As global markets respond to rising U.S. Treasury yields, the broad S&P 500 Index has seen a decline, with large-cap stocks faring better than their smaller counterparts. In this context, penny stocks—often associated with smaller or newer companies—remain an intriguing investment area despite being considered somewhat niche today. By focusing on those with strong financial foundations, investors can uncover potential growth opportunities in these under-the-radar companies poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.32 | THB1.88B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,796 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NagaCorp Ltd., an investment holding company, manages and operates a hotel and casino complex in the Kingdom of Cambodia with a market cap of HK$14.33 billion.

Operations: The company's revenue is derived primarily from casino operations, generating $545.61 million, with an additional $23.22 million from hotel and entertainment operations.

Market Cap: HK$14.33B

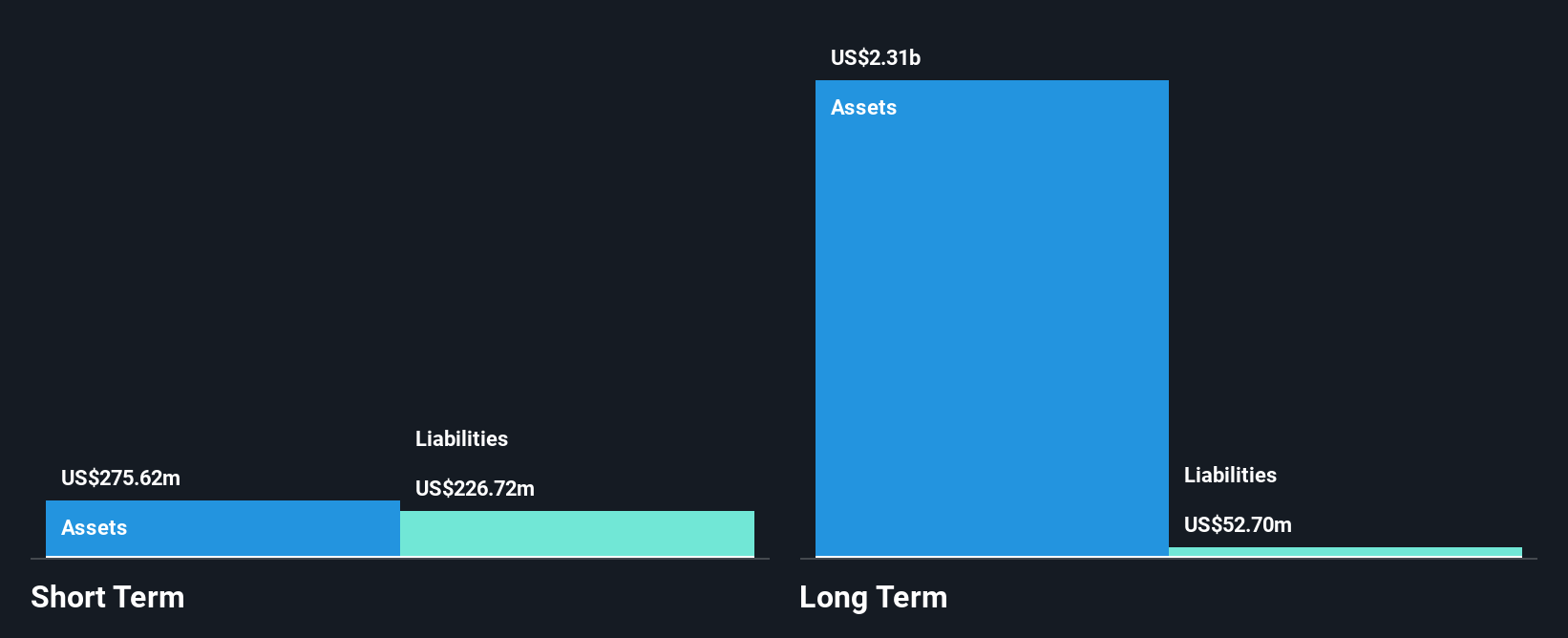

NagaCorp's financial stability is challenged, with short-term liabilities exceeding assets and a significant one-off loss of US$48.9 million impacting recent results. Despite a market cap of HK$14.33 billion, the company reported a net loss of US$0.963 million for the first half of 2024, compared to a net income last year, driven by an impairment charge related to its Vladivostok project. While debt levels are manageable and interest coverage is strong at 9.1 times EBIT, earnings growth has been negative recently and profit margins have decreased from 30% to 17.7%.

- Click here and access our complete financial health analysis report to understand the dynamics of NagaCorp.

- Review our growth performance report to gain insights into NagaCorp's future.

Royal GroupLtd (SZSE:002329)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Royal Group Co., Ltd. is involved in the processing, production, and sale of dairy products in China, with a market cap of CN¥3.01 billion.

Operations: Royal Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.01B

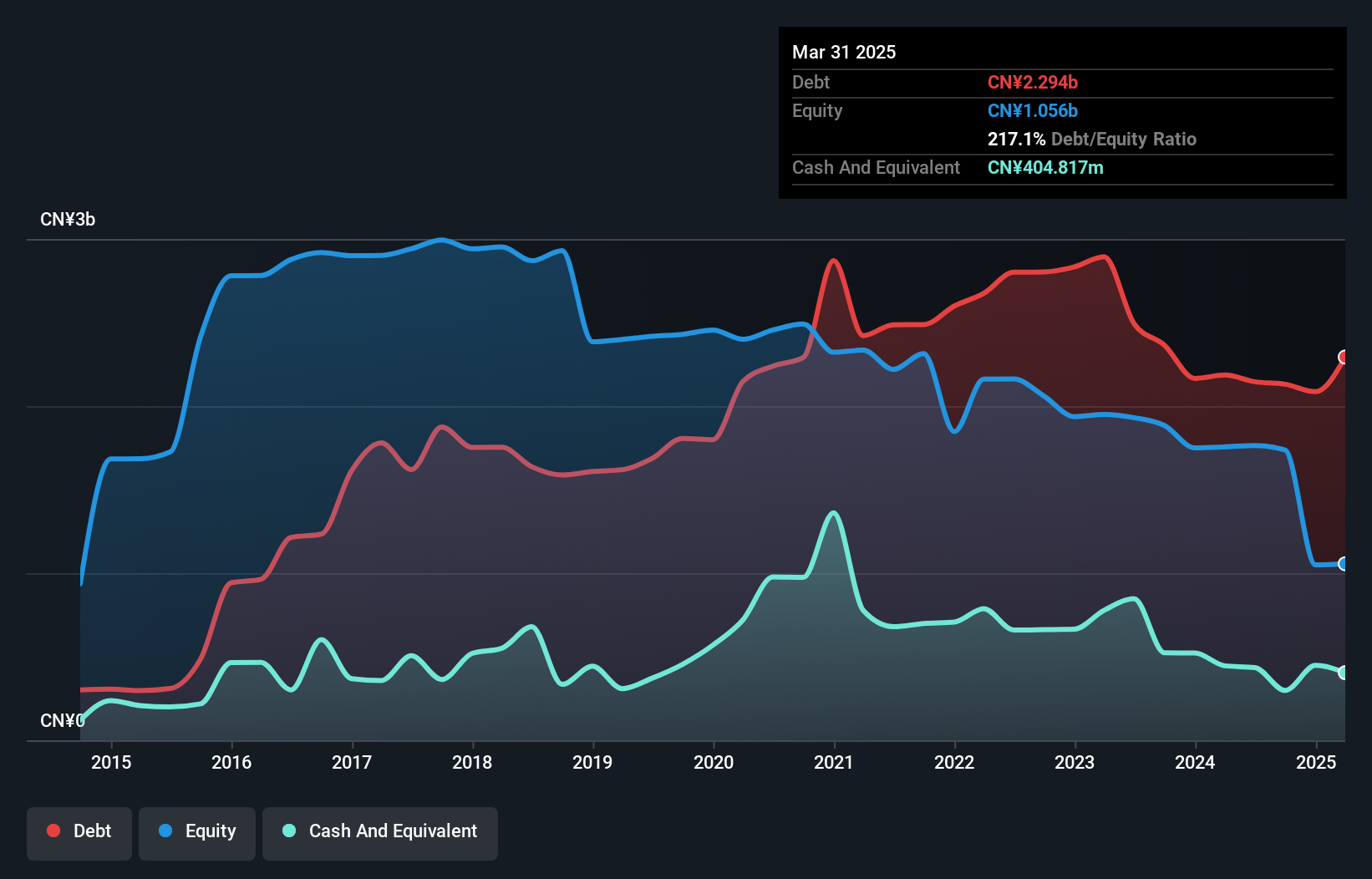

Royal Group Co., Ltd. faces financial challenges, with a net loss of CN¥14.66 million for the nine months ended September 2024, compared to a net income last year. Despite this, the company maintains a robust cash position with short-term assets exceeding liabilities and sufficient cash runway for over three years due to positive free cash flow growth. However, its debt to equity ratio has increased significantly over five years, suggesting rising leverage concerns. The board remains experienced with an average tenure of 8.6 years, but recent earnings have shown declining sales and profitability metrics compared to previous periods.

- Navigate through the intricacies of Royal GroupLtd with our comprehensive balance sheet health report here.

- Assess Royal GroupLtd's previous results with our detailed historical performance reports.

Shandong Polymer Biochemicals (SZSE:002476)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Polymer Biochemicals Co., Ltd. and its subsidiaries produce and sell special chemicals for oil and gas exploitation both in China and internationally, with a market cap of CN¥2.63 billion.

Operations: There are no reported revenue segments for Shandong Polymer Biochemicals Co., Ltd.

Market Cap: CN¥2.63B

Shandong Polymer Biochemicals Co., Ltd. has shown a turnaround in profitability, reporting net income of CN¥23.37 million for the nine months ending September 2024, compared to a loss last year. The company's earnings growth has outpaced the chemicals industry despite being driven by a significant one-off gain of CN¥26.3 million. Financially stable, it holds more cash than debt and its short-term assets significantly exceed liabilities, though its operating cash flow remains negative. However, challenges include an inexperienced board with an average tenure of 0.4 years and low return on equity at 3.2%.

- Take a closer look at Shandong Polymer Biochemicals' potential here in our financial health report.

- Gain insights into Shandong Polymer Biochemicals' past trends and performance with our report on the company's historical track record.

Where To Now?

- Reveal the 5,796 hidden gems among our Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002476

Shandong Polymer Biochemicals

Produces and sells special chemicals for oil and gas exploitation in China and internationally.

Adequate balance sheet with questionable track record.