- China

- /

- Semiconductors

- /

- SZSE:002119

Undiscovered Gems With Strong Fundamentals For October 2024

Reviewed by Simply Wall St

As global markets face the pressure of rising U.S. Treasury yields, small-cap stocks are experiencing heightened volatility compared to their large-cap counterparts, with indices like the Russell 2000 showing notable declines. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking resilience and potential growth amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhuzhou Smelter GroupLtd (SHSE:600961)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhuzhou Smelter Group Co., Ltd. is a Chinese company engaged in the production and sale of lead, zinc, and alloy products, with a market capitalization of approximately CN¥9.49 billion.

Operations: Zhuzhou Smelter Group generates revenue primarily from its lead and zinc products, amounting to CN¥18.99 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into profitability trends over time.

Zhuzhou Smelter Group, a small cap player in the metals and mining sector, showcases robust financial health with a reduced debt to equity ratio of 46.7% from 607.8% over five years. Despite sales dipping slightly to CNY 14.39 billion from CNY 14.81 billion year-on-year, net income rose to CNY 581.72 million compared to last year's CNY 531.01 million, reflecting high-quality earnings and profitability that cover interest payments comfortably at a rate of 43 times EBIT. Trading at a price-to-earnings ratio of 14.6x against the market's average of 34x suggests it offers good value relative to peers and industry standards.

- Navigate through the intricacies of Zhuzhou Smelter GroupLtd with our comprehensive health report here.

Understand Zhuzhou Smelter GroupLtd's track record by examining our Past report.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China, with a market cap of CN¥8.79 billion.

Operations: The company generates revenue primarily from aircraft airborne equipment maintenance services. It has a market cap of CN¥8.79 billion, reflecting its scale in the industry.

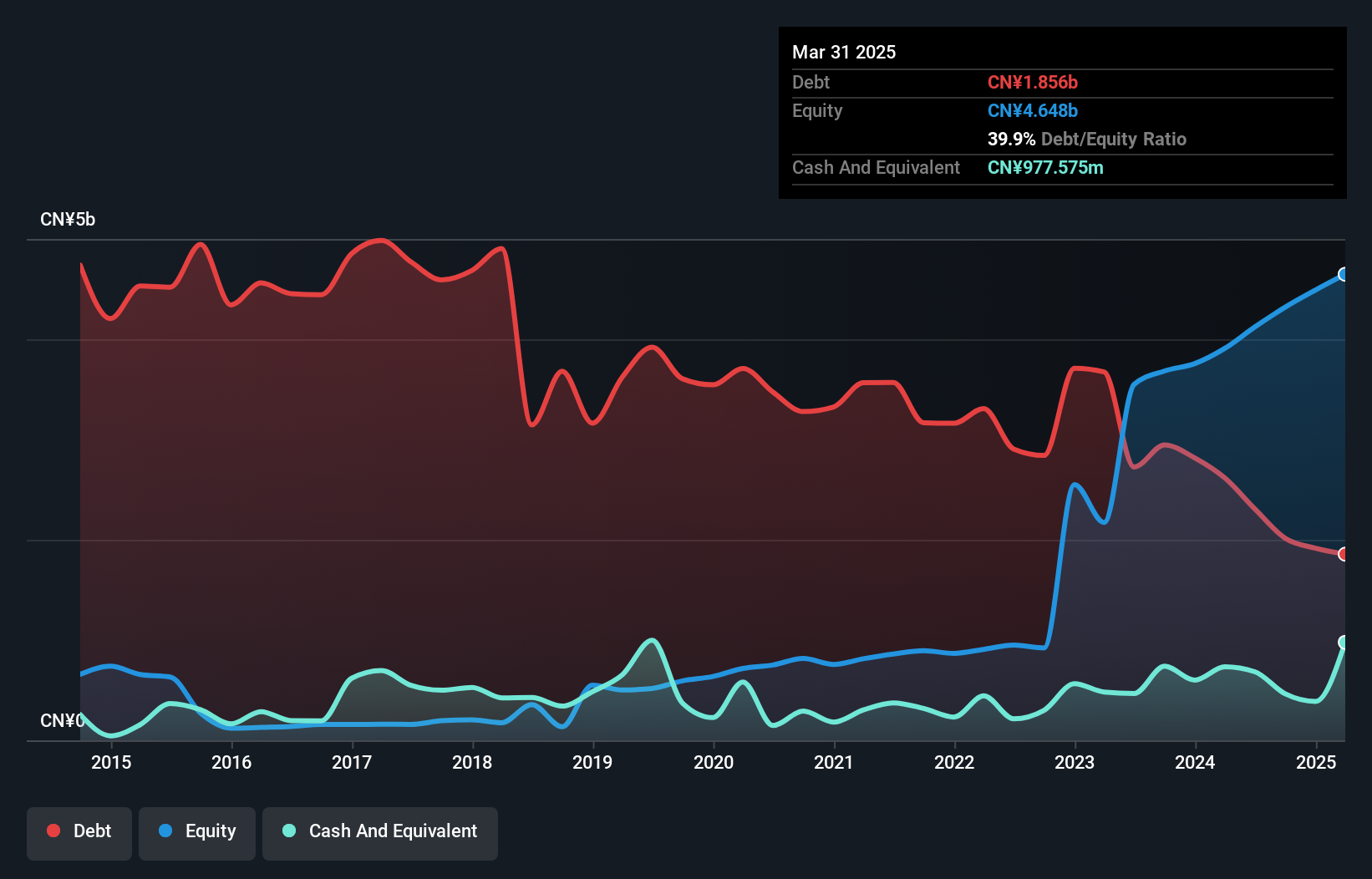

Sichuan Haite High-tech has shown impressive growth, with earnings surging 139% over the past year, significantly outpacing the infrastructure industry's 4%. The company's net income for the first nine months of 2024 reached CNY 61.9 million, up from CNY 33.3 million last year, reflecting its robust performance. Basic earnings per share rose to CNY 0.0835 from CNY 0.045 a year ago, indicating improved profitability. Despite not fully covering interest payments with EBIT at a coverage ratio of only 2.2x, Haite's debt-to-equity ratio has decreased from 57.9% to a more manageable level of 49.9% over five years.

- Dive into the specifics of Sichuan Haite High-techLtd here with our thorough health report.

Learn about Sichuan Haite High-techLtd's historical performance.

Ningbo Kangqiang Electronics (SZSE:002119)

Simply Wall St Value Rating: ★★★★★☆

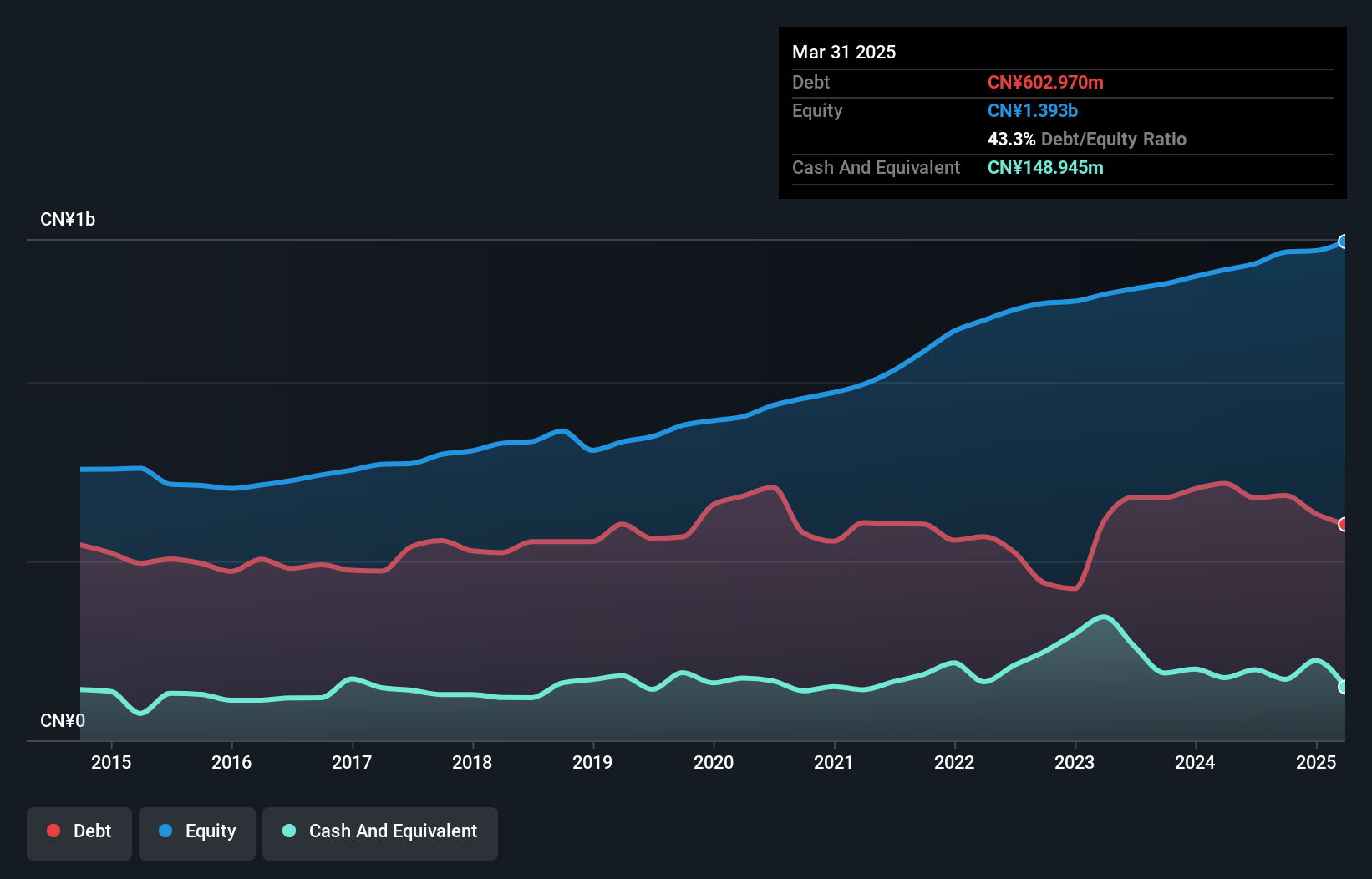

Overview: Ningbo Kangqiang Electronics Co., Ltd, along with its subsidiaries, focuses on the production and sale of semiconductor packaging materials in China and has a market cap of CN¥5.46 billion.

Operations: The company generates revenue primarily from the sale of semiconductor packaging materials. It has a market capitalization of CN¥5.46 billion, indicating its scale within the industry.

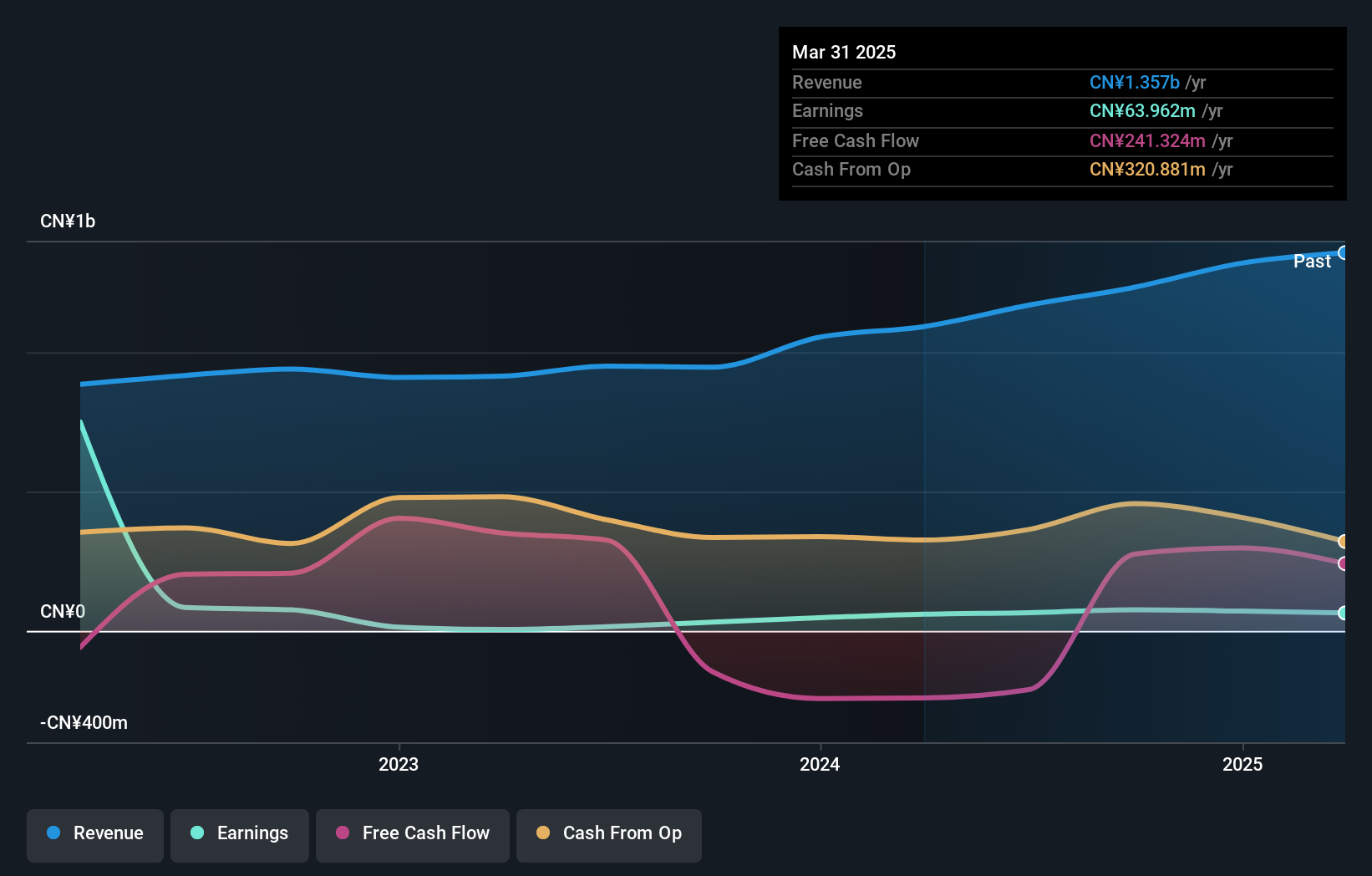

Ningbo Kangqiang Electronics, a notable player in the semiconductor industry, has shown impressive growth with its recent earnings report. Over the past year, the company’s net income jumped to CNY 79.42 million from CNY 59.75 million, while sales climbed to CNY 1.49 billion from CNY 1.31 billion a year earlier. The price-to-earnings ratio stands at 58x, slightly below the industry average of 59.9x, suggesting it could be attractively valued relative to peers. With earnings growing by an impressive 53.9% over the past year and high-quality past earnings reported, this small cap stock seems poised for continued interest in its sector.

Where To Now?

- Click this link to deep-dive into the 4735 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Kangqiang Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002119

Ningbo Kangqiang Electronics

Manufactures and sells semiconductor packaging materials in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives