.8% annual growth rate, albeit slightly below the broader Chinese market's 22.1%. Its revenue growth at 23.4% annually surpasses the market average of 13.6%. However, shareholder dilution occurred last year and its dividend track record remains unstable despite recent dividend increases, reflecting a mixed financial discipline outlook.

- Click here to discover the nuances of MCLON JEWELLERYLtd with our detailed analytical future growth report.

- Our valuation report unveils the possibility MCLON JEWELLERYLtd's shares may be trading at a premium.

Where To Now?

- Explore the 367 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688267

China Catalyst Holding

Engages in the research and development, production, and sale of zeolite catalyst, customized process package solutions, and fine chemicals in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives