- China

- /

- Real Estate

- /

- SHSE:603506

Top Dividend Stocks To Consider For October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking stability in dividend stocks. In this environment, a good dividend stock is characterized by its ability to provide consistent income while potentially offering some resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

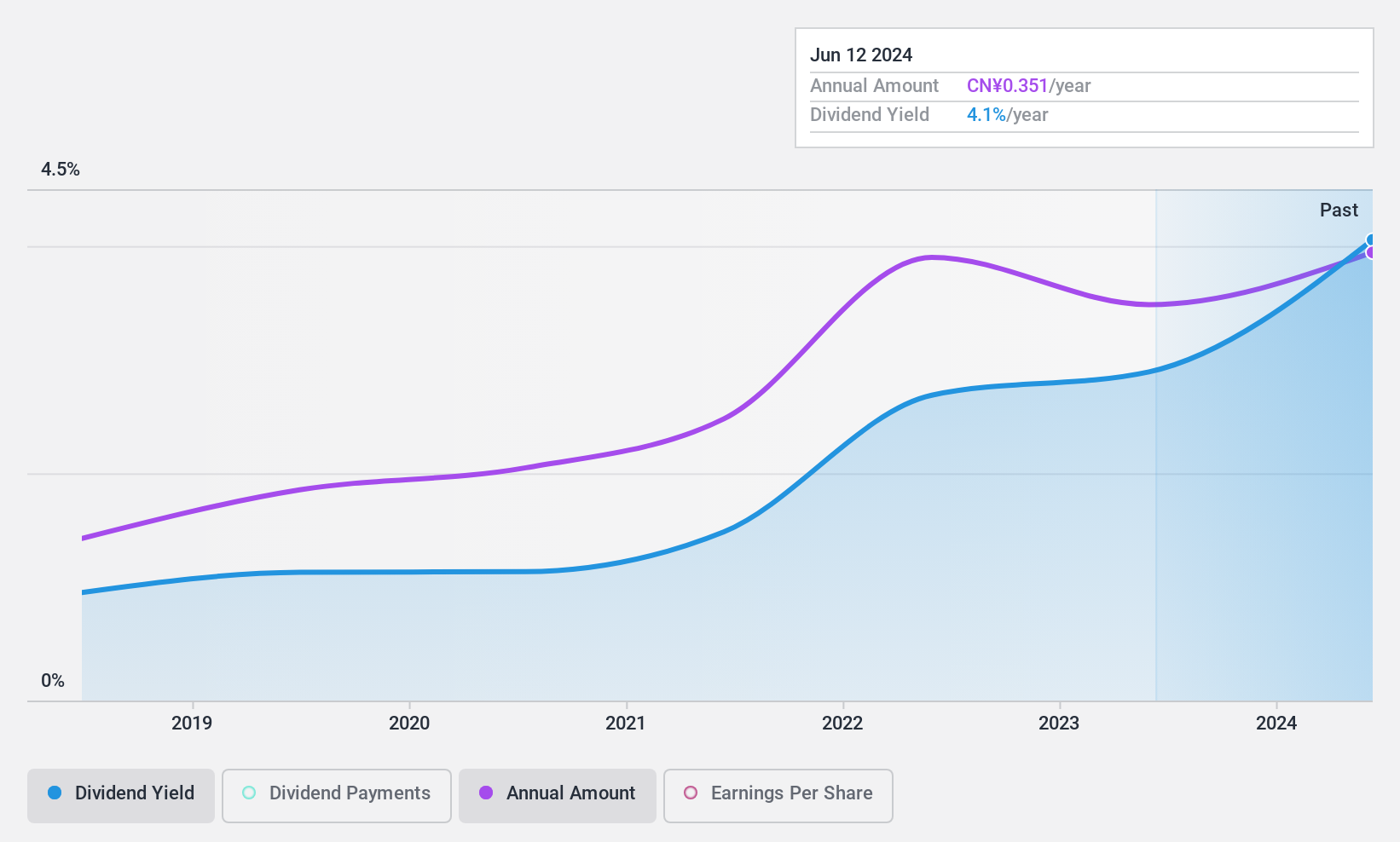

Nacity Property Service GroupLtd (SHSE:603506)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nacity Property Service Group Co., Ltd. provides real estate property management services in China and has a market capitalization of CN¥1.63 billion.

Operations: Nacity Property Service Group Co., Ltd. generates its revenue from real estate property management services in China.

Dividend Yield: 3.9%

Nacity Property Service Group Ltd. has a stable dividend track record, with payments covered by both earnings (50.2% payout ratio) and cash flows (51.6% cash payout ratio). Despite only six years of dividend history, the company offers a competitive yield at 3.9%, ranking in the top 25% of CN market payers. However, recent earnings reports show declining net income from CNY 114.52 million to CNY 60.32 million year-over-year, which may impact future dividends stability.

- Delve into the full analysis dividend report here for a deeper understanding of Nacity Property Service GroupLtd.

- According our valuation report, there's an indication that Nacity Property Service GroupLtd's share price might be on the cheaper side.

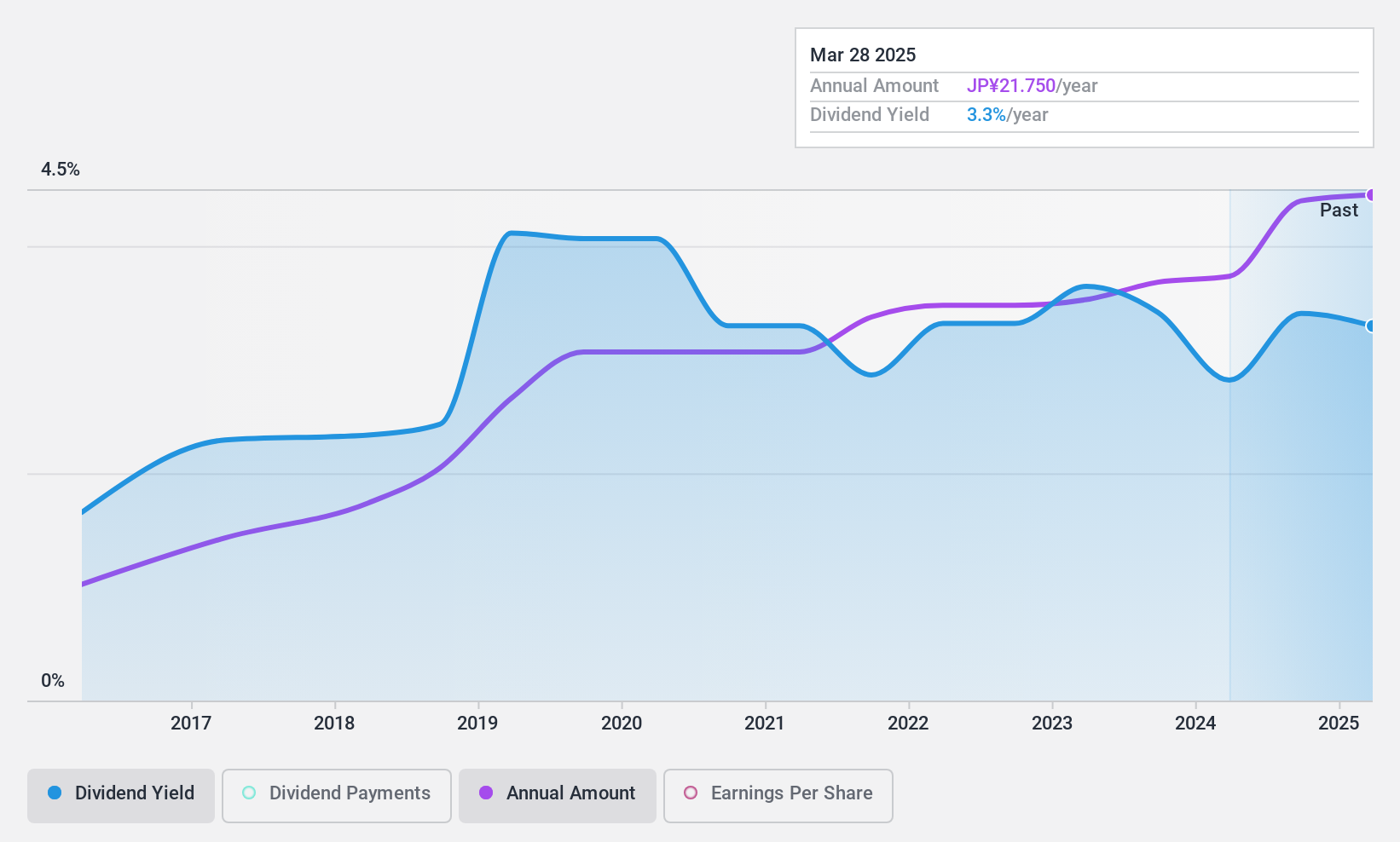

SBI Global Asset Management (TSE:4765)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SBI Global Asset Management Co., Ltd. offers financial and asset management services both in Japan and internationally, with a market cap of ¥53.98 billion.

Operations: SBI Global Asset Management Co., Ltd. generates its revenue through providing financial and asset management services across domestic and international markets.

Dividend Yield: 3.6%

SBI Global Asset Management has consistently increased dividends over the past decade, with recent payments rising to JPY 8.75 per share. However, its high payout ratio of 119.6% indicates dividends are not covered by earnings, though cash flows provide adequate coverage at a 23.4% cash payout ratio. The current yield of 3.57% is below the top tier in Japan's market and profit margins have declined from last year’s figures, potentially affecting future dividend sustainability.

- Click to explore a detailed breakdown of our findings in SBI Global Asset Management's dividend report.

- In light of our recent valuation report, it seems possible that SBI Global Asset Management is trading beyond its estimated value.

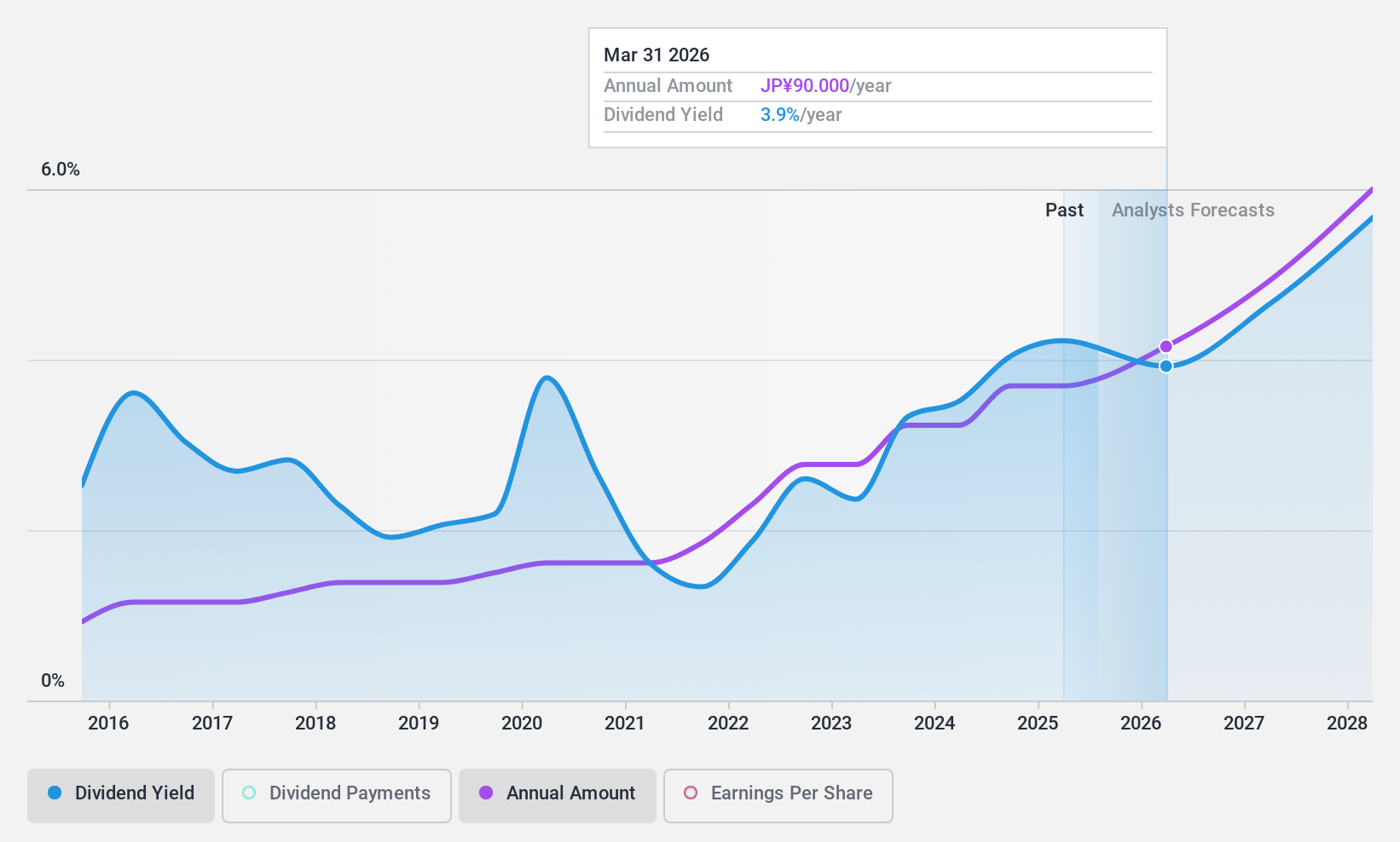

Globeride (TSE:7990)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Globeride, Inc. manufactures and sells sports and leisure products worldwide, with a market cap of ¥43.20 billion.

Operations: Globeride, Inc.'s revenue segments are comprised of ¥79.69 billion from Japan, ¥15.51 billion from Europe, ¥13.13 billion from the Americas, and ¥48.29 billion from Asia and Oceania.

Dividend Yield: 4%

Globeride offers a stable dividend profile, with payments reliably growing over the past decade. Its dividends are well covered by earnings and cash flows, reflected in payout ratios of 43.3% and 28.9%, respectively. Although profit margins have decreased from last year, the stock's dividend yield of 4.02% ranks among the top quarter in Japan's market. Trading significantly below estimated fair value may present an attractive opportunity for income-focused investors seeking stability and growth potential in dividends.

- Take a closer look at Globeride's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Globeride is trading behind its estimated value.

Make It Happen

- Click here to access our complete index of 2013 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nacity Property Service GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603506

Nacity Property Service GroupLtd

Offers real estate property management services in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives