- China

- /

- Capital Markets

- /

- SZSE:002961

Undiscovered Gems Three Promising Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and subdued economic growth, small-cap stocks have faced increased pressure compared to their large-cap counterparts. With the S&P 500 experiencing a downturn after weeks of gains, investors are seeking opportunities in smaller companies that boast strong fundamentals despite broader market volatility. In this environment, identifying stocks with robust financial health and potential for growth is crucial for those looking to uncover hidden value amidst uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Huitong EnergyLtd (SHSE:600605)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Huitong Energy Co., Ltd focuses on house leasing and property services in China with a market capitalization of CN¥7.20 billion.

Operations: The company generates revenue primarily from house leasing and property services in China.

Shanghai Huitong Energy, a smaller player in the energy sector, has shown remarkable financial growth with earnings rising 227.7% over the past year, significantly outpacing its industry peers. The company's net income for the nine months ended September 2024 was CN¥98.42 million, up from CN¥43.35 million a year earlier, reflecting strong operational performance despite a one-off gain of CN¥37.2 million impacting recent results. With more cash than total debt and interest payments well-covered by profits, Shanghai Huitong seems financially stable and poised for potential growth amidst ongoing strategic acquisitions and index inclusion activities.

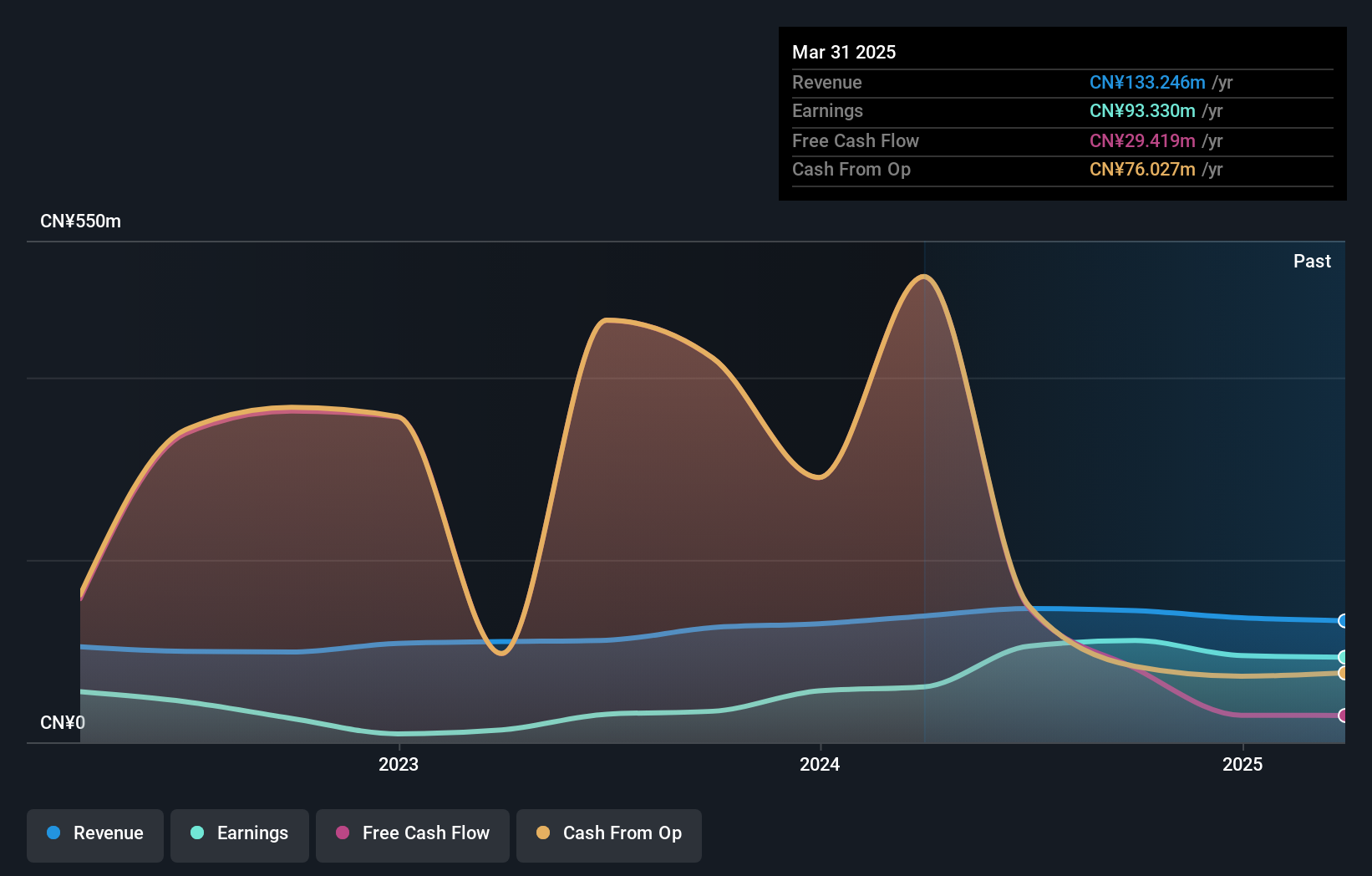

Zhejiang Juli Culture DevelopmentLtd (SZSE:002247)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Juli Culture Development Co., Ltd. operates in the cultural and entertainment industry with a market capitalization of CN¥2.19 billion.

Operations: Zhejiang Juli Culture Development Co., Ltd. generates revenue primarily from its cultural and entertainment operations. The company's focus on these segments contributes to its financial performance, with specific data on cost breakdowns and profit margins not provided in the available information.

Zhejiang Juli Culture Development, a nimble player in the entertainment sector, has turned profitable this year with net income reaching CN¥220.53 million for the nine months ending September 2024, a significant turnaround from last year's CN¥342.53 million loss. The company's debt-free status is notable, having reduced its debt to equity ratio from 22% five years ago to zero today. Despite facing a large one-off loss of CN¥809.1 million impacting recent results, it boasts a price-to-earnings ratio of 10.6x—an attractive figure compared to the broader Chinese market's 34x average—indicating potential value for investors seeking opportunities beyond the mainstream radar.

- Navigate through the intricacies of Zhejiang Juli Culture DevelopmentLtd with our comprehensive health report here.

Understand Zhejiang Juli Culture DevelopmentLtd's track record by examining our Past report.

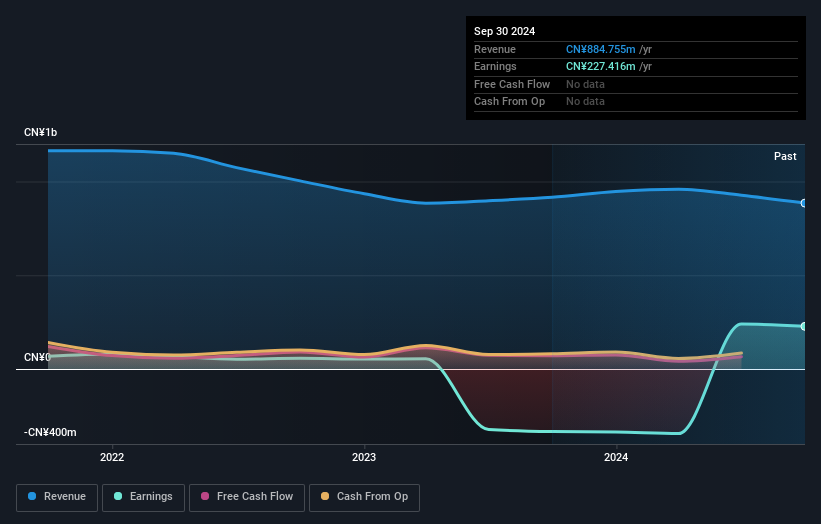

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market cap of CN¥6.83 billion.

Operations: Ruida Futures generates revenue primarily through brokerage services and asset management. The company's cost structure includes expenses related to personnel, technology, and operations. Over recent periods, the net profit margin has shown a varied trend without consistent patterns.

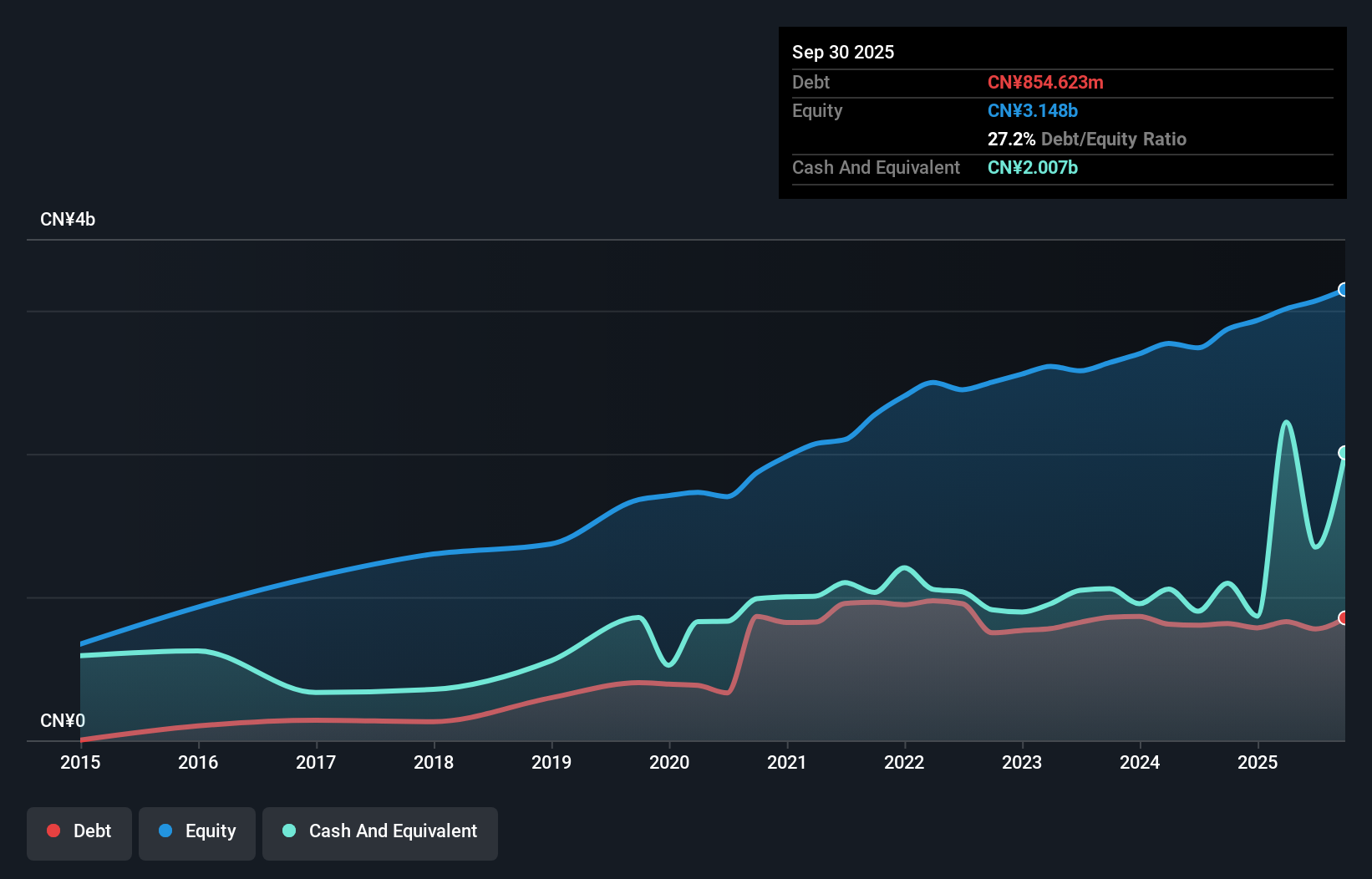

Ruida Futures, a nimble player in the market, has shown notable growth with earnings rising by 42% over the past year, outpacing its industry. The company's debt-to-equity ratio nudged up from 24% to 28%, yet it holds more cash than total debt, indicating solid financial footing. Trading at a price-to-earnings ratio of 21x compared to the market's 34x suggests it's attractively valued. Recent earnings for nine months ended September show revenue at CNY1.67 billion and net income of CNY271 million, marking significant improvements from last year’s figures. Earnings per share rose to CNY0.61 from CNY0.4 previously.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4735 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002961

Proven track record with adequate balance sheet.