As global markets navigate the pressures of rising U.S. Treasury yields, growth stocks have shown resilience, particularly in the tech-heavy Nasdaq Composite Index, which managed slight gains despite broader market declines. In this environment of cautious optimism and moderated inflation expectations, companies with high insider ownership can be appealing due to their potential alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning business, with a market cap of approximately HK$29.08 billion.

Operations: The company generates revenue from its Cloud Service Business, which accounts for CN¥4.86 billion, and its ERP Business and Others, contributing CN¥1.13 billion.

Insider Ownership: 19.9%

Kingdee International Software Group is experiencing robust growth, with earnings expected to increase by 45.24% annually and revenue projected to grow at 14% per year, outpacing the Hong Kong market average. Despite this positive outlook, the company has seen shareholder dilution over the past year and currently trades significantly below its estimated fair value. Recent financial results show improved sales of CNY 2.87 billion and a reduced net loss compared to last year, indicating progress towards profitability within three years.

- Navigate through the intricacies of Kingdee International Software Group with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Kingdee International Software Group's current price could be quite moderate.

China Catalyst Holding (SHSE:688267)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Catalyst Holding Co., Ltd. specializes in the R&D, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both domestically and internationally, with a market cap of CN¥3.56 billion.

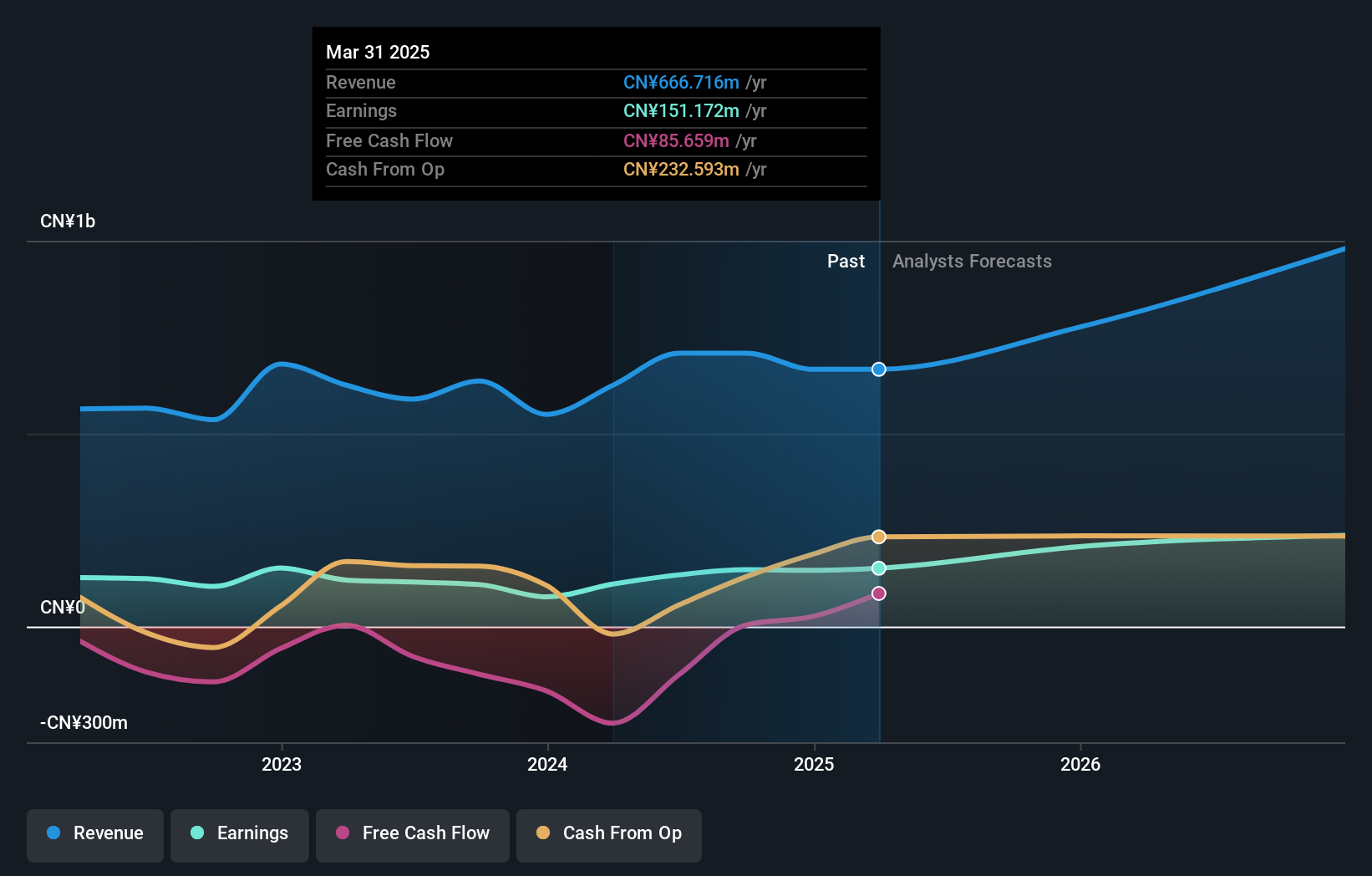

Operations: The company generates revenue from its Chemical Reagent and Auxiliary Manufacturing segment, amounting to CN¥708.63 million.

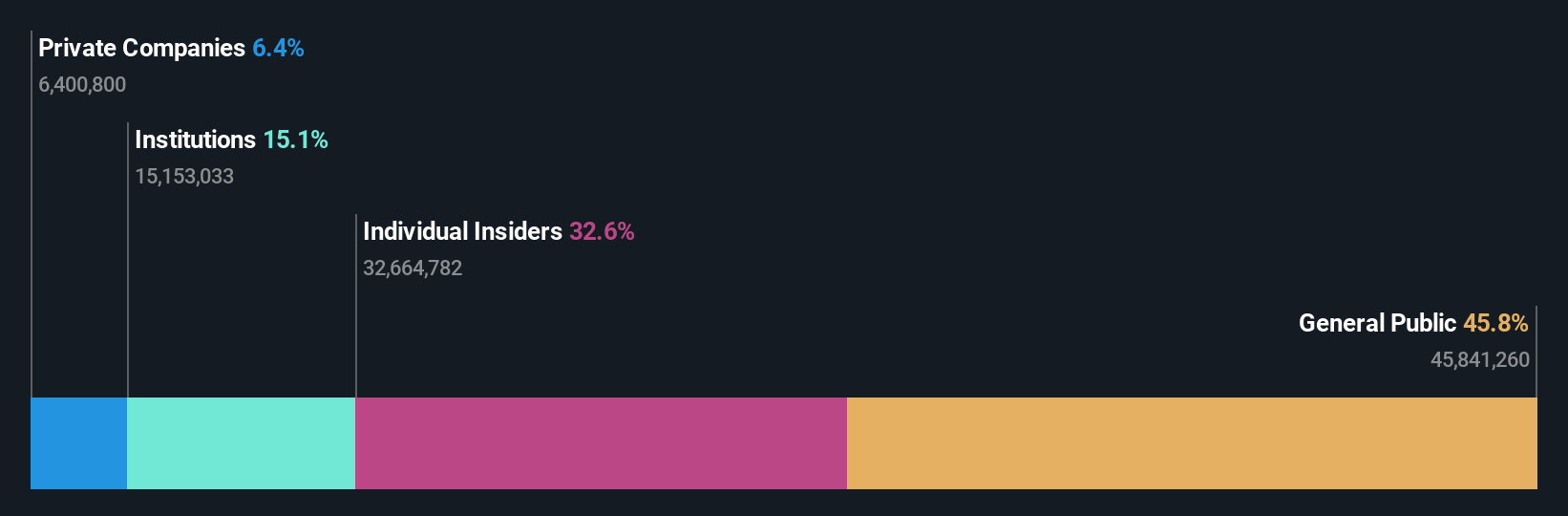

Insider Ownership: 31.5%

China Catalyst Holding shows strong growth potential, with revenue forecasted to grow at 24.9% annually, surpassing the Chinese market average of 13.9%. Recent earnings reports highlight significant improvements, with sales reaching CNY 523.1 million and net income rising to CNY 113.66 million for the nine months ending September 2024. However, its return on equity is expected to remain low at 7.3%, and its dividend coverage is weak, posing challenges despite trading below market P/E ratios.

- Take a closer look at China Catalyst Holding's potential here in our earnings growth report.

- Our valuation report here indicates China Catalyst Holding may be undervalued.

Luoyang Jianlong Micro-nano New Material (SHSE:688357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Luoyang Jianlong Micro-nano New Material Co., Ltd is a Chinese company that manufactures and sells molecular sieves, with a market cap of CN¥2.39 billion.

Operations: Luoyang Jianlong Micro-nano New Material Co., Ltd generates its revenue primarily from the manufacturing and sale of molecular sieves in China.

Insider Ownership: 24.3%

Luoyang Jianlong Micro-nano New Material is poised for growth, with revenue expected to increase by 24.1% annually, outpacing the Chinese market's 13.9%. Despite a drop in recent earnings—sales fell to CNY 565.68 million and net income to CNY 60.53 million for the nine months ending September 2024—the company's earnings are projected to grow significantly at 35% per year. However, profit margins have decreased, and dividend coverage remains weak despite a favorable P/E ratio of 31.3x compared to the market's average of 34x.

- Get an in-depth perspective on Luoyang Jianlong Micro-nano New Material's performance by reading our analyst estimates report here.

- Our valuation report here indicates Luoyang Jianlong Micro-nano New Material may be overvalued.

Taking Advantage

- Discover the full array of 1530 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688267

China Catalyst Holding

Engages in the research and development, production, and sale of zeolite catalyst, customized process package solutions, and fine chemicals in China and internationally.

Flawless balance sheet with solid track record.